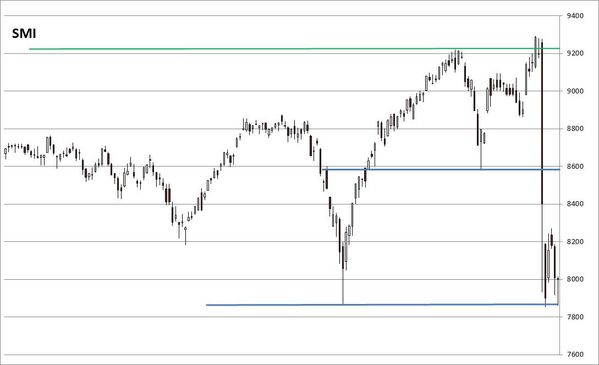

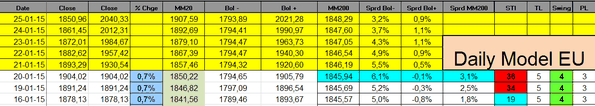

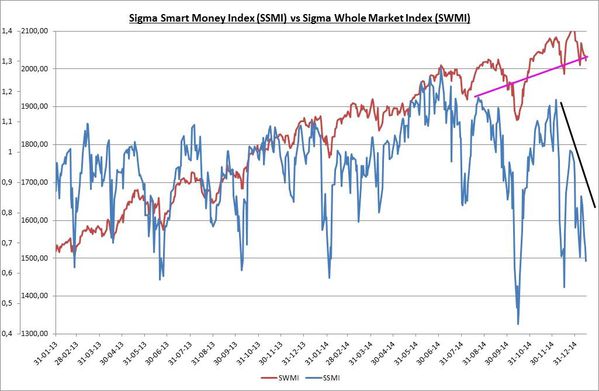

The Sigma Whole Europe Index continues its pull back but we consider there is no real danger at this time. No danger, as long as the market is able to remain above the red horizontal resistance. If the market declines below this strong horizontal support, recent breakup would look like a false break.

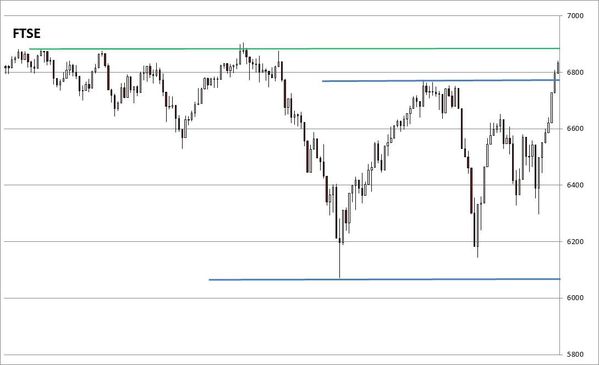

Looking at key European indexes, it is interesting to notice that while the DAX, EuroStoxx 50, Stoxx600, CAC, .... reached new highs in recent session, the IBEX, PSI, .... remain well below their 52 weeks highs. This means that tension between core Europe and periphery are not easing. So, I don't believe that the market is 'really' convinced by the outcome of the EU QE.

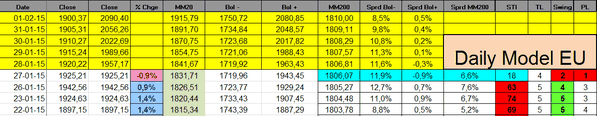

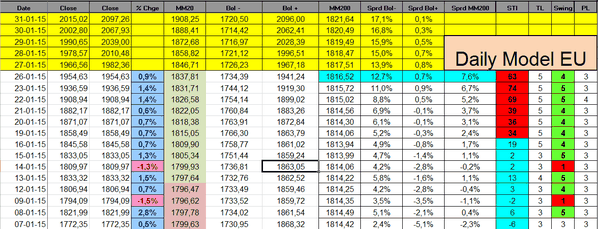

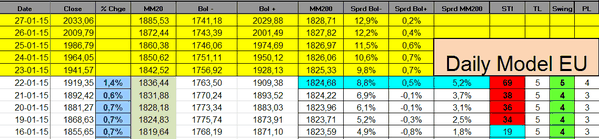

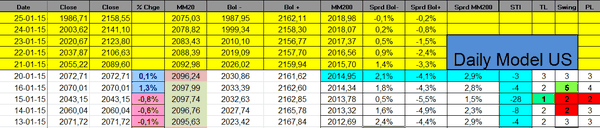

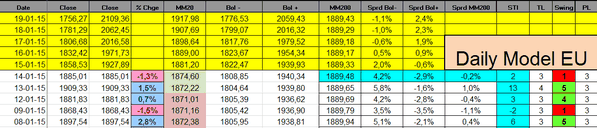

The Sigma Trend Index sharply declined in the last two sessions: from '63' to '13'. Both the Swing and the Power Level were neutral at '3'.

