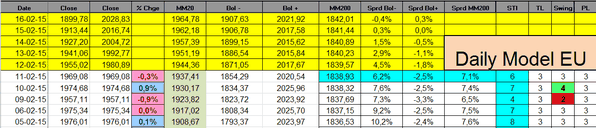

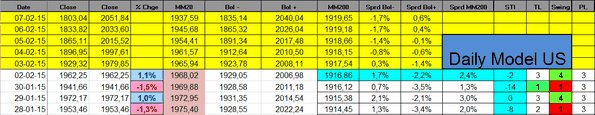

Europe:

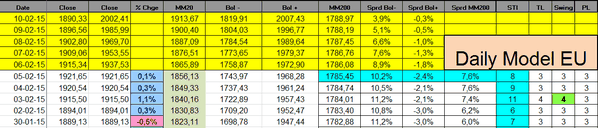

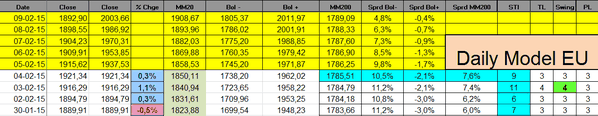

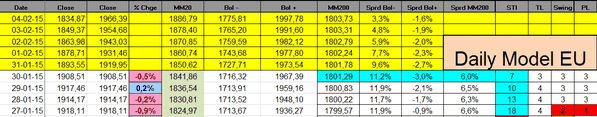

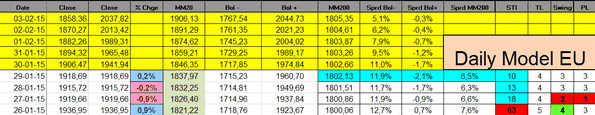

The Sigma Whole Europe remains very resilient, this is impressive to see the current strength on this market: indexes are in consolidation mode and they remain well above their major resistances and it seems there is no danger at this stage.

There is some differences when we look at different European indexes, but the situation remains mainly positive (consolidation phase at this stage before another up leg):

The IBEX is even more impressive because it has been able to print a candle looking at a key reversal day. It will be interesting to track the situation in this market and to monitor if there is some follow through.

The Sigma Trend Index came in at 6, all other indicators are neutral at '3'

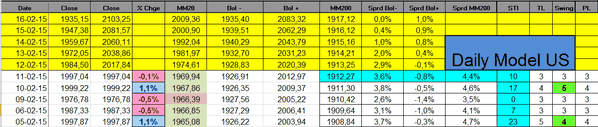

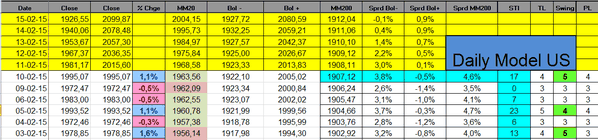

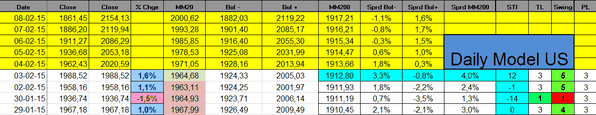

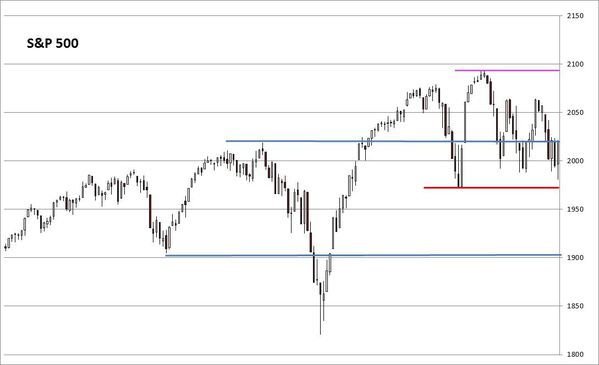

United States:

