The Sigma Whole Market Index slightly pulled back after the strong impulse day we had on Monday. The market remains above the top of the red uptrend . There is nothing special at this stage.

Once again, the catalyst for the next move will be a political event: Fed's decision related to "taper or not taper". I've to admit the market acts more and more like a communist central plan rather than a free market: I mean the biggest drivers of the market in recent years had been: Merkel, Draghi, Bernanke, Boehner.... and not earnings, growth, valuation, free cash flow, ... After the "new economy" in 1998-2000 we have "the subsidised" economy in 2012-2013...

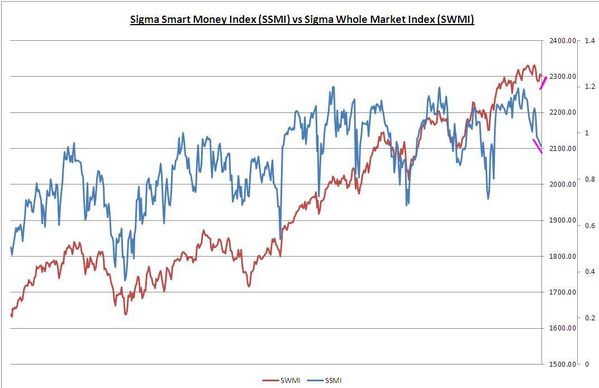

Nevertheless, it remains one warning signal in place: the Sigma Smart Money Index continues to decline, and it didn't bounce back on Monday (as can be seen on the chart).

There is no change in our indicators. The Trend Level (TL) pulled back from '3' to '2'. (neutral to negative)

Short Term Trading Book:

- SPX: long at 1787.18 (stop @ 1739, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 3475.53 (stop @ 3367, 5pts below the ST model to take into account bid/ask spread)

- CAC: long at 4115.38 (stop @ 4032, 5pts below the ST model to take into account bid/ask spread)

- DAX: long at 9164.04 (stop @ 8808, 10pts below the ST model to take into account bid/ask spread)

- EStoxx: long at 2974.13 (stop @ 2856, 5pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- No more medium term position at this stage.

Out of model position: (hedge against a blow off rally like in 2000)

- 1 call NDX January 2014 strike 3700 @ 5.06