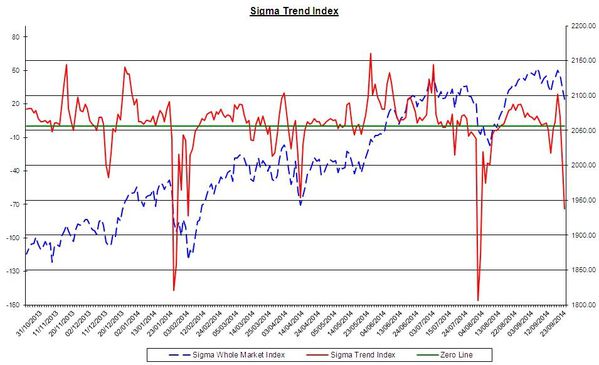

The Sigma Whole Market Index continues to slide. It is now well below the red horizontal support. It will be important to stay in the uptrend channel (close to pink support).

If the situation continues to deteriorate from here, there is a meaningful risk we have just printed a major top. Why? The market broke its uptrend in May (not), then it was able to rally and to print a marginal new high (could be a failed top). Moreover, this top was a weak momentum top because it was not confirmed by the Russell 2000, The Mid Cap 400 and the Samll Cap 600.

Looking at the Russell 2000, the Nasdaq100 and the Mid Cap, we can notice those markets were under heavy pressure on Monday. Some are talking about an Alibaba effect (building cash in order to subscribe to the IPO). This is possible but there is no certainty this is the right explanation.

In Europe, the situation looks in a better shape: key indexes are still above horizontal supports. But it is important to bounce back from here or those markets will be under pressure.

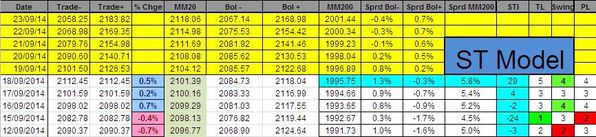

The Sigma Trend Index sharply declined to '-24'. The Power Level (PL) was at '2', telling us the decline was rather impulsive.

There is no change in our position at this stage:

Short Term Trading Book:

- SPX: long at 1936.12 (stop @ 1920, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 3894.96 (stop @ 3840, 5pts below the ST model to take into account bid/ask spread)

- CAC: long at 4180.52 (stop @ 4337, 5pts below the ST model to take into account bid/ask spread)

- EStox: long at 3036.56 (stop @ 3165, 5pts below the ST model to take into account bid/ask spread)

- DAX: long at 9184.25 (stop @ 9446, 10pts below the ST model to take into account bid/ask spread)

- IBEX: no position at this stage (according to our model, stop would be at 10725)