We wrote during the week-end that the market was in danger. The market decided to bounce back and Monday's move sounds like a positive impulse day in Europe while the bounce back is more muted in US.

The Sigma Whole Market Index was able to move back above the top of the red uptrend channel and this is another positive sign.

So, the big question is: Was it an 'abc' correction? Is this correction already over?

When we look at European indexes, the bounce back looks like an impulse move: in one session, the market was able to retrace several days of decline. On top of that, it is clearly possible to count recent decline as an 'abc' move.

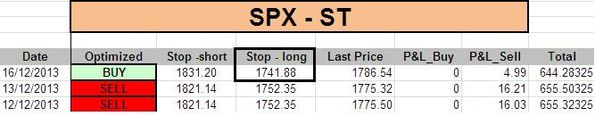

Looking at our indicators, the Swing jumped to '4' while the TL had been at '1' during a couple of session. So, the ST model generated a fresh 'buy' signal. (for more details on our methodology, click on 'methodology' in the right column)

So, we closed our short positions and opened long positions at the end of US session:

- 1 short CAC closed at 4115.38 => 4272.14 - 4115.38 = 156.76 (gains)

- 1 short EuroStoxx closed at 2974.13 => 3027.17 - 2974.13 = 53.04 (gains)

- 1 short SPX closed at 1787.18 => 1792.26 - 1787.18 = 5.08 (gains)

Short Term Trading Book:

- SPX: long at 1787.18 (stop @ 1739, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 3475.53 (stop @ 3367, 5pts below the ST model to take into account bid/ask spread)

- CAC: long at 4115.38 (stop @ 4032, 5pts below the ST model to take into account bid/ask spread)

- DAX: long at 9164.04 (stop @ 8808, 10pts below the ST model to take into account bid/ask spread)

- EStoxx: long at 2974.13 (stop @ 2856, 5pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- No more medium term position at this stage.

Out of model position: (hedge against a blow off rally like in 2000)

- 1 call NDX January 2014 strike 3700 @ 5.06