The Sigma Whole Market Index slightly declined on Tuesday. So, the possible double top we identified on Monday remains valid. We would be surprised that this bull run ends on a 'clean double top' without a crazy asymptotic move, but a consolidation before the 'crazy move' is possible. We could consolidate until next Fed meeting and then rally.

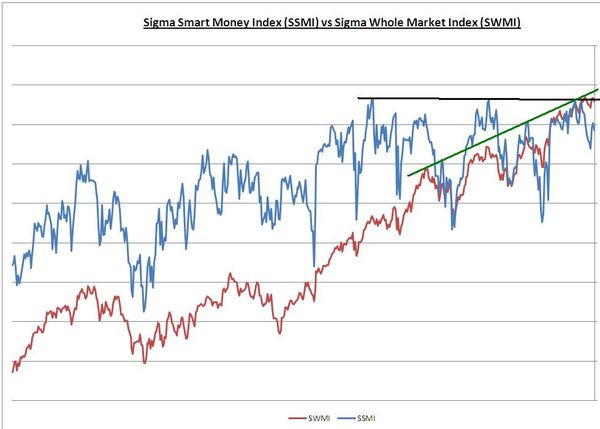

The negative divergence between the Sigma Smart Money Index and the Sigma Whole Market Index remains well in place.

Looking at the CAC40 and the Eurostoxx50, the open gap at 4050 (on the CAC40) and the horizontal support around 2875 (on the Eurostoxx50) are the next obvious target if we break Friday's low.

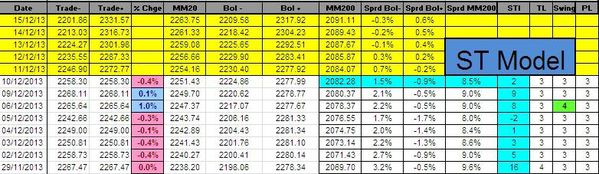

There is no change in our indicators. The Sigma Trend Index remains in positive territory and other indicators are neutral (at '3').

There is no change in our trading book.

Short Term Trading Book:

- SPX: short at 1792.26 (stop @ 1827, 3pts above the ST model to take into account bid/ask spread)

- NDX: stopped

- CAC: short at 4272.14 (stop @ 4319, 5pts above the ST model to take into account bid/ask spread)

- DAX: stopped

- EStoxx: short at 3027.17 (stop @ 3055, 5pts above the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- No more medium term position at this stage.

Out of model position:

- 1 call NDX January 2014 strike 3700 @ 5.06