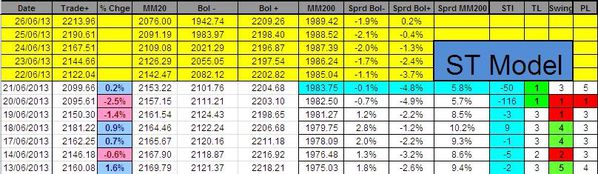

The Trend level is at '1'. So the model will generate a new 'buy' signal if the Swing moves at '4' or '5' on Tuesday.

Trading Book:

-No more position for the time being

The Trend level is at '1'. So the model will generate a new 'buy' signal if the Swing moves at '4' or '5' on Tuesday.

Trading Book:

-No more position for the time being

The market continued to decline on Friday morning and we hit our stop loss. At the end of the day, the market printed a 'doji'.

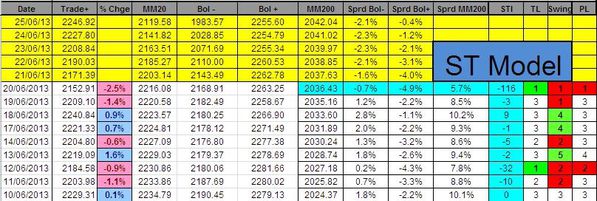

The Sigma Trend Index is improving, jumping from '-116' to '-50'. The trend Level is at '1', so a fresh buy signal could be generated on monday if we get a swing at '4' or '5'.

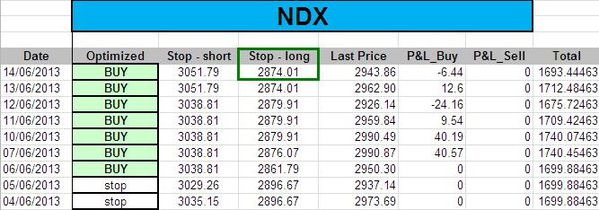

NDX and DAX were stopped so we don't have anymore position:

- NDX: 1 long at 2951.63 (stopped @ 2878.67, 72.96pts lost)

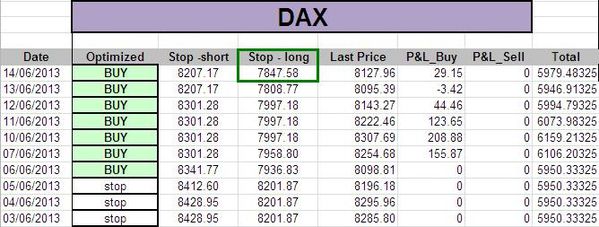

- DAX: 1 long at 8145.34 (stopped @ 7885.81, -259.53 pts lost)

Trading Book:

-No more position for the time being

Following Thursday's sharp decline, the STI is now deeply oversold at '-116', the Trend Level is at '1'.

So, we could get a buy signal on Friday if we get a Swing at '4'

SPX and CAC were stopped but the NDX and the DAX are still 'running':

- SPX: 1 long at 1624.62 (stopped @ 1599.91, 24.71pts lost)

- CAC: 1 long at 3823.10 (stopped @ 3747.63, 75.47 pts lost)

Trading Book:

- NDX: 1 long at 2951.63 (stop @ 2879, 5pts below the model to take into account bid/ask spread)

- DAX: 1 long at 8145.34 (stop @ 7886, 10pts below the model to take into account bid/ask spread)

Following Fed's decision, the market sharply declined. There is no new signal in our indicators:

The model updated stop level on DAX:

Trading Book:

- SPX: 1 long at 1624.62 (stop @ 1600, 3pts below the model to take into account bid/ask spread)

- NDX: 1 long at 2951.63 (stop @ 2879, 5pts below the model to take into account bid/ask spread)

- CAC: 1 long at 3823.10 (stop @ 3748, 5pts below the model to take into account bid/ask spread)

- DAX: 1 long at 8145.34 (stop @ 7886, 10pts below the model to take into account bid/ask spread)

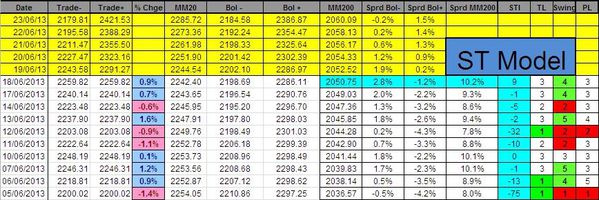

The market continues to rally and the Sigma Trend Index (STI) is back in positive territory. Today is an important day due to Fed meeting, we will see what happens.

Our model updated some stop levels:

Trading Book:

- SPX: 1 long at 1624.62 (stop @ 1600, 3pts below the model to take into account bid/ask spread)

- NDX: 1 long at 2951.63 (stop @ 2879, 5pts below the model to take into account bid/ask spread)

- CAC: 1 long at 3823.10 (stop @ 3748, 5pts below the model to take into account bid/ask spread)

- DAX: 1 long at 8145.34 (stop @ 7876, 10pts below the model to take into account bid/ask spread)

The market is stuck between a support and a resistance (green and pink lines).

After a successful test of the pink horizontal support, the market bounced back and was able to print a higher low. This situation is short term positive (until we print a new low).

The Sigma Trend Index(STI) remains in negative territory, telling us current trend remains to the downside.

Some of our stop levels have been modified by the model. Here are the updated levels:

Trading Book:

- SPX: 1 long at 1624.62 (stop @ 1593, 3pts below the model to take into account bid/ask spread)

- NDX: 1 long at 2951.63 (stop @ 2869, 5pts below the model to take into account bid/ask spread)

- CAC: 1 long at 3823.10 (stop @ 3727, 5pts below the model to take into account bid/ask spread)

- DAX: 1 long at 8145.34 (stop @ 7837, 10pts below the model to take into account bid/ask spread)

The market came under pressure on Wednesday and the Sigma Trend Index fall back to '1'.

It will be important to see if last week lows can resist or if we move lower.

There is no change in our stop levels for today.

Trading Book:

- SPX: 1 long at 1624.62 (stop @ 1590, 3pts below the model to take into account bid/ask spread)

- NDX: 1 long at 2951.63 (stop @ 2871, 5pts below the model to take into account bid/ask spread)

- CAC: 1 long at 3829.67 (stop @ 3738, 5pts below the model to take into account bid/ask spread)

- DAX: 1 long at 8145.34 (stop @ 7927, 10pts below the model to take into account bid/ask spread)

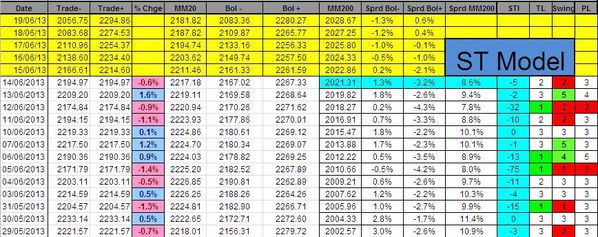

The market declined on Tuesday, the Sigma trend Index "refused" to move in positive territory after a test of its zero line and closed at -10.

It would be better (for the bull case) to remain above last week low.

There is no change in our stop levels for today.

Trading Book:

- SPX: 1 long at 1624.62 (stop @ 1590, 3pts below the model to take into account bid/ask spread)

- NDX: 1 long at 2951.63 (stop @ 2871, 5pts below the model to take into account bid/ask spread)

- CAC: 1 long at 3829.67 (stop @ 3738, 5pts below the model to take into account bid/ask spread)

- DAX: 1 long at 8145.34 (stop @ 7927, 10pts below the model to take into account bid/ask spread)

The market experienced a quiet session on Monday. The Sigma Trend Index is now testing its zero line:

The ST model modified the stop levels on some indices:

Trading Book:

- SPX: 1 long at 1624.62 (stop @ 1592, 3pts below the model to take into account bid/ask spread)

- NDX: 1 long at 2951.63 (stop @ 2875, 5pts below the model to take into account bid/ask spread)

- CAC: 1 long at 3829.67 (stop @ 3738, 5pts below the model to take into account bid/ask spread)

- DAX: 1 long at 8145.34 (stop @ 7955, 10pts below the model to take into account bid/ask spread)

After the massive 'U' turn achieved during Thursday's session, the equity market continued to rally on Friday.

Following Friday's advance, our ST model uplifted our stop levels to following prices:

Trading Book:

- SPX: 1 long at 1624.62 (stop @ 1590, 3pts below the model to take into account bid/ask spread)

- NDX: 1 long at 2951.63 (stop @ 2871, 5pts below the model to take into account bid/ask spread)

- CAC: 1 long at 3829.67 (stop @ 3738, 5pts below the model to take into account bid/ask spread)

- DAX: 1 long at 8145.34 (stop @ 7927, 10pts below the model to take into account bid/ask spread)

If you want to get alerts when we post new articles, follow us on Twitter:

Our account is @SigmaTradingOsc

Some explanations on the model itself (English version)

Quelques explications sur le modèle (Version Française)

Recopiez l'adresse de notre site internet dans l'encadré du

site Google Translate et appuyez sur entrée pour obtenir la traduction

NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT, INCLUDING BUT NOT LIMITED TO STOCKS, COMMODITIES, OPTIONS, BONDS, FUTURES, OR BULLION. ACTIONS YOU UNDERTAKE AS A CONSEQUENCE OF OUR ANALYSIS, OPINION OR ADVERTISEMENT ON THIS SITE ARE YOUR SOLE RESPONSIBILITY.

FOR INVESTMENT ADVICE, PLAN A MEETING WITH A FINANCIAL ADVISOR IN ORDER TO ESTABLISH YOUR OWN RISK PROFILE.