Looking at the weekly chart of the Sigma Whole Market Index, we can notice the market closed for the first time (since early 2010) above its pink ascending resistance. An acceleration at this stage in the cycle is either a false break (bull trap) or a clear breakout leading to an exhaustion move (asymptotic move).

Until Thursday we were close to enter the weekly sell zone but with Friday's weak session, the weekly Sigma Trend Index ended the week at '40' and we are below the key 50 level. ('50' is the required level, on a weekly basis, in order to enter the sell zone). So, we won't be able to get a weekly sell signal next week and the MT model will remain neutral.

(for more detail related to our buy and sell signal, please have a look at our methodology).

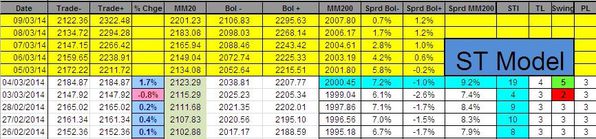

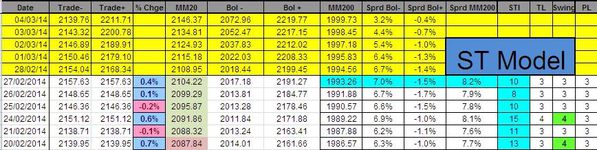

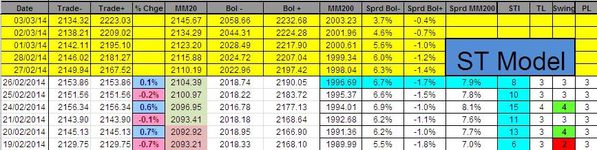

Looking at the Short Term model, there was no new information on Friday. The daily Sigma Trend Index closed at 18, well below the key '34' level required for a sell signal (for more detail related to our buy and sell signal, please have a look at our methodology).

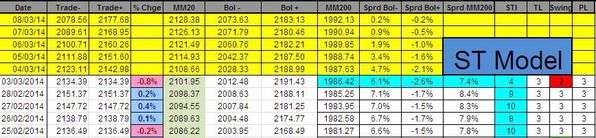

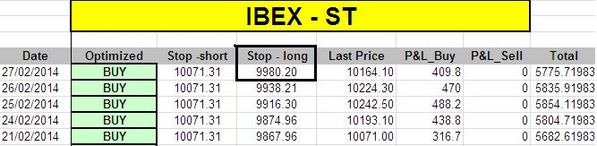

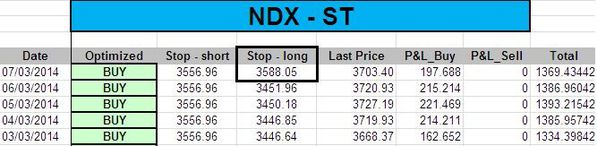

The ST model sharply uplifted its stop on the NDX:

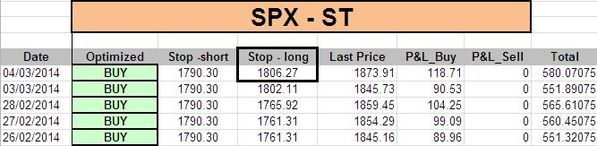

Short Term Trading Book:

- SPX: long at 1754.73 (stop @ 1806, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 3506.23 (stop @ 3583, 5pts below the ST model to take into account bid/ask spread)

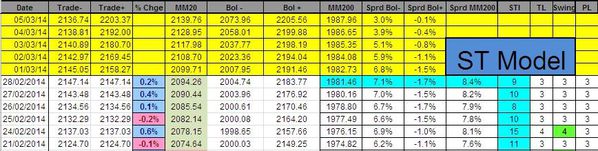

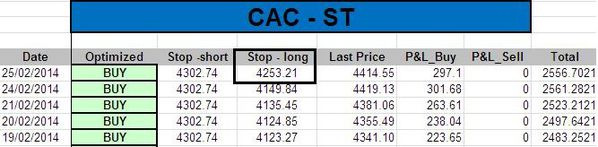

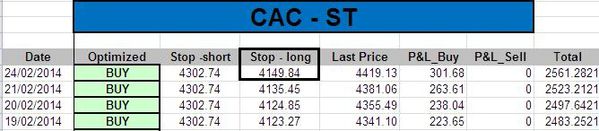

- CAC: long at 4107.69(stop @ 4253, 5pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- No more medium term position at this stage.

Out of model position:

- 1 put SPX, MAY, strike 1400 @ usd2.85