The Sigma Whole Europe Index is testing an important horizontal support. This market will remain under pressure as long as it prints lower highs and lower lows.

Looking at some key European markets, the danger is evident.

The Sigma Trend Index remains near its zero line: a decline in negative territory would be another bad signal for European markets.

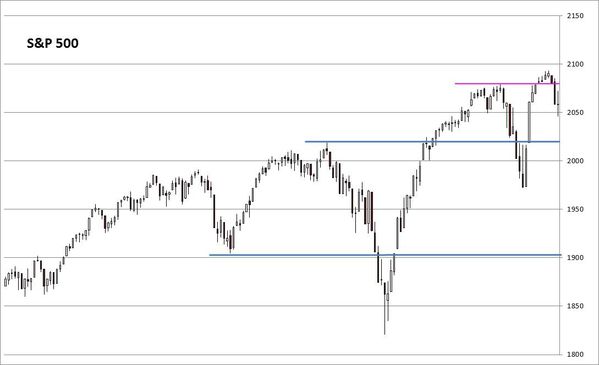

The Sigma Whole Market (SWM) Index was under pressure on Friday but it is too early to say if we printed a medium term top or if we have a short term consolidation. As long as the SWM stays above October's low, the short term consolidation is our favorite scenario.

Looking at some US indexes, there is no sign of reversal but the weakness in the NDX remains something to focus on because current pattern looks like a double top.

The Sigma Trend Index is also close to its zero line. So, this indicator tells us there is more danger than it looks at first glance.