29 juin 2012

5

29

/06

/juin

/2012

00:01

After today's action, it is difficult to say if the decline we are waiting for has already begun or if the consolidation period is still running.

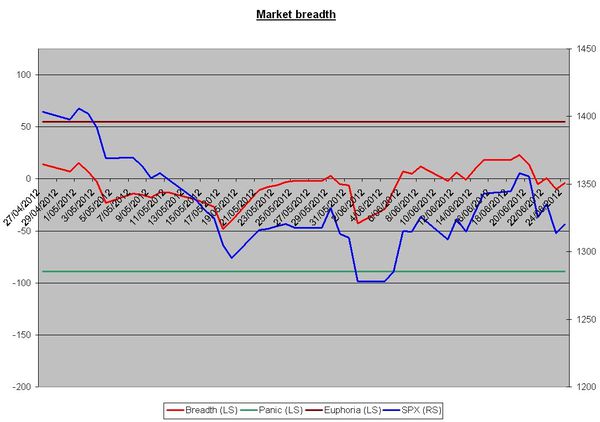

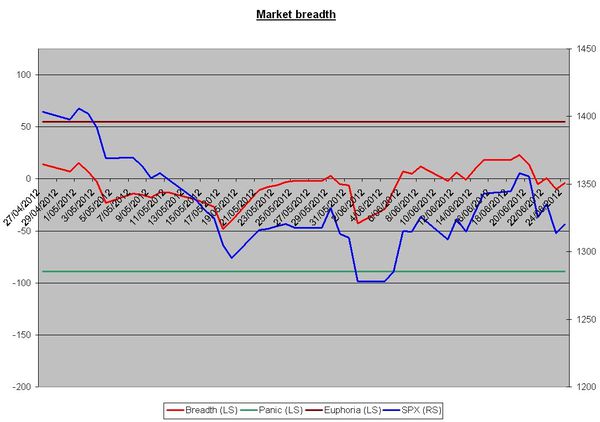

Looking at the Sigma Whole Market Index (aggregate of 16 US indexes), we can notice an important reversal day (today). In this context, it seems that the consolidation is still alive and further upside within this bounce back is possible (upside to the horizontal green line):

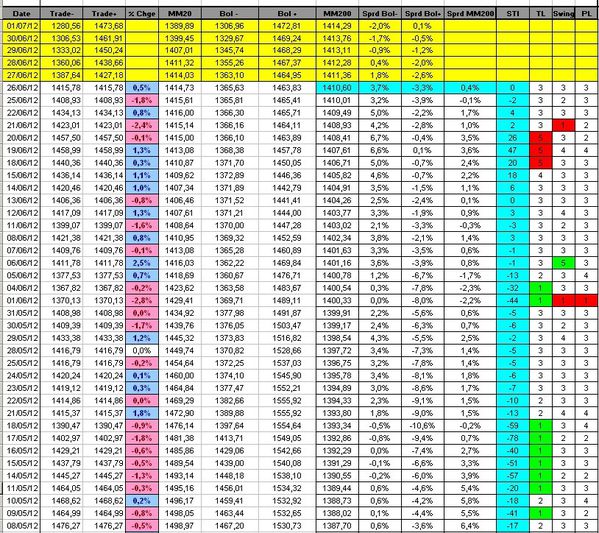

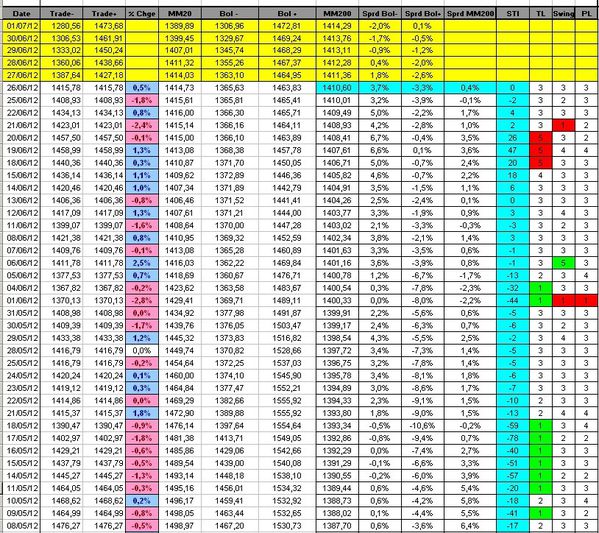

Looking at our Sigma Trend Index (STI), we can notice that this index remains above the zero line, telling us the consolidation phase is not over (yet). Other indicators are in neutral territory (at '3'):