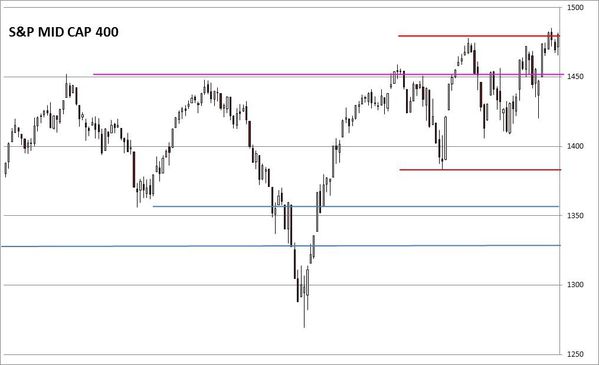

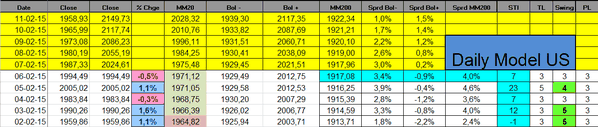

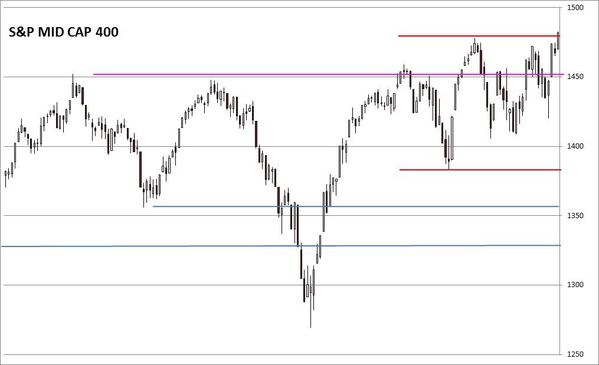

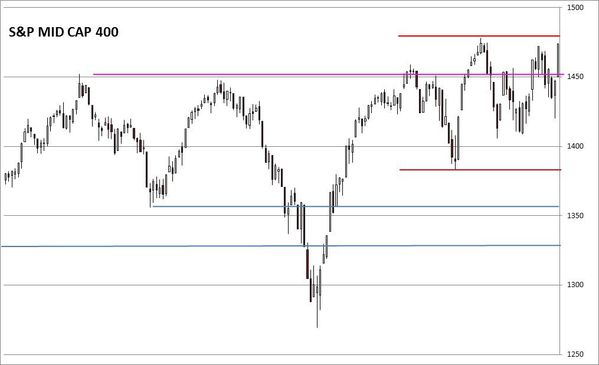

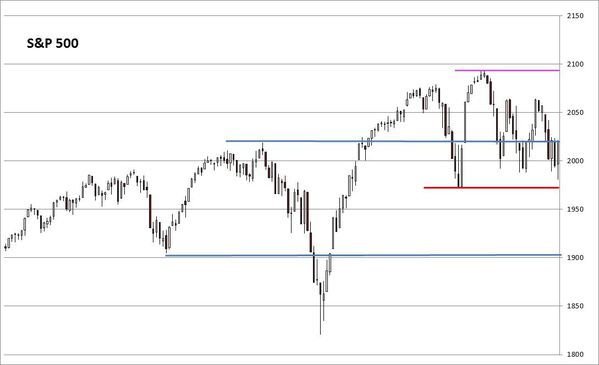

The Sigma Whole Market Index was in danger because it was trading below its ascending trendline but it seems it found some support at critical level (red horizontal support). In this rebound, the market closed the session right below a strong resistance. So, we are now at a key turning point: even the market resumes its uptrend moving above the pink horizontal line or it rolls down and it breaks the red horizontal support. As long as it remains between those two lines, we are in wait and see situation.

Looking at key US indexes, we can notice that most of them found support on a strong horizontal support and printed what looks like a key reversal day. The DJ Utilities remains very strong, probably a yield hunting area.

The Sigma Trend Index bounced back but it is still below its zero line, so the danger is still present.

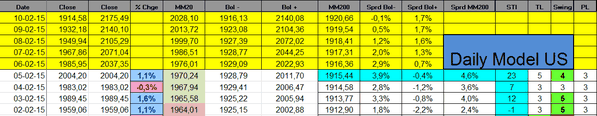

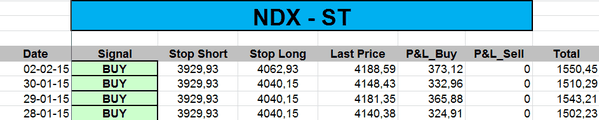

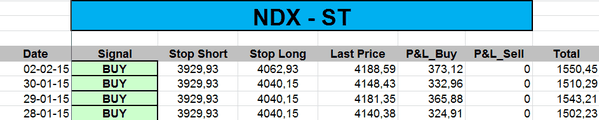

The ST model uplifted its stop on the NDX:

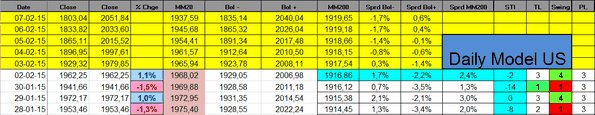

Daily Trading Book:

- SPX: stopped

- NDX: long at 4236.28 (2014's close) (stop @ 4058, 5pts below the ST model to take into account bid/ask spread)

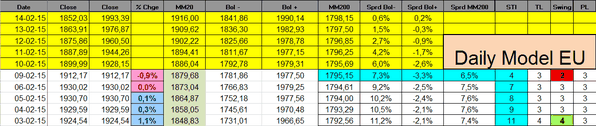

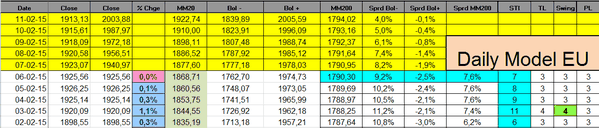

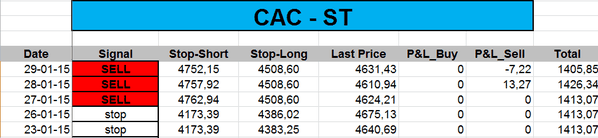

- CAC: short at 4659.35 (stop @ 4757, 5pts above the ST model to take into account bid/ask spread)

- EuroStoxx50: short at 3392.5 (stop @ 3465, 5pts above the ST model to take into account bid/ask spread)

- DAX: short at 10699.75 (stop @ 10938, 10pts above the ST model to take into account bid/ask spread)

- IBEX: short at 10677.7 (stop @ 10823, 10pts above the ST model to take into account bid/ask spread)

- CAC: short at 4490.35

- EuroStoxx50: short at 3276.5