We wrote on Thursday:

"Looking at the Sigma Whole Market Index (aggregate of 16 US indexes), we can notice an important reversal day (today). In this context, it seems that the consolidation is still alive and further upside within this bounce back is possible (upside to the horizontal green line)"

Nevertheless, we had never expected such a rally and were were really surprised by the violence of Friday's move.

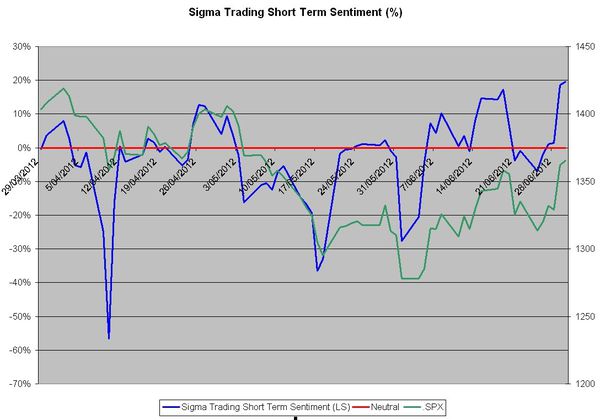

Looking at our indicators, we can notice the huge move from the Swing indicator, moving from 3 to 5, telling us this move (to the upside) is probably not over.

On the short term, the Trend Level (TL) is at '5' (overbought territory).

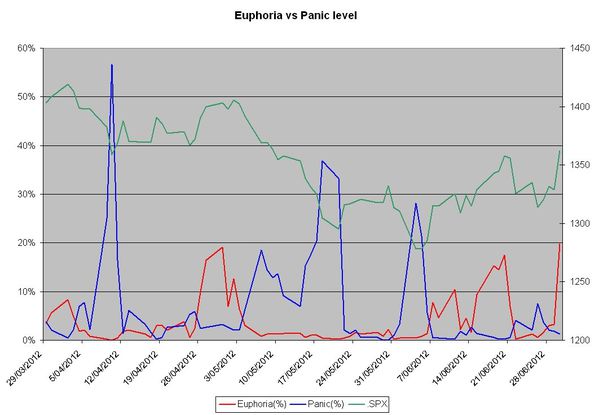

Looking at the short term sentiment, we can notice that 'euphoria' is peaking up (red line), reaching level in line with previous tops in the market:

Conclusion:

We have to admit that this scenario is not the one we were expecting, and most of our positions hit their respective stop loss during Friday's session.

Looking at the nature of Friday's move, it looks like a pullback is possible early next week, but higher price should be reached later in the week.

Even if we consider that current move remains corrective, we have to respect what happen on Friday: a powerful impulse move (to the upside).

Like I often say to my colleagues: "never try to stop a train with your hands, it could hurt..."

If we have a pullback on Monday, we will reduce our short position on the SPX, and we will wait on the sideline, waiting for an opportunity (long or short).

We wish you a nice week,

SigmaTradingOscillator

Current position:

- short 2.5x std size SPX at 1331.28 (no stop loss in place)