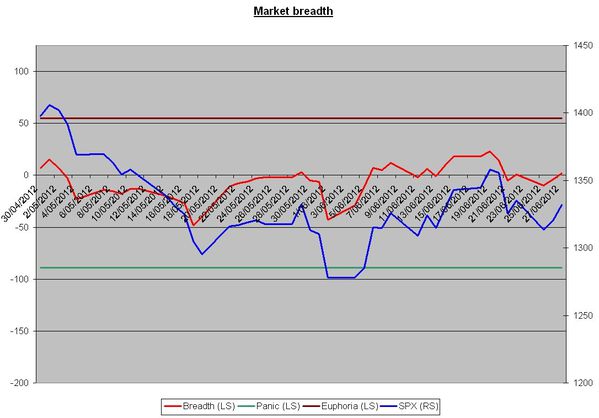

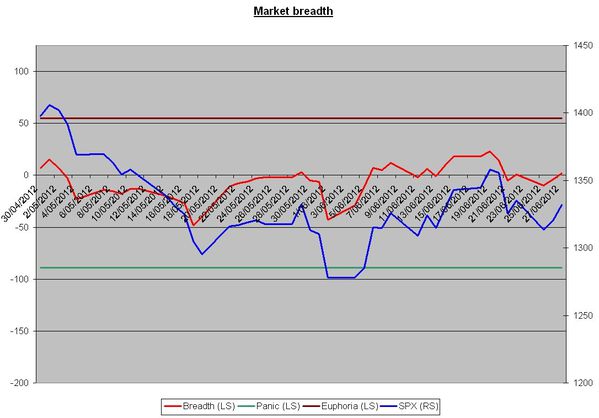

The Breadth index was unchanged (vs wednesday) while the market declined. This situation underlines that the bounce back is still alive due to positive divergence between the breradth (red line) and market price (blue line).

Conclusion:

Late day rally underlines that the consolidation period is (maybe) not over. This is not a big problem for us because at current levels, we continue to believe that current move is just a bounce back in a downtrend.

In this context, we keep our sell orders in place, and we consider current bounce back as a selling opportunity.

Current positions:

- short 2.25x std size SPX at 1330.98 (stop loss 1354)

- 1/2 short NDX at 2565 (SL 2613)

- 1/2 short CAC at 3057 (SL 3120)

Published by sigmatradingoscillator

-

dans

Market Analysis

28 juin 2012

4

28

/06

/juin

/2012

19:53

If we look at the NDX, we can notice it has broken its previous low at 2526. On top of that, today's decline seems clearly impulsive.

So, there is a high level of probability that the bounce back peaked yesterday.

As the bounce back was rather weak (unability to retrace 50% of the decline), it underlines our view that markets will suffer from a sharp decline in coming weeks (~=10% or more)

Published by sigmatradingoscillator

-

dans

Trade

28 juin 2012

4

28

/06

/juin

/2012

16:07

Yesterday's highs were between 2 important retracements from previous move( on NDX,SPX and CAC): betwwen 38.2% and 50%.

So, the bounce back could already be finished but it is too early to say if it is the case (50% and 61.8% retracement are still achievable).

So, for the time being, we are waiting for more clarity from the market: wait and see attitud...

Current positions:

- short 2.25x std size SPX at 1330.98 (stop loss 1354)

- 1/2 short NDX at 2565 (SL 2613)

- 1/2 short CAC at 3057 (SL 3120)

P.S.:

We didn't change anything to our pending orders.

Published by sigmatradingoscillator

-

dans

Market Analysis

28 juin 2012

4

28

/06

/juin

/2012

02:06

Short update tonight because markets are in a consolidation phase and we are not sure we have already reached the top of this pullback.

Looking at our indicators, we can notice that the Sigma Trend Index (STI) is at '2' while other indicators remains at '3' (neutral level)

Looking at the breadth index, it is worth noting that a small positive divergence could be under development (new high from the red line not confirmed by the blueline). This is not what we are waiting for, but we need to monitor this point.

Conclusion:

We need to wait in order to know if our expectations of a sharp decline to come will materialize next week.

Current positions:

- short 2.25x std size SPX at 1330.98 (stop loss 1354)

- 1/2 short NDX at 2565 (SL 2613)

- 1/2 short CAC at 3057 (SL 3120)

