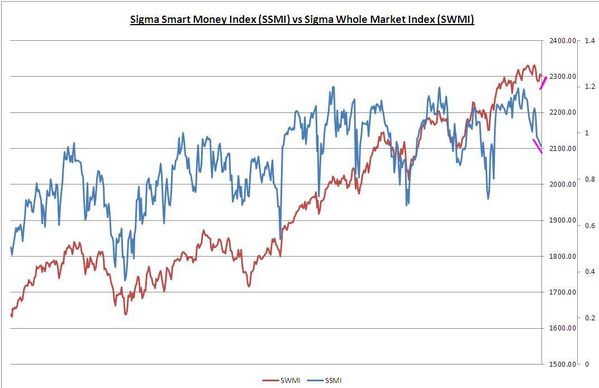

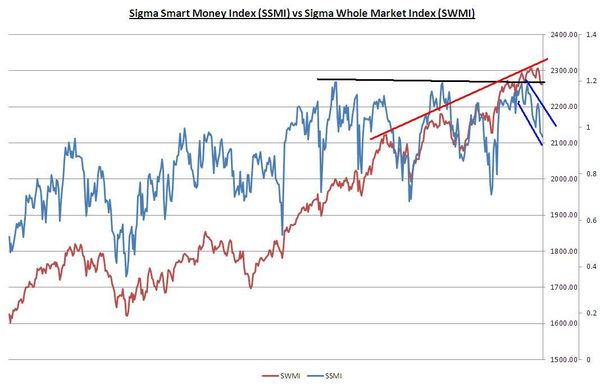

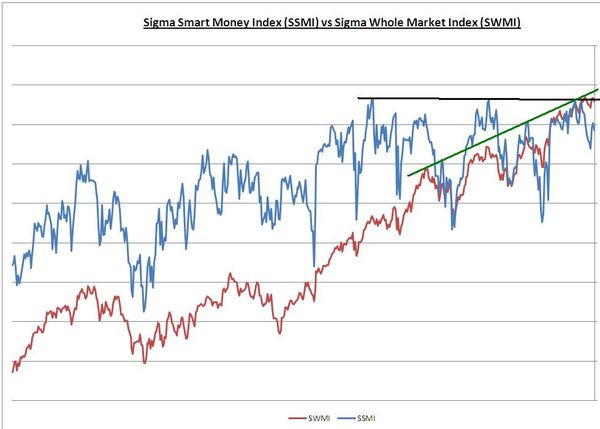

Looking at the chart of the Sigma Whole Market Index, it is very clear we are ready to break previous highs (very bad if we can't due to a triple top situation !!!!!! ). If the market is able to clean this resistance, we will be (again) in uncharted territory and euphoria can easily materialize in this area.

The situation in Europe is also very positive with fresh bullish gaps on all indexes. The DAX and the Eurostoxx are more advance than the CAC40, and we would not be surprised to see new 52weeks highs on those 2 indexes. Nevertheless, a 'fresh down gap' would cancel this bullish scenario.

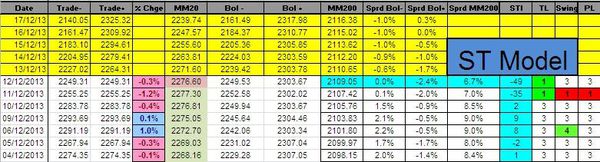

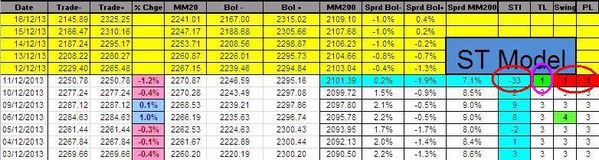

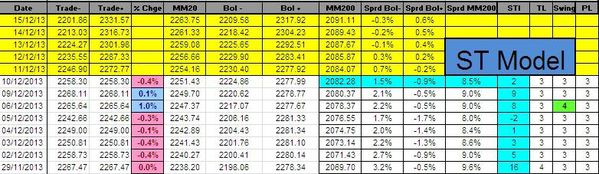

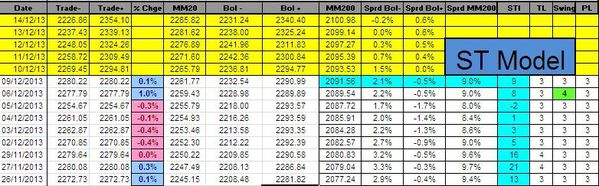

There is no new information coming from our indicators for today:

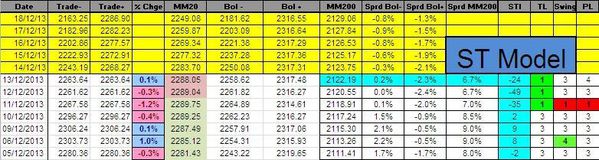

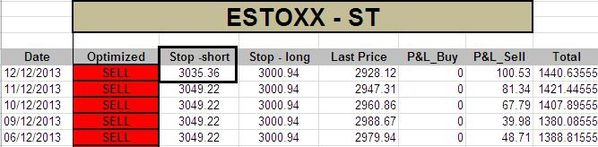

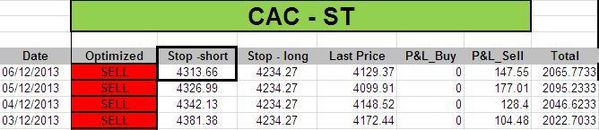

The ST model computed new stop levels for the DAX, CAC and Eurostoxx:

Short Term Trading Book:

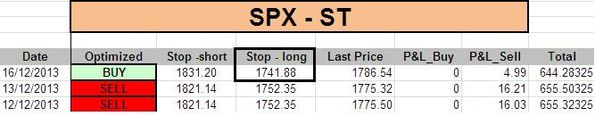

- SPX: long at 1787.18 (stop @ 1748, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 3475.53 (stop @ 3372, 5pts below the ST model to take into account bid/ask spread)

- CAC: long at 4115.38 (stop @ 4055, 5pts below the ST model to take into account bid/ask spread)

- DAX: long at 9164.04 (stop @ 8890, 10pts below the ST model to take into account bid/ask spread)

- EStoxx: long at 2974.13 (stop @ 2900, 5pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- No more medium term position at this stage.

Out of model position: (in case of a blow off rally like in 2000)

- 1 call NDX January 2014 strike 3700 @ 5.06