The Sigma Whole Europe Index was able to move above the first pink horizontal resistance. There is a high probability the market could test the red horizontal resistance on the ECB' decision. In order to open the way for further gains, we need a close above the red horizontal resistance.

Looking at key EU indexes, we can see various situations: some indexes are printing new highs while other indexes remain in the middle of their trading range.

The Sigma Trend Index Europe remains above the key '34' level. So, any impulse move to the downside in the next 3 sessions will trigger a 'sell' signal. The 5 latest sessions were impulsive, this is rather unusual: either we are at the early stage of a major move or we are in a capitulation situation. But the rally is so extended on a short term basis that we believe a sell on news (after the ECB's decision) is likely.

The Sigma Whole Market Index remains above a strong horizontal resistance but recent action is not really convincing for a bull run. It seems we could be in a counter trend move.

Looking at key indexes, we have roughly the same situation than in Europe: some indexes are close to their recent top while others remain in the middle of their recent trading range.

The Sigma Trend Index is testing its zero line. So, US markets are not out of the wood, recent action could have been a technical rebound.

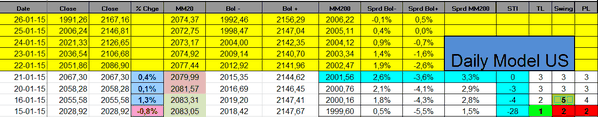

Daily Trading Book: