It looks like the 200d MA is holding on.

In this context, we closed 1/2 short position at 1284.75 => 1334.07 - 1284.75 = 49.32 (gains).

We keep our stop buy at 1302 on the remaining part of our short position.

Have a nice day,

SigmaTradingOscillator

It looks like the 200d MA is holding on.

In this context, we closed 1/2 short position at 1284.75 => 1334.07 - 1284.75 = 49.32 (gains).

We keep our stop buy at 1302 on the remaining part of our short position.

Have a nice day,

SigmaTradingOscillator

The market is under heavy pressure. (S&P at 1285.6)

We are close to the 200d MA at 1284.57.

It is important to track what happen here: if we bounce back on the 200d MA, we could have a short term rally (around 1340-1360), BUT if we break this level, we could assist to a sharp decline, and a capitulation around 1200 within 3 to 5 sessions.

In this context, we move our take profit on our short position to 1302 (stop buy order).

Have a nice day,

SigmaTradingOscillator

After a difficult start, the market ran 2% (reaching 1320) and closed roughly unchanged.

We were really surprised that the market didn't accelerate when breaking the 1300 level.

We will see what happen after payrolls data

Going back to our key indicators, there is nothing to add, both are in negative territory.

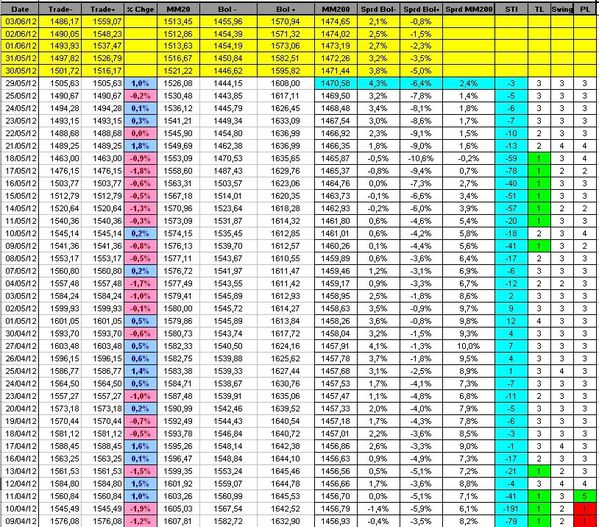

The Sigma Trend Index (STI) is at'-5'. But we don't like a trend Level (TL) in neutral territory at '3': being short, we would like a TL at 1 or 2.

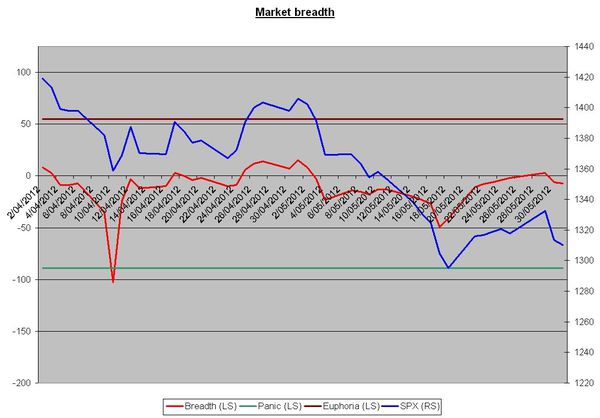

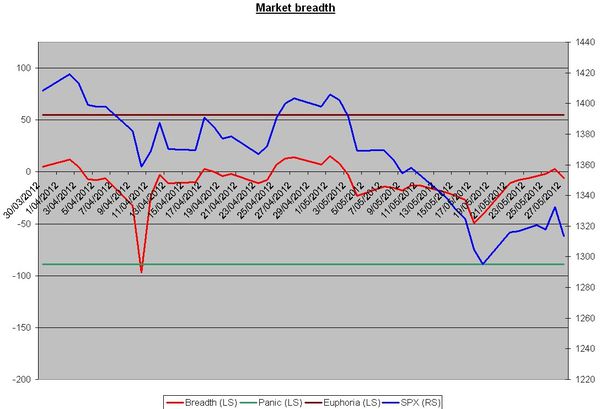

Looking at our Breadth index, it confirmed Wednesday's negative close:

Conclusion:

We remain short, but we are surprised by the lack of negative momentum in this move. It looks like we are (still) in a consolidation move rather than in a new impulse move (to the downside).

We hope to have more clarity after Friday's session.

We will close our short position if the market is able to move above 1326.

Current position: short @ 1334.07

Have a nice day,

SigmaTradingOscillator

If the market is able to bounce back above 1326, we will close our short at 1326

Following PMI data, market is under heavy pressure.

I believe we will test the 200d MA either today or tomorrow (~=1280).

If it doesn't hold (~= 1280), market will be in big trouble.

This development is fully in line with what we were waiting for.

After a retest of the zero line from our key indicators, the market declined again this Wednesday, telling us the bounce back is probably over.

The Sigma Trend Index declined from '-2' to '-6'.

Our Swing Indicators moved from '4' to '2', telling us the decline was severe and made important damages.

The Breadth index fall back in negative territory:

Conclusion:

We expect an acceleration to the downside in coming days (capitulation mode).

For the time being we feel comfortable with our short position.

Current position: short @ 1334.07

Have a nice day,

SigmaTradingOscillator

Last week we wrote we were expecting a rally in the area 1335 - 1345.

Yesterday the SPX had a top @ 1334.93.

Following a strong open, we decided to close our long position early in the session at 1329.48 (earning 10.56 pts).

We wanted to open a short position at 1336, but after a intraday double top at 1334.93, we lowered our price and opened our short position at 1334.07.

As we expected, our key indicators are now very close to the zero line:

The Breadth Index is already in positive territory (red line)

But the Sigma Trend Index (STI) remains in negative territory ('-3' vs '-5'):

Conclusion:

With our key indicators around the zero line, and our Trend Level (TL) at '3', we can say that markets aren't anymore oversold. If market internals continue to improve from here, then we will be in presence of a trend reversal rather than in presence of a bounce back.

Current position: short @ 1334.07 (Stop loss @ 1346)

Have a nice day,

SigmaTradingOscillator

We are so close of our target zone (1336) that we decided to open our short here, at 1334.07

Current position: short @ 1334.07

We closed our long position @ 1329.48 => 1329.48 - 1318.92 = 10.56 (gain).

Our next position will be on the short side: either we sell on strength at 1336 or we will sell when we break 1309

According to futures, S&P should open close to 1324.

I we are not able to break this level, we could retest the low at 1289.

In this context, we will short the market aggressively if we move below 1308 (with a very tight SL at 1314)

If you want to get alerts when we post new articles, follow us on Twitter:

Our account is @SigmaTradingOsc

Some explanations on the model itself (English version)

Quelques explications sur le modèle (Version Française)

Recopiez l'adresse de notre site internet dans l'encadré du

site Google Translate et appuyez sur entrée pour obtenir la traduction

NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT, INCLUDING BUT NOT LIMITED TO STOCKS, COMMODITIES, OPTIONS, BONDS, FUTURES, OR BULLION. ACTIONS YOU UNDERTAKE AS A CONSEQUENCE OF OUR ANALYSIS, OPINION OR ADVERTISEMENT ON THIS SITE ARE YOUR SOLE RESPONSIBILITY.

FOR INVESTMENT ADVICE, PLAN A MEETING WITH A FINANCIAL ADVISOR IN ORDER TO ESTABLISH YOUR OWN RISK PROFILE.