Published by sigmatradingoscillator

-

dans

Market Analysis

27 juin 2012

3

27

/06

/juin

/2012

17:10

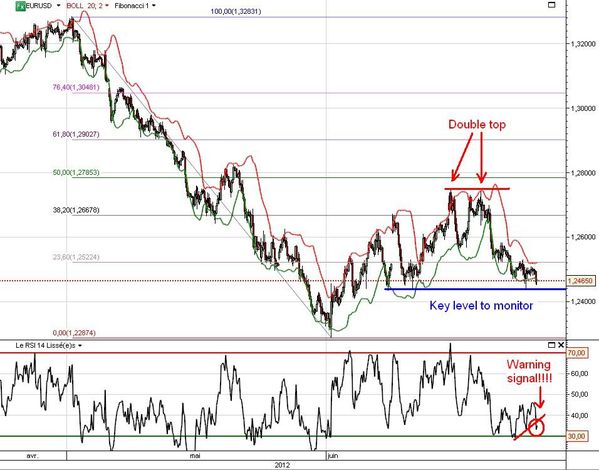

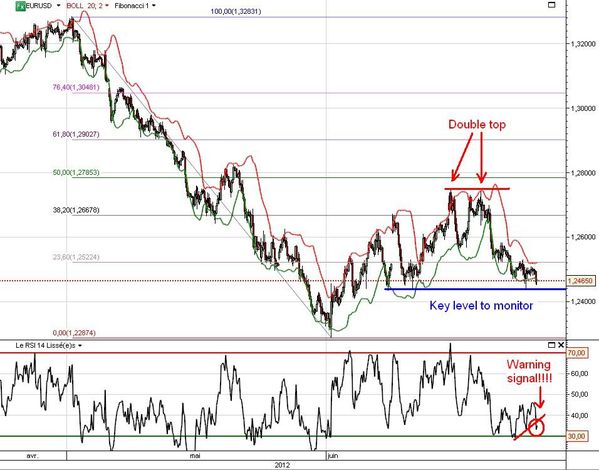

The Forex gives us an important warning, current rebound could already be at risk:

Published by sigmatradingoscillator

-

dans

Trade

27 juin 2012

3

27

/06

/juin

/2012

16:07

Some of our pending orders were executed:

CAC40 (order book)

- We sell 1/2 position at 3057(done)

- We sell 1/2 position at 3074

SPX (order book)

- we sell 1/4 position at 1328(done)

- we sell 1/4 position at 1334

NDX(order book):

- we sell 1/2 NDX at 2565(done)

- we sell 1/2 NDX at 2577

Published by sigmatradingoscillator

-

dans

Trade

27 juin 2012

3

27

/06

/juin

/2012

15:46

While markets are bouncing back like we were expecting, we notice that the Forex (eur vs usd) is under pressure, breaking previous support level.

This action underlines our view that current move is just a bounce back and that further weakness has to be expected.

Published by sigmatradingoscillator

-

dans

Trade

27 juin 2012

3

27

/06

/juin

/2012

09:35

As we are expecting a bounce back in coming days but we have no visibility on the strength of this rebound, we will short it at each key level.

CAC40 (order book)

- We sell 1/2 position at 3057

- We sell 1/2 position at 3074

SPX (order book)

- we sell 1/4 position at 1328

- we sell 1/4 position at 1334

We have just added 2 orders:

- we sell 1/2 NDX at 2565

- we sell 1/2 NDX at 2577

Current position:

- short 1.5x std size SPX at 1336.48 (stop loss 1350)

- 1/2 short SPX at 1316

Published by sigmatradingoscillator

-

dans

Trade

27 juin 2012

3

27

/06

/juin

/2012

08:52

As we wrote during the week-end:

"After Thursday's selloff, the market achieved a small pullback, retesting a key resistance. We believe this move could be a 4th of 1. Then we should have a lower low early next week followed by 3 to 5 days of consolidation. A sharp decline should start (3rd wave) after this consolidation."

We believe we are in this consolidation phase. It looks like the SPX could retrace between 38.2% and 61.8% of recent decline. So, the target zone for current move is 1329-1342.

Looking at the CAC40, the same retracement gives a target zone between 3060 and 3096. Nevertheless, as the CAC40 has been one of the weakest index on a ytd basis, we don't believe that 3096 is achievable in this bounce back.

It looks like 3060-3080 is more in line with CAC's internal dynamic.

Looking at our indicators, we can notice that the Sigma Trend Index (STI) is once again testing the zero line. Other indicators are neutral at '3' (1 = oversold level, 3 = neutral, 5 = overbought level)

Looking at the Breadth Index, we can notice that the index (red line) remains in negative territory:

Conclusion:

We stick to our view that a sharp decline should occur next week.

Current position:

- short 1.5x std size SPX at 1336.48 (stop loss 1350)

- 1/2 short SPX at 1316 (take profit at 1302)

Have a nice day,

SigmaTradingOscillator

Published by sigmatradingoscillator

-

dans

Market Analysis

26 juin 2012

2

26

/06

/juin

/2012

20:20

It looks like yesterday's low was the short term bottom we were waiting for in our Saturday's update.

The SPX should now retrace between 38.2% and 61.8% of recent drop. So, the target zone for current move is 1329-1342.

We will carefully analyze this bounce back and short it VERY AGRESSIVELY when we detect the right oportunity because we believe the SPX should decline to 1200 (at least) in coming weeks.

Published by sigmatradingoscillator

-

dans

Trade