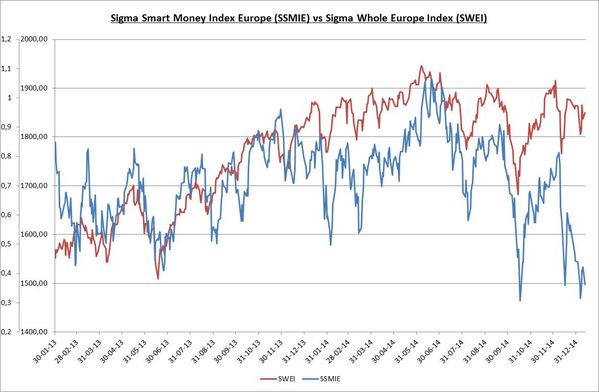

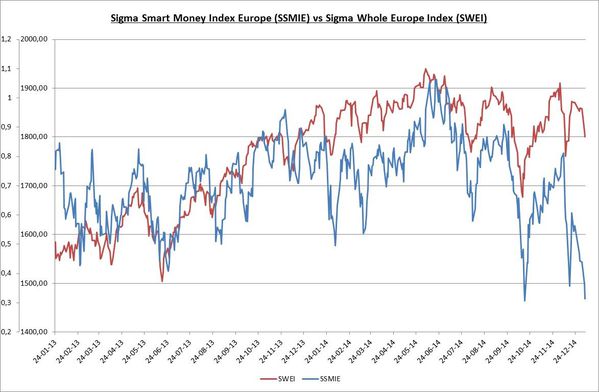

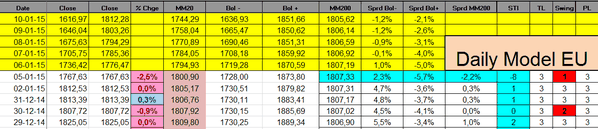

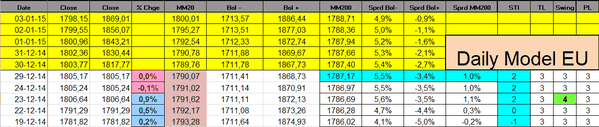

The Sigma Whole Market Index enjoyed another strong session on Tuesday. The market is close to retest the red dotted ascending line (by the south). Nevertheless, we can't turn positive on the European market as long as it remains below the pink horizontal resistances.

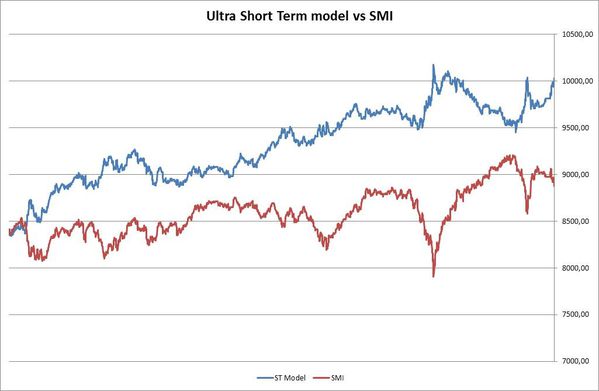

It is also interesting to notice that both the SMI and the Europe Small Cap 200 were able to move above key resistances. Is it an early sign for the broad European market?

In the case of the Stoxx600, the situation remains neutral (for now).

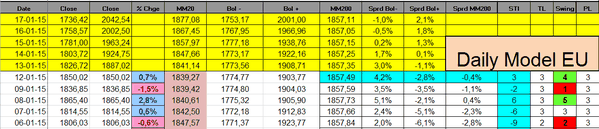

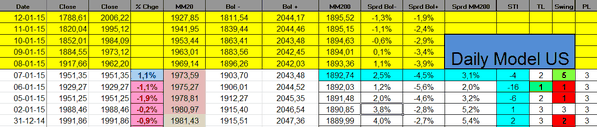

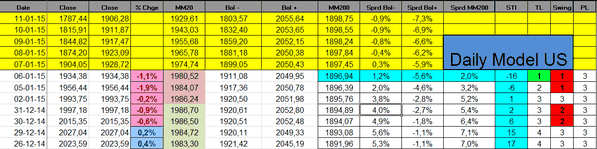

The Sigma Trend Index jumped to '13' and the Swing came in at '5' telling us the session was highly impulsive. It seems that more and more investors are betting on the January ECB's meeting .

