After a weak start, the market seems to resume its uptrend.

We fear that any reversal from here could be a "double top".

In this context, we uplift our stop order, in order to secure a positive outcome for our trade.

Current position: long @ 1307.77

After a weak start, the market seems to resume its uptrend.

We fear that any reversal from here could be a "double top".

In this context, we uplift our stop order, in order to secure a positive outcome for our trade.

Current position: long @ 1307.77

The market was able to find some support around the key 50% retracement (from the recent bounce back).

As long as this level holds on, we remain comfortable with our 'abc' scenario (currently in 'c') and we stick with our view that the 1350 - 1360 area should be achievable in coming days.

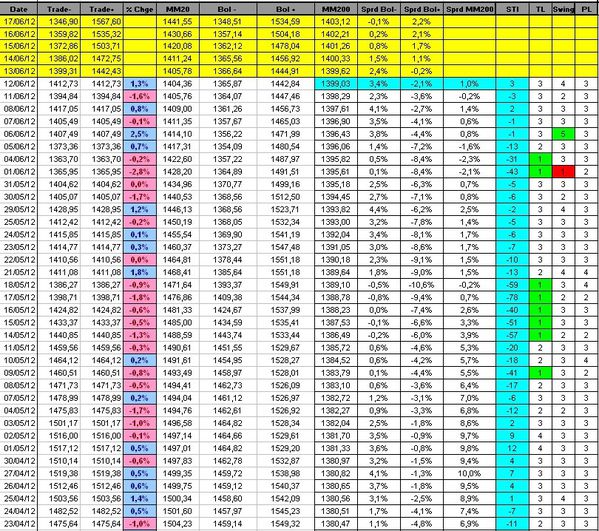

Looking at our indicators, we can notice that the Sigma Trend Index (STI) moved from '-3' to '3'. (We need two consecutive closes in positive territory in order to confirm an uptrend).

But, today, the most positive indicator was the Swing, moving from '2' to '4' (on a scale from 1 to 5, 5 is best).

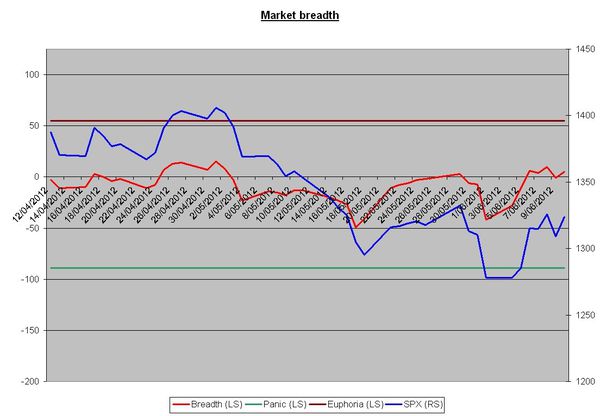

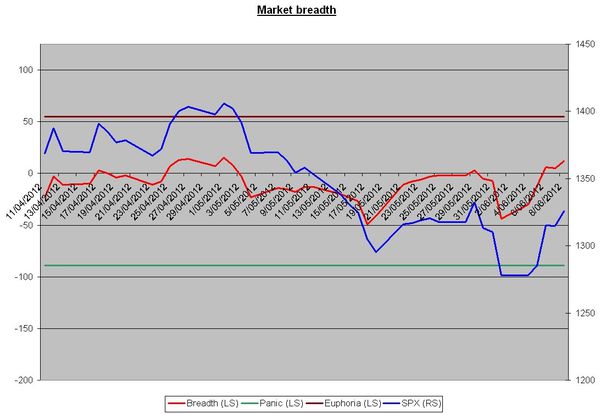

Looking at our Breadth Index, we can notice that this indicator is also in positive territory (red line):

Conclusion:

Our scenario is unchanged, here is our updated chart based on the Sigma Whole Market Index (Aggregate of 16 US indexes):

Current position: long @ 1307.77 (stop @ 1308)

Have a nice day,

SigmaTradingOscillator

We have just created a twitter account in order to tell you what we are doing (in real time).

