The Sigma Whole MArket Index continues its advance. It seems nothing can stop it.

At the same time, both the Small Cap 600 and the Russell 2000 are close to break their recent downtrend.

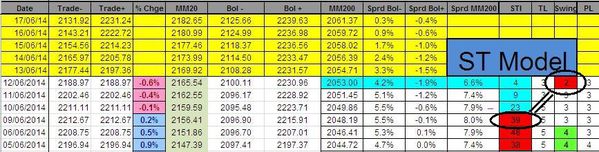

Looking at our indicators, there is no change.

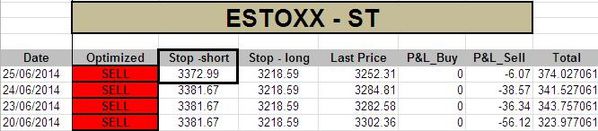

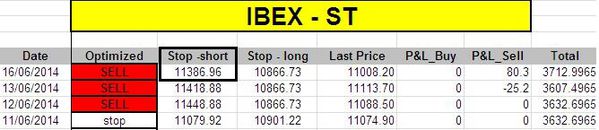

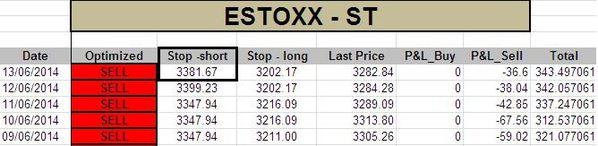

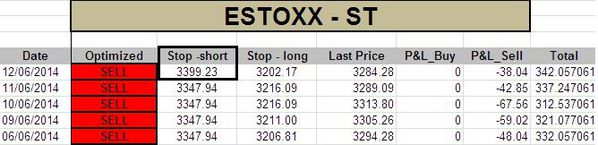

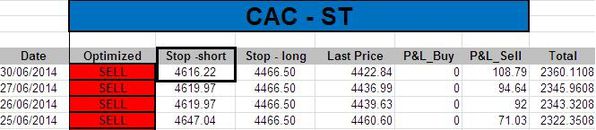

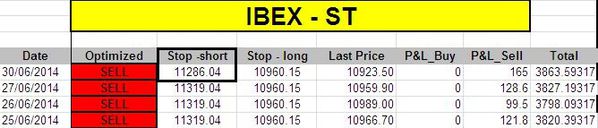

Europe remains weaker than US. The ST model computed new stop levels on the CAC, the EStoxx and the IBEX

Short Term Trading Book:

- SPX: short at 1912.06 (stop @ 1981, 3pts above the ST model to take into account bid/ask spread)

- NDX: short at 3720.24 (stop @ 3881, 5pts above the ST model to take into account bid/ask spread)

- CAC: short at 4526.78 (stop @ 4621, 5pts above the ST model to take into account bid/ask spread)

- EStox: short at 3242.67 (stop @ 3354, 5pts above the ST model to take into account bid/ask spread)

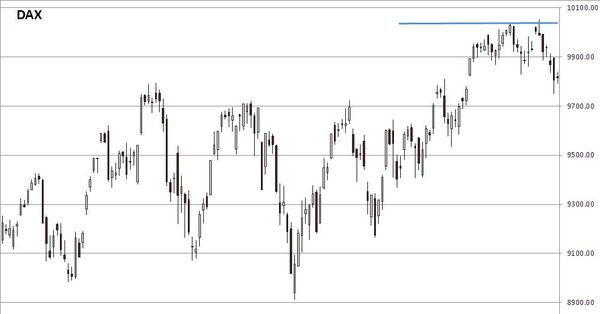

- DAX: short at 9936.15 (stop @ 10085, 10pts above the ST model to take into account bid/ask spread)

- IBEX: short at 110496.6 (stop @ 11296, 10pts above the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- No more medium term position at this stage.