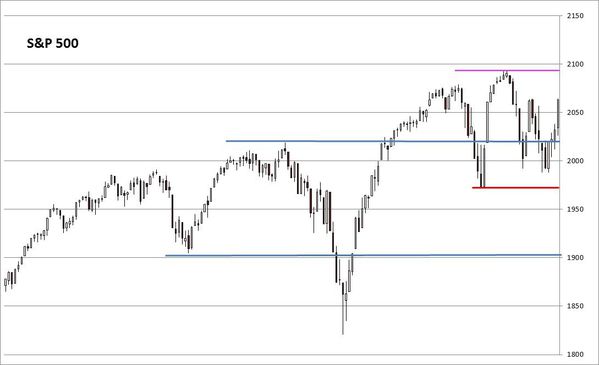

The Sigma Whole Market Index was under pressure on Wednesday. The index is now testing an important ascending trend line. If the market can't hold on this level, there is a major risk of acceleration to the downside.

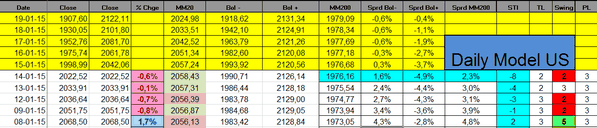

Looking at key US indexes, we can notice that most market leaders of this bull market (NDX, RUT) are now in the middle of their trading range. The new leaders are the dividend stocks: DJ Utilities. But even the DJU is now facing some strong resistance.

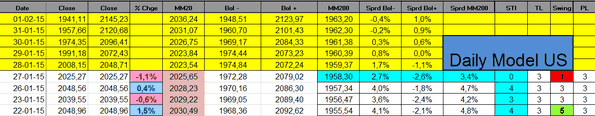

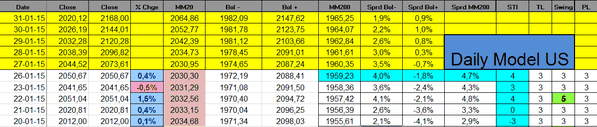

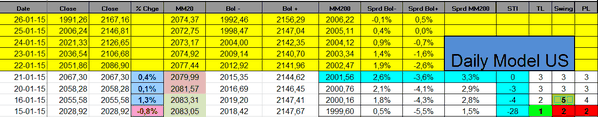

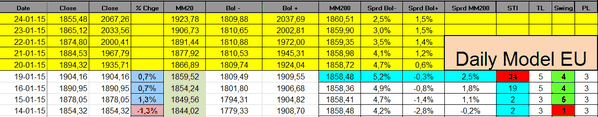

The Sigma Trend Index declined in negative territory. This is negative for the market because it is rolling back in negative territory after a first decline, a bounce back and a consolidation phase. So, current decline looks like a clean move, a new direction for the market.

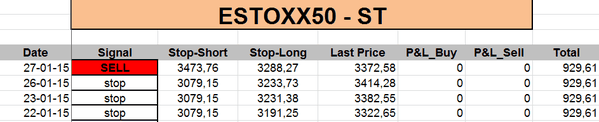

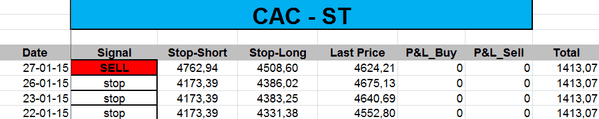

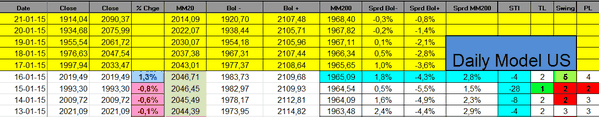

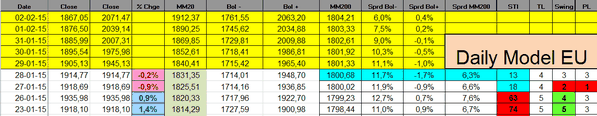

Daily Trading Book: