30 janvier 2013

3

30

/01

/janvier

/2013

06:53

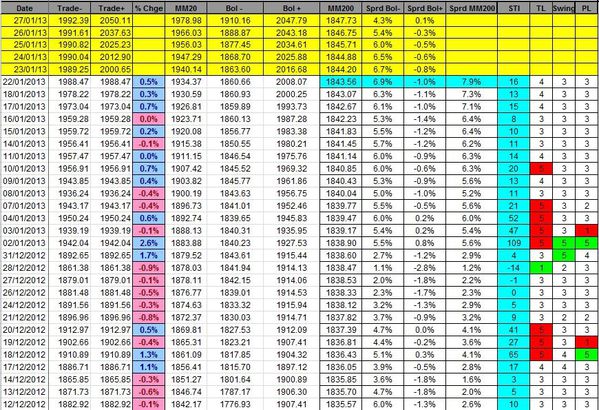

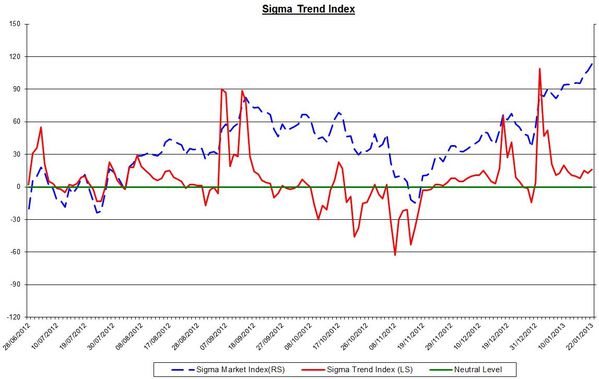

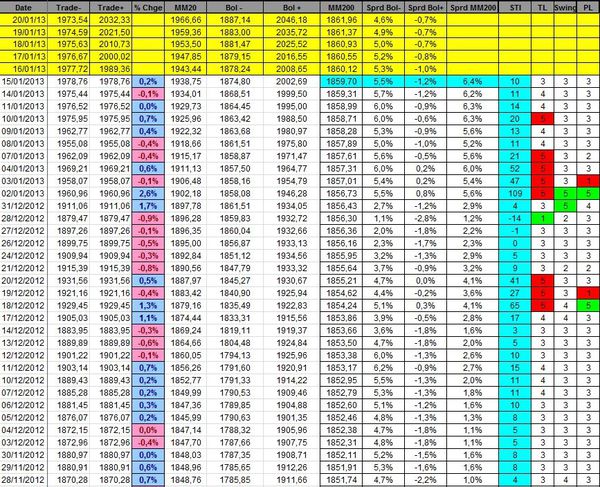

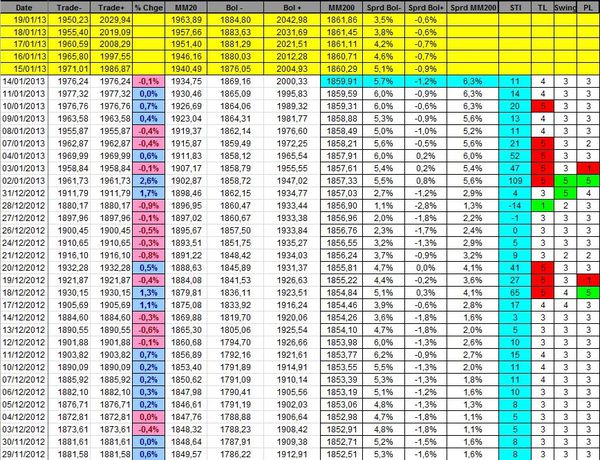

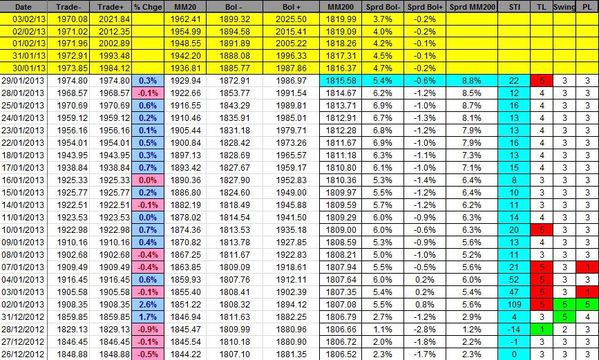

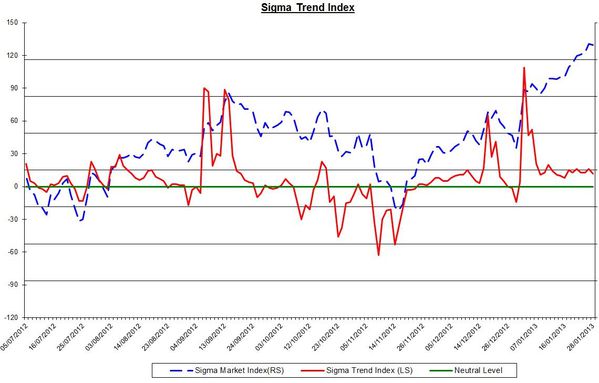