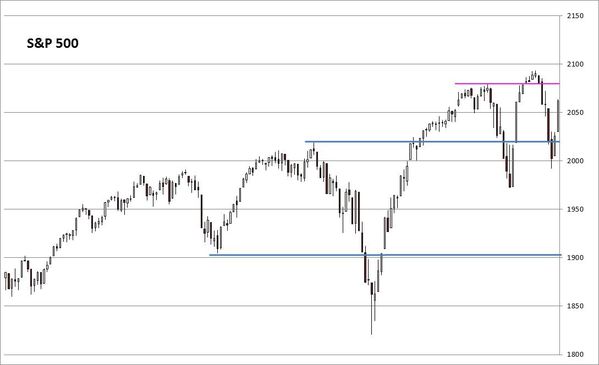

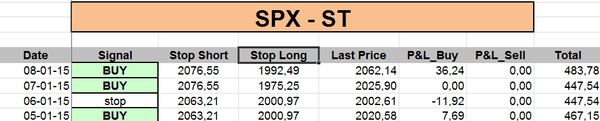

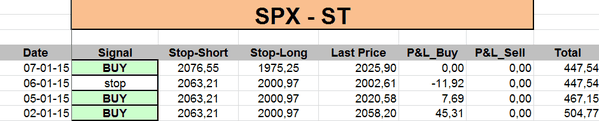

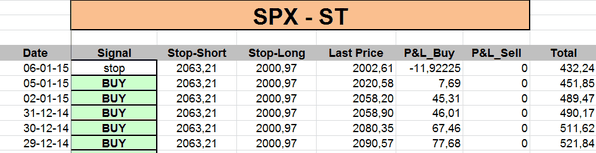

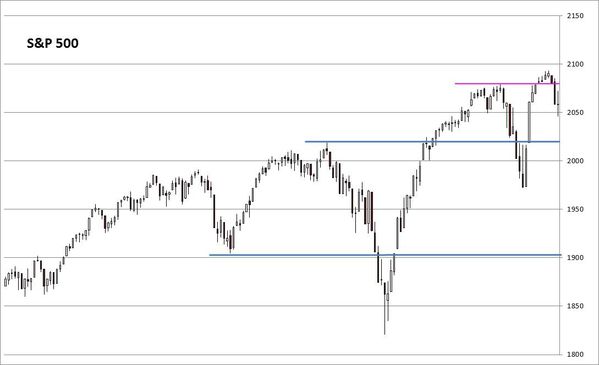

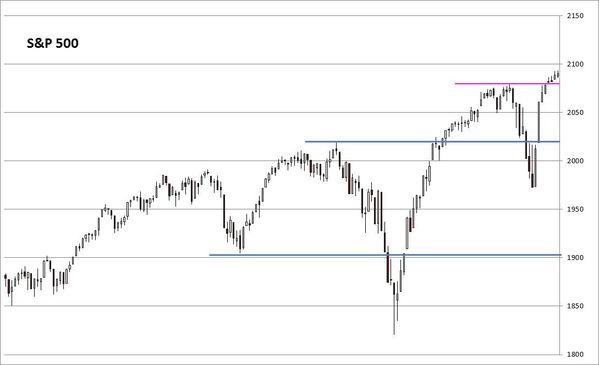

After a good start, the US market faced a strong reversal. This kind of candle is bearish but the market found some supports around the red dotted ascending line. So, all in all, not as bad as it could look at first glance.

Most US indexes remain above strong support but Tuesday's candle looks like a "key reversal day" (mainly on the DJ Utilities). In order to be validated, this reversal day needs to be confirmed in coming session (by another leg down). So, there is no drama at this stage.

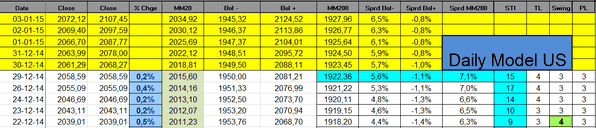

The Sigma Trend Index remains in negative territory.

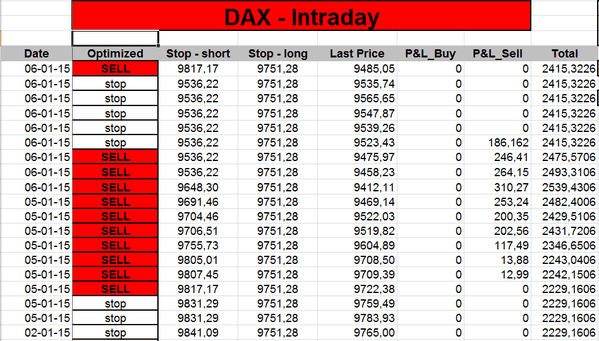

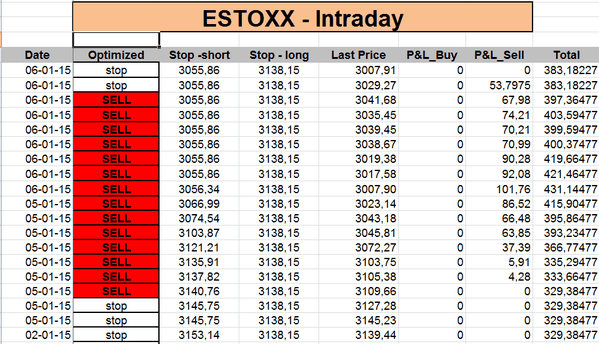

Daily Trading Book: