Yesterday was a very exciting day, and I think it gave us a lot of information:

