7 juin 2013

5

07

/06

/juin

/2013

07:02

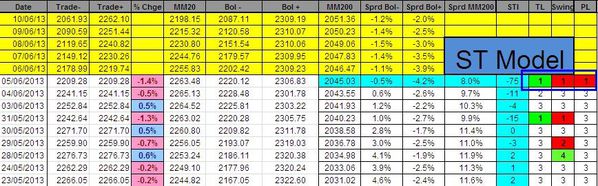

The market did an impressive U turn during Thursday's session: after declining by roughly 1%, the market reversed and closed at the high of the day (at +0.9%).

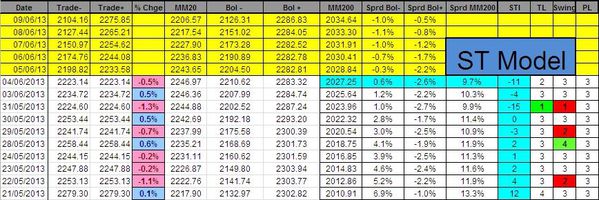

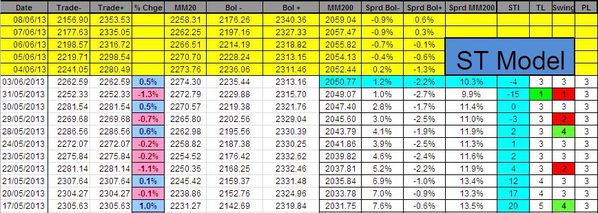

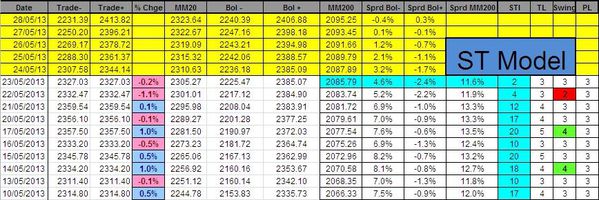

The swing moved at '4' and generated a 'buy' signal (because the Trend Level was at '1' on Wednesday).

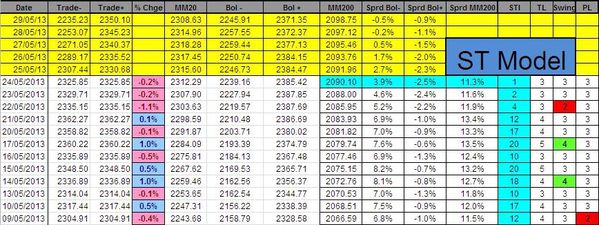

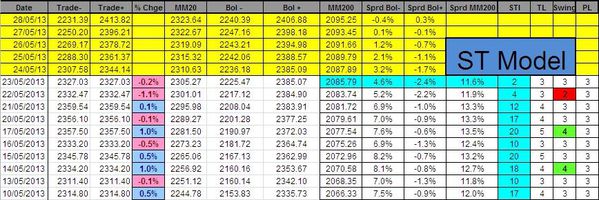

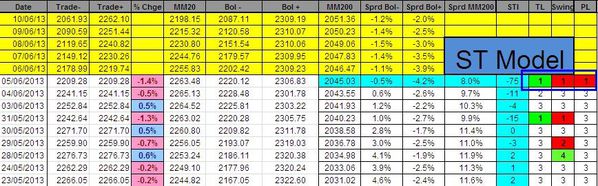

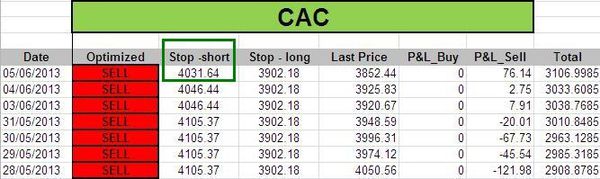

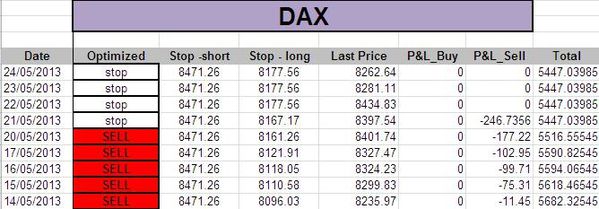

Here are the new stop levels generated by the ST model:

Trading Book:

We closed our short position on both the CAC40 and the NDX just before US close:

- CAC40 closed at 3829.67 (gains 187.31pts)

- NDX closed at 2951.63 (gains 70.41pts)

According to our model, we opend long position:

- SPX: 1 long at 1624.62 (stop @ 1579, 3pts below the model to take into account bid/ask spread)

- NDX: 1 long at 2951.63 (stop @ 2856, 5pts below the model to take into account bid/ask spread)

- CAC: 1 long at 3829.67 (stop @ 3733, 5pts below the model to take into account bid/ask spread)

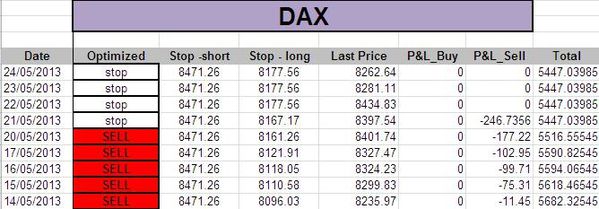

- DAX: 1 long at 8145.34 (stop @ 7926.5, 10pts below the model to take into account bid/ask spread)

Published by sigmatradingoscillator

-

dans

Market Analysis

6 juin 2013

4

06

/06

/juin

/2013

07:38

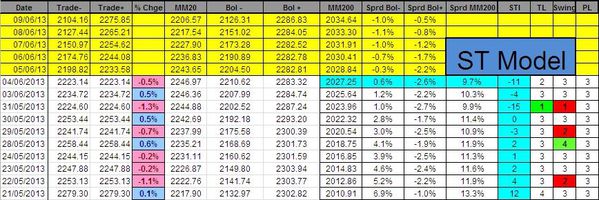

The market sharply decline on Wednesday. The Trend Level(TL) is now at '1' (oversold) which means we could get a fresh buy signal on Thursday's if the Swing move to '4' or '5'.

As the market reached new lows, we model adjusted stop levels on our short positions:

Trading Book:

Our short position on the NDX is still alive because our stop was at 3055 (5pts above the model, and we didn't reach this level).

- SPX: no position at this time (model is 'stop')

- NDX: 1 short at 3022.04 (stop @ 3035, 5pts above the model to take into account bid/ask spread)

- CAC: 1 short at 4016.98 (stop @ 4037 5pts above the model to take into account bid/ask spread)

- DAX: no position at this time (model is 'stop')

Published by sigmatradingoscillator

-

dans

Market Analysis

5 juin 2013

3

05

/06

/juin

/2013

09:11

The Sigma Whole Market Index declined by 0.5% on Tuesday, and the trend Level is now at '2' => there is no chance to get a 'buy' signal on Wednesday because we need an oversold situation (trend leve(TL) at '1') in order to generate a 'buy' signal.

The market didn't print new lows on Tuesday (relative to monday's lows), so stop levels haven't been modified

Trading Book:

Our short position on the NDX is still alive because our stop was at 3055 (5pts above the model, and we didn't reach this level).

- SPX: no position at this time (model is 'stop')

- NDX: 1 short at 3022.04 (stop @ 3040, 5pts above the model to take into account bid/ask spread)

- CAC: 1 short at 4016.98 (stop @ 4050 5pts above the model to take into account bid/ask spread)

- DAX: no position at this time (model is 'stop')

Published by sigmatradingoscillator

-

dans

Market Analysis

4 juin 2013

2

04

/06

/juin

/2013

08:50

The model didn't generate a 'buy' signal on Monday because the Swing was at '3' and we needed a '4' or '5' in order to generate a 'buy' signal.

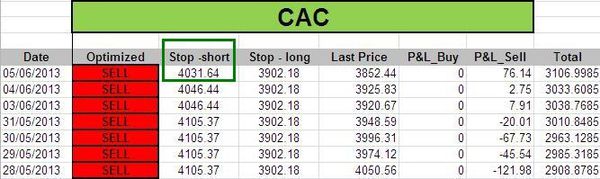

But as the market sharply declined (intraday), the model generated new stop levels for both the NDX and the CAC(have a look at 'stop - short' levels in the 2 tables):

Trading Book:

Our short position on the NDX is still alive because our stop was at 3055 (5pts above the model, and we didn't reach this level).

- SPX: no position at this time (model is 'stop')

- NDX: 1 short at 3022.04 (stop @ 3040, 5pts above the model to take into account bid/ask spread)

- CAC: 1 short at 4016.98 (stop @ 4050 5pts above the model to take into account bid/ask spread)

- DAX: no position at this time (model is 'stop')

Published by sigmatradingoscillator

-

dans

Market Analysis

1 juin 2013

6

01

/06

/juin

/2013

11:47

The Sigma Whole Market Index is right on the green horizontal support. If this support is breached, there is a high probability that we will decline until the next horizontal support (pink line) in coming sessions. But after recent consolidation, we can also imagine that the market could rebound from current levels and retest recent highs.

Looking at the CAC40, we can see the same pattern than for the US market. The index is right on the red horizontal support, and if this support doesn't hold on, we will probably decline until the next horizontal support (green line).

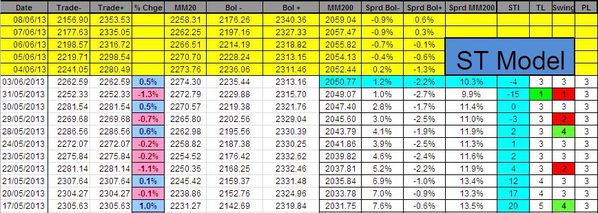

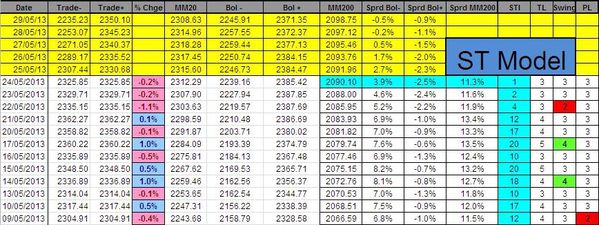

Looking at our ST model, we can notice that the Trend Level(TL) is at '1' (oversold). So, if we get a Swing at '4' or '5' on Monday, this will generate a 'buy' signal.

Looking at the different index we track, there is no change at this time: The CAC is in 'sell' while all other indexes are 'stop':

Trading Book:

Our short position on the NDX is still alive because our stop was at 3055 (5pts above the model).

- SPX: no position at this time (model is 'stop')

- NDX: 1 short at 3022.04 (stop @ 3055, 5pts above the model to take into account bid/ask spread)

- CAC: 1 short at 4016.98 (stop @ 4110, 5pts above the model to take into account bid/ask spread)

- DAX: no position at this time (model is 'stop')

Published by sigmatradingoscillator

-

dans

Market Analysis

31 mai 2013

5

31

/05

/mai

/2013

07:54

There is no change today: no new signal, no change in stop levels.

The Sigma Trend Index (STI) is back to its zero line. All other indicators are neutral at '3'.

Trading Book:

Our short position on the NDX is still alive because our stop was at 3055 (5pts above the model).

- SPX: no position at this time (model is 'stop')

- NDX: 1 short at 3022.04 (stop @ 3055, 5pts above the model to take into account bid/ask spread)

- CAC: 1 short at 4016.98 (stop @ 4110, 5pts above the model to take into account bid/ask spread)

- DAX: no position at this time (model is 'stop')

Published by sigmatradingoscillator

-

dans

Market Analysis

30 mai 2013

4

30

/05

/mai

/2013

08:51

There is no change today: no new signal, no change in stop levels.

Nevertheless, it is interesting to notice that the Sigma Trend Index (STI) is now in negative territory and that the Swing moved to '2'.

Trading Book:

Our short position on the NDX is still alive because our stop was at 3055 (5pts above the model).

- SPX: no position at this time (model is 'stop')

- NDX: 1 short at 3022.04 (stop @ 3055, 5pts above the model to take into account bid/ask spread)

- CAC: 1 short at 4016.98 (stop @ 4110, 5pts above the model to take into account bid/ask spread)

- DAX: no position at this time (model is 'stop')

Published by sigmatradingoscillator

-

dans

Market Analysis

29 mai 2013

3

29

/05

/mai

/2013

07:28

There is absolutely no change today: no new signal, no change in stop levels.

Trading Book:

Our short position on the NDX is still alive because our stop was at 3055 (5pts above the model).

- SPX: no position at this time (model is 'stop')

- NDX: 1 short at 3022.04 (stop @ 3055, 5pts above the model to take into account bid/ask spread)

- CAC: 1 short at 4016.98 (stop @ 4110, 5pts above the model to take into account bid/ask spread)

- DAX: no position at this time (model is 'stop')

Published by sigmatradingoscillator

-

dans

Market Analysis

27 mai 2013

1

27

/05

/mai

/2013

08:45

There is nothing new in our short term model, The Sigma trend Index (STI) is close to zero, all other indicators are neutral at '3':

The short term model is 'stop' on the NDX, SPX and DAX, we have one remaining position on the CAC:

Trading Book:

Our short position on the NDX is still alive because our stop was at 3055 (5pts above the model).

- SPX: no position at this time (model is 'stop')

- NDX: 1 short at 3022.04 (stop @ 3055, 5pts above the model to take into account bid/ask spread)

- CAC: 1 short at 4016.98 (stop @ 4110, 5pts above the model to take into account bid/ask spread)

- DAX: no position at this time (model is 'stop')

Published by sigmatradingoscillator

-

dans

Market Analysis

24 mai 2013

5

24

/05

/mai

/2013

08:26

There is no change today:

Stop levels are unchanged:

Trading Book:

Our short position on the NDX is still alive because our stop was at 3055 (5pts above the model).

- SPX: no position at this time (model is 'stop')

- NDX: 1 short at 3022.04 (stop @ 3055, 5pts above the model to take into account bid/ask spread)

- CAC: 1 short at 4016.98 (stop @ 4110, 5pts above the model to take into account bid/ask spread)

- DAX: no position at this time (model is 'stop')

Published by sigmatradingoscillator

-

dans

Market Analysis