The Sigma Whole Europe Index had a small bounce back on Wednesday. Nevertheless it is impossible to say at this stage if it is just a bounce back in a downtrend or if it is the end of the "correction".

Looking at key EU indexes, we can notice that December's gaps were closed but there is no sign the correction is over: a retest of the next horizontal support seems more likely on a 10 days basis but a short term bounce back remains possible.

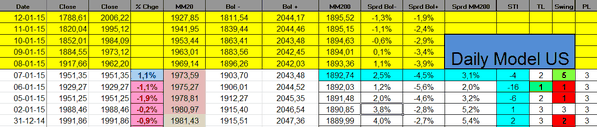

The Sigma Trend Index remains in negative territory, all other indicators are neutral at '3'.

The Sigma Whole Market Index enjoyed a strong bounce back and it is right below the pink resistance. The red ascending line acted twice as a support, this line will be important to monitor.

Looking at key indexes, we can notice the 4100 level is very important for the NDX. On other indexes, we are between support and resistance, so it is very difficult to have a clear opinion here.

The best thing to do is (probably) to monitor the NDX: as long as it remains above '4100', it is ok but if it closes below this level, this is a very bad signal.

The Sigma Trend Index is now at '-4', not far from its zero line. It will be interesting to see if it can move in positive territory.

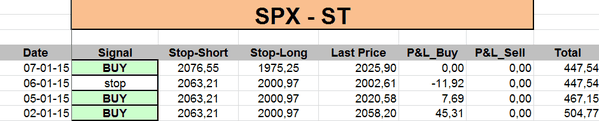

The Swing came in at '5'. As the Trend Level (TL) was at '1' on Tuesday, this means the ST model generated a fresh buy signal on US markets.

It is not a question to know if we are convinced or not by this signal but we are focused on our model, and discipline is key in trading. Feeling and sentiment is your worst enemy.

So, we bought 1 SPX at 2026.41