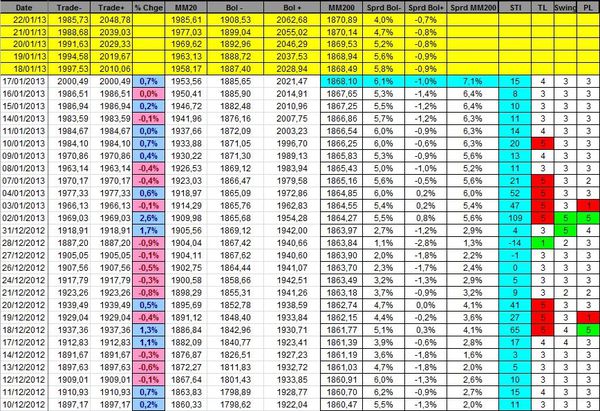

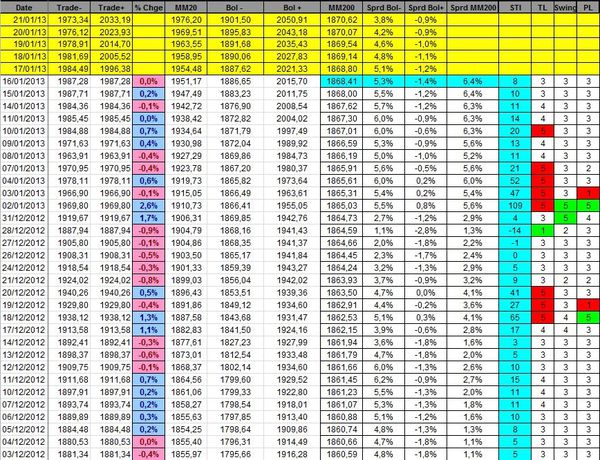

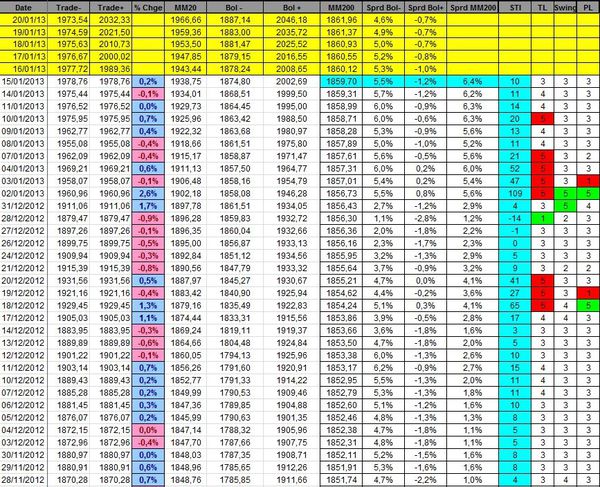

The market continues to climb at the top of the (red) uptrend. This is impressive to notice the perfect match between the Sigma Whole Market Index and this uptrend.

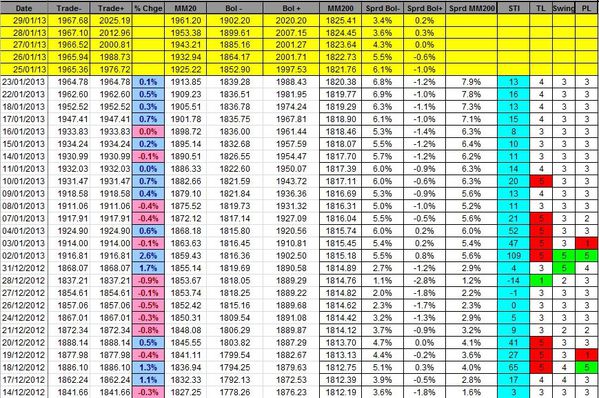

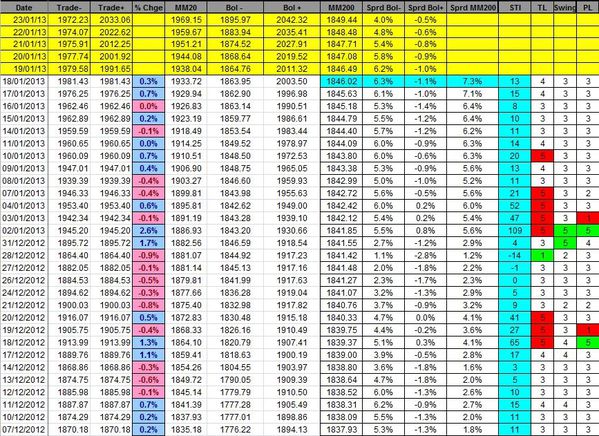

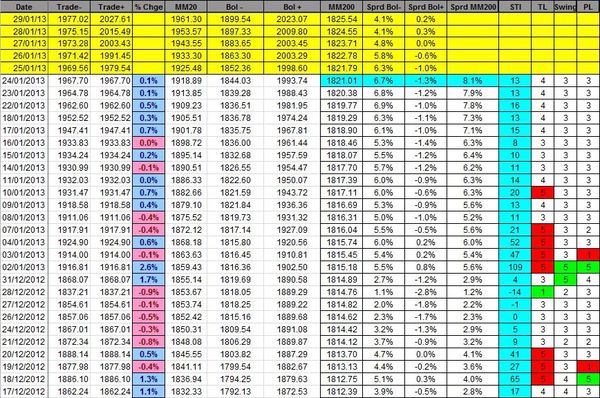

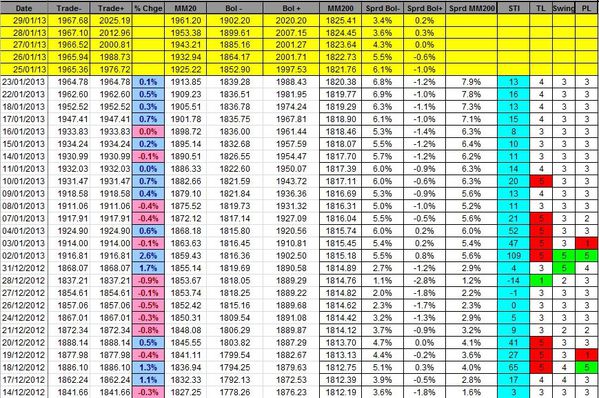

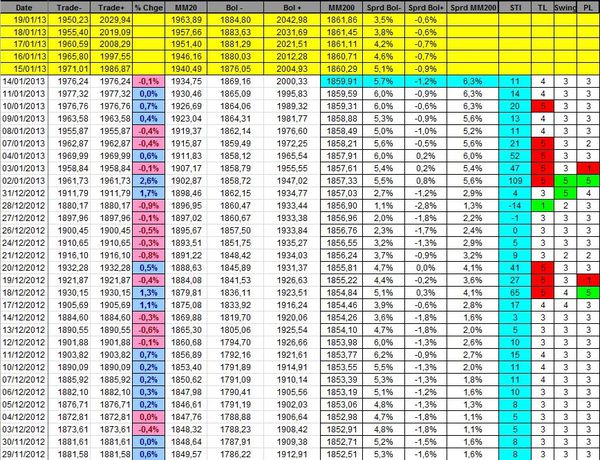

The Sigma Trend Index increased a little bit on Tuesday, allowing the Trend Level (TL) to move in overbought territory (at '5'). Other indicators are neutral at '3'.

We will get a fresh sell signal on the market if either the Swing or the Power Level decline to '1' with the Trend Level (TL) at '5' one day before this decline.