Thanks for this idea Scott.

Feedback and comments are always welcome.

Have a nice evening,

SigmaTradingOscillator

We uplift our stop loss from 1285 to 1308 (breakeven).

Current position: long at 1307.77

On Saturday, we posted two different scenario that could be under development.

It looks like the first one is currently under development. Here is the chart we posted on Saturday:

With this scenario in mind, we decided to cut our long position just after the European Market open at 1342.69.Then, we introduced a buy order at 1308 in order to take benefit of the expected pullback.

Our order was filled at the end of US session at 1307.77

Looking at our indicators, we can notice that the Sigma Trend Index (STI) fall back to '-2'. It is in line with a pullback scenario, but it must move (quickly) above the zero line.

Conclusion:

We don't have new information coming from our indicators, but it looks like our scenario is under development. We believe the 1350 - 1360 area is achievable in coming days (on the SPX):

Current position: long @ 1307.77 (stop loss @ 1285)

Have a nice day,

SigmaTradingOscillator

Thanks to the late day sell off, our buy order was executed at 1307.77

Current position: long @ 1307.77

It looks like the scenario 1 (see Saturday's post) is under development.

=> We are waiting for 1308 in order to open a long position

Current position: no position

We believe the current move is nearly finished, so we close our long position @ 1342.69 [1342.69 - 1308.02 = 34.67 (gain)].

If our scenario is correct, we should have a "last" upswing around 1350.

We will use this "last" upswing in order to open a short position. (around 1350)

Current position: no position

We opened 2/3rd of a long position at 1308.02 and we introduced an order at 1301 for the last third. Why?

We are pretty comfortable that the market should retest de 1335 - 1360 area in coming days (or weeks), but we are not convinced that the pullback is already over.

So, we will increase our position if the market retest the 1290 - 1305 area.

Looking at our indicators, we can notice that they are (all) in positive territory:

- The Sigma Trend Index moved from '-1' to '2', telling us the downtrend is over (at least for the short term) and that we should have more than a simple bounce back in this move.

- The Swing indicator and the Power Level (PL) are at '3' (neutral), but it is not a problem because we got a swing indicator at '5'(strong buy) on the 6th of June.

Looking at our Breadth Index (red line), we can see that it is also in positive territory:

Conclusion:

All our indicators give us comfort in our short term bullish scenario.

Nevertheless, we have 2 different scenario for the "ultra short term" (1 or 2 days):

After 5 waves to the downside, the market is in a countertrend move in abc. We believe we are within the 'a' wave of this countertrend rally (subdivided in 5 subwaves).

We believe that the 3 first subwaves of 'a' are finished, but we are not sure than the fourth one is also finished.

Here are our 2 short term scenario:

Scenario 1:

Scenario 2:

If we move to 1301 (scenario 2), we will increase our exposure to the SPX (with a stop loss at 1285).

If we move on a straight line to 1335 (scenario 1), we will cut our long, waiting for a pullback in order to re-enter the market with a target at 1360.

current position: 2/3 long at 1308.02

Have a nice day,

SigmaTradingOscillator

We will buy our last third (of long position) at 1301 rather than 1298

If you want to get alerts when we post new articles, follow us on Twitter:

Our account is @SigmaTradingOsc

Some explanations on the model itself (English version)

Quelques explications sur le modèle (Version Française)

Recopiez l'adresse de notre site internet dans l'encadré du

site Google Translate et appuyez sur entrée pour obtenir la traduction

NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT, INCLUDING BUT NOT LIMITED TO STOCKS, COMMODITIES, OPTIONS, BONDS, FUTURES, OR BULLION. ACTIONS YOU UNDERTAKE AS A CONSEQUENCE OF OUR ANALYSIS, OPINION OR ADVERTISEMENT ON THIS SITE ARE YOUR SOLE RESPONSIBILITY.

FOR INVESTMENT ADVICE, PLAN A MEETING WITH A FINANCIAL ADVISOR IN ORDER TO ESTABLISH YOUR OWN RISK PROFILE.