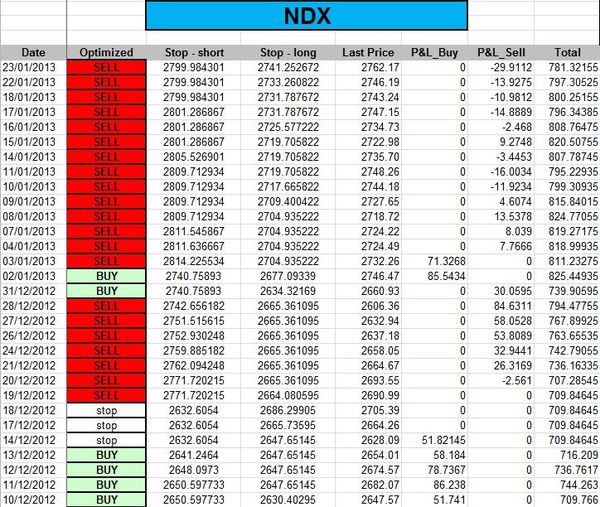

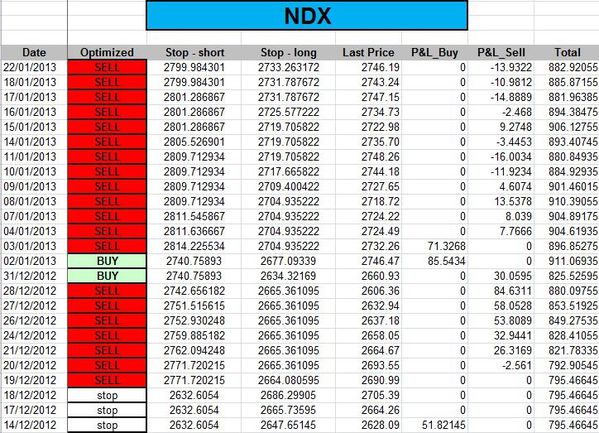

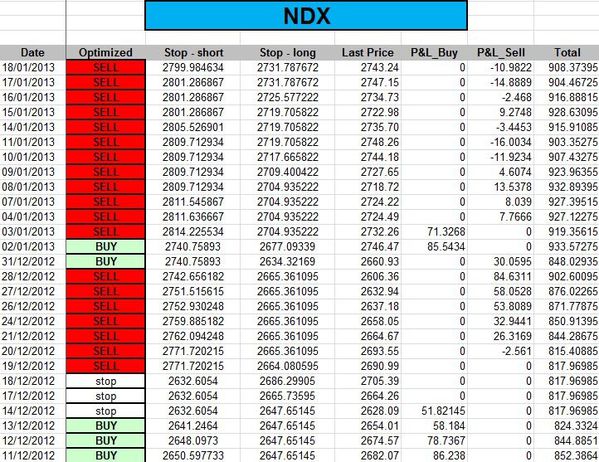

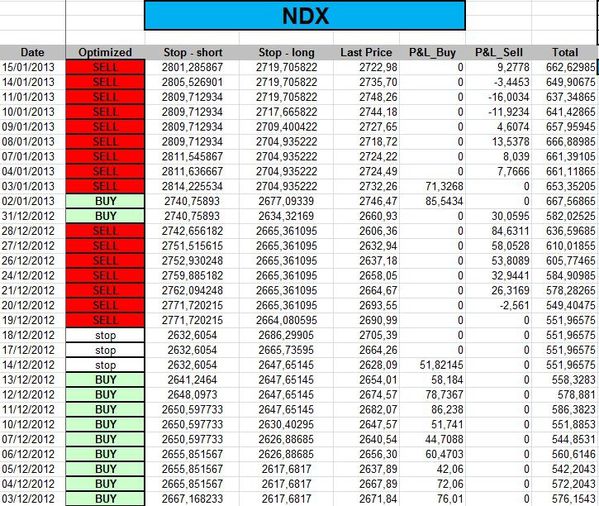

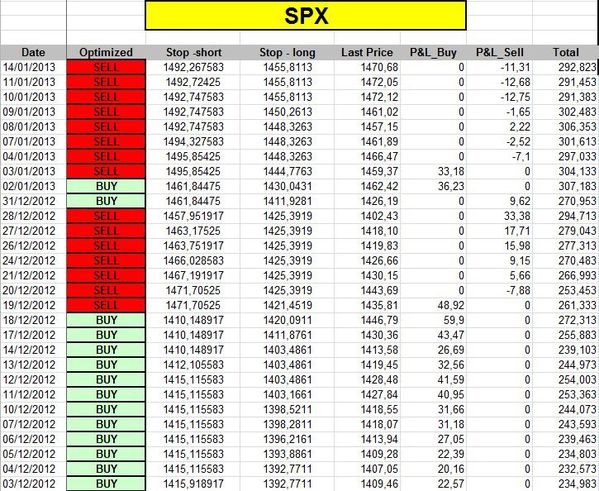

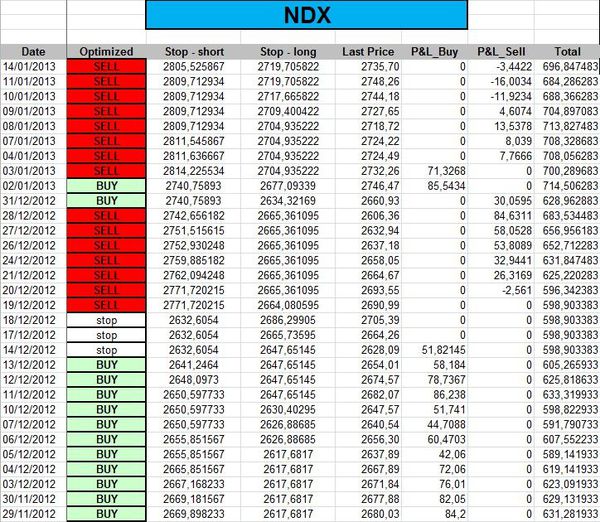

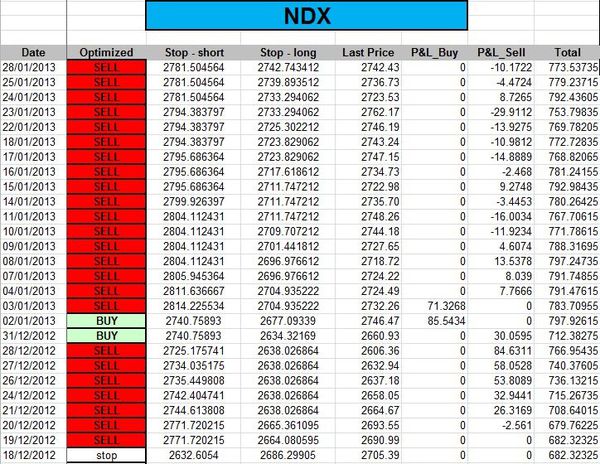

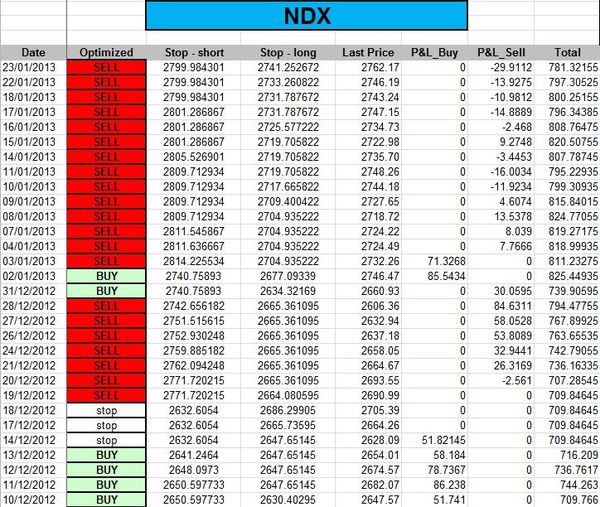

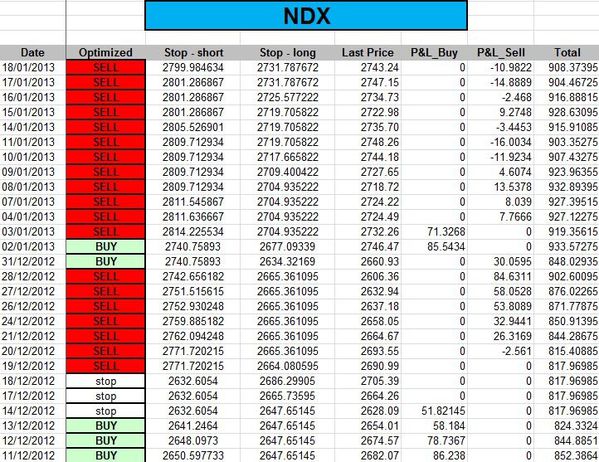

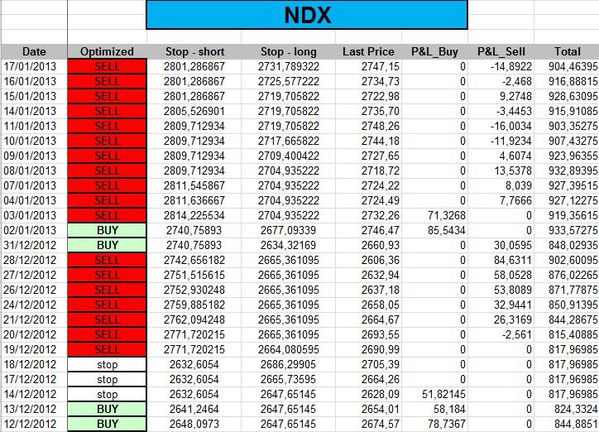

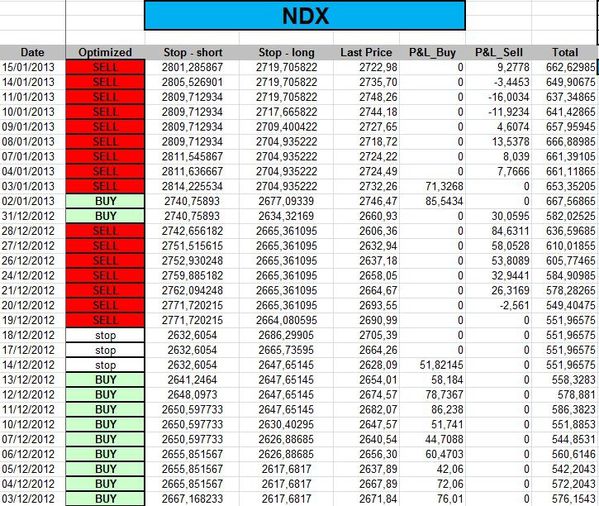

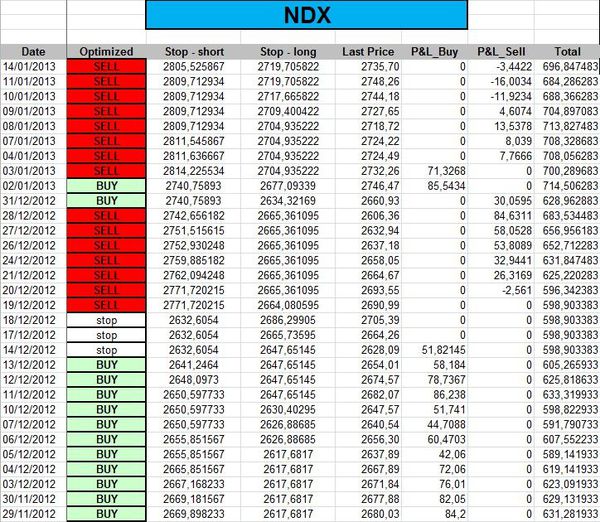

Our short term model remains in sell mode on the NDX.

Conclusion:

The market is (once again) overbought on a short term basis, we still consider the short side as the safest one on a risk/return basis (for the short term).

Short term position:

- short 1 NDX at 2734.9 (stop at 2781.5)

- short 1 CAC at 3783.56

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

29 janvier 2013

2

29

/01

/janvier

/2013

07:53

The market remains at the top of the red uptrend. This is impressive to see the perfect match between the Sigma Whole Market Index and the price action.

The Sigma Trend Index continues to underline a losing momentum market, this situation is unsustainable:

Our short term model remains in sell mode on the NDX:

Conclusion:

The market is stuck at the top of the uptrend. We don't believe it could be able to accelerate and break this uptrend now.

So, with a 5days average and standard deviation of returns at 0.5% (both of them), and the market at the top of its 2 months uptrend, we don't consider we have a major risk to be short at this time. A pullback should occurs sooner rather later.

Short term position:

- short 1 NDX at 2734.9 (stop at 2781.5)

- short 1 CAC at 3783.56

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

25 janvier 2013

5

25

/01

/janvier

/2013

07:40

The market tried to break the uptrend channel but it was unable to close above it.

Nevertheless, market was very strong even with Apple going down 12%, for me it was a major surprise.

All our indicators were unchanged on the day:

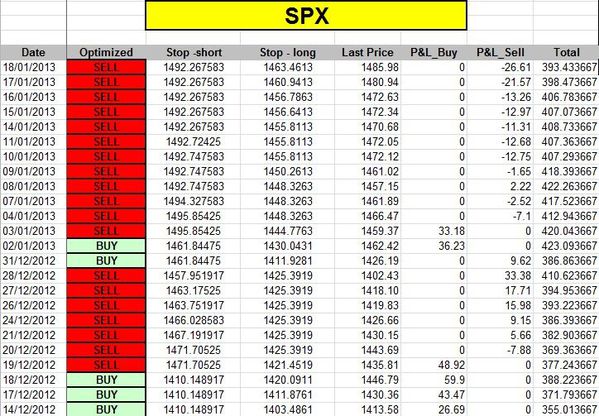

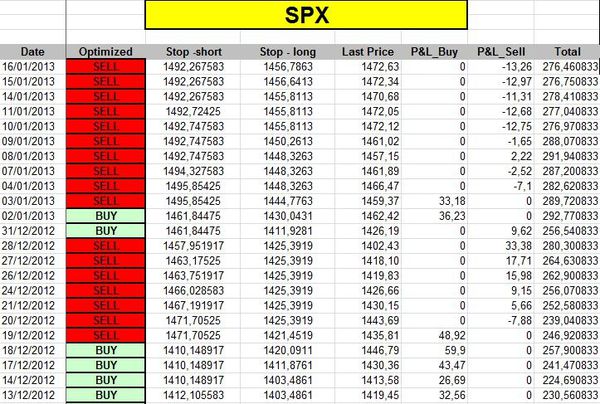

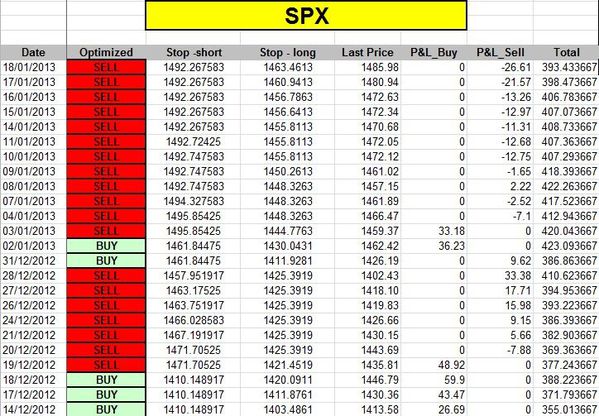

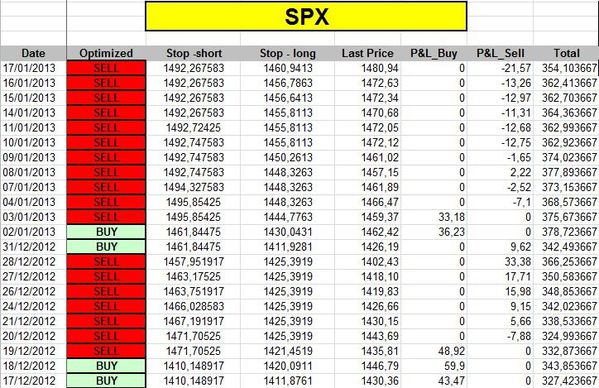

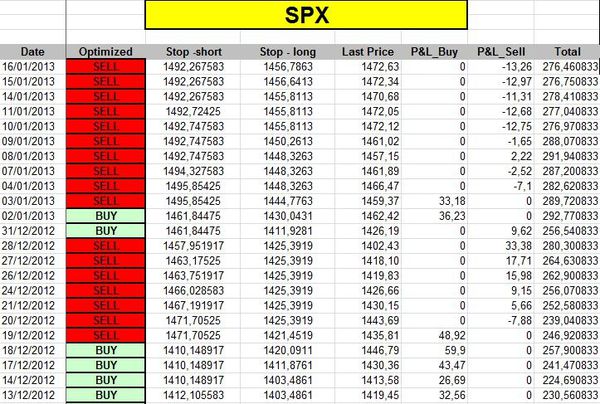

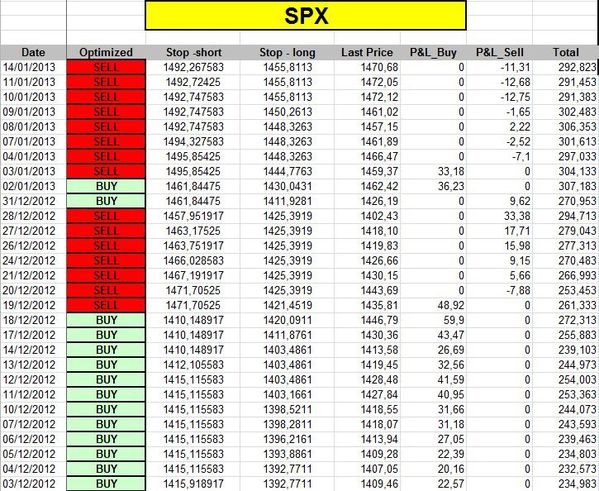

Our ST model remains in sell mode for the NDX, it is neutral on the SPX:

Conclusion:

We continue to believe the market needs a pullback, the momentum is low at this stage and the risk/return is in favor of short term short positions.

Short term position:

- short 1 NDX at 2734.9 (stop at 2787.1)

- short 1 CAC at 3748.55 (stop loss at 3763)

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

24 janvier 2013

4

24

/01

/janvier

/2013

09:10

Market printed a 'doji' on Wednesday. As this 'doji' comes after a huge rally and as we are right at the top of the (red) uptrend channel, we believe there is a high level of probability that we get a meaningful pullback in the market in coming days.

Our indicators are roughyl unchanged relative to Tuesday.

Our short term model remains in 'sell' on the NDX, it was stopped on Tuesday for the SPX.

Conclusion:

Looking at the chart, the market looks toppish. Looking at futures (following Apple's results), it looks we will have a gap down on Thursday. This gap down could be a 'reversal Island' which is quiet bearish.

In this context, we keep our short term short positions.

Short term position:

- short 1 NDX at 2734.9 (stop at 2799.98)

- short 1 CAC at 3748.55 (stop loss at 3763)

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

23 janvier 2013

3

23

/01

/janvier

/2013

08:58

Market was able, once again, to move higher. Nevertheless, we are now at the top of the red uptrend channel, and we would be surprised to get a clear breakout of this uptrend at this time: there is probably not enough momentum to do it now.

The Sigma Trend Index is roughly unchanged, other indicators are unchanged:

It is interesting to notice there is a major negative divergence between the STI and the Whole Market Index. This kind of divergence can't last forever.

Our short term model hit a stop loss on the SPX and remains in sell mode on the NDX:

Conclusion:

The chart looks more and more toppish, our short term model hit a stop loss on the SPX.

We keep our short position on both the CAC40 and the NDX

Short term position:

- short 1 NDX at 2734.9 (stop at 2799.98)

- short 1 CAC at 3748.55 (stop loss at 3763)

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

21 janvier 2013

1

21

/01

/janvier

/2013

08:42

The market continues to climb and remains very well oriented. There is no sign of reversal at this stage:

The Sigma Trend Index eased a little bit on Friday. The Trend Level remains at '4' and other indicators are neutral at '3':

Our short term model is unchanged as we haven't reached our stop loss:

Conclusion:

There isn't any sign of reversal at this stage and market isn't overbought on a short term basis.

Nevertheless, we won't close our short positions as long as we don't reach our stop losses.

Short term position:

- short 1 NDX at 2734.9 (stop at 2799.98)

- short 1 SPX at 1462.67 (stop at 1492.27)

- long 1 CAC at 3722.52 (stop loss at 3720, take profit 3777)

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

18 janvier 2013

5

18

/01

/janvier

/2013

08:34

The market resumed its uptrend on Thursday, there is no sign of reversal at this stage:

The Sigma Trend Index (STI) slightly increased on Thursday, the Trend Level is at '4', other indicators remained neutral at '3':

Our short term model remains in sell mode:

Conclusion:

The market remains well oriented, but our model didn't reverse its sell position.

Short term position:

- short 1 NDX at 2734.9 (stop at 2801.28)

- short 1 SPX at 1462.67 (stop at 1492.27)

- long 1 CAC at 3722.52 (stop loss at 3720)

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

17 janvier 2013

4

17

/01

/janvier

/2013

08:38

The market remains in its narrow range for the 5th consecutive session. But as long as the market remains above the blue horizontal line (support), we consider the market is bias to the upside.

The Sigma Trend Index (STI) continues to ease, other indicators are neutral at '3':

Our short term model remains in "sell" mode for both the NDX and the SPX:

Conclusion:

This market is trendless, stuck in a trading range for the 5th consecutive session, waiting for something...

Short term position:

- short 1 NDX at 2734.9 (stop at 2801.28)

- short 1 SPX at 1462.67 (stop at 1492.27)

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

16 janvier 2013

3

16

/01

/janvier

/2013

10:35

The Sigma Whole Market index remains above key support and looking at the chart, the big pictures looks short term bullish: we succesfully tested the horizontal support on Tuesday.

The Sigma Trend Index declined 5STI), but there is no negative impulse at this time: both the Power Level(PL) and the Swing indicators are neutral at '3'. We will have to monitor what happen if/when we test the STI's zero line.

Our short term model remains in sell mode:

Conclusion:

We will keep our short term short positions on USA (according to our short term model) but we will reduce our risk by closing our short term short on the CAC40.

Short term position:

- short 1 CAC at 3703.01

- short 1 NDX at 2734.9 (stop at 2801.28)

- short 1 SPX at 1462.67 (stop at 1492.27)

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

15 janvier 2013

2

15

/01

/janvier

/2013

10:27

The market printed a second consecutive doji, this usually happens close to trend reversal.

There is no meaningful change vs Friday's close: the equity market remains above strong support while losing momentum

The Sigma Trend Index continues to ease: the uptrend is losing a lot of momentum (but remains alive as long as the STI remains in positive territory).

Our short term model remains in sell mode:

Conclusion:

We keep our positions, we adjut our stop orders in order to fit with our model.

Short term position:

- short 1 CAC at 3703.01

- short 1 NDX at 2734.9 (stop at 2805.53)

- short 1 SPX at 1462.67 (stop at 1492.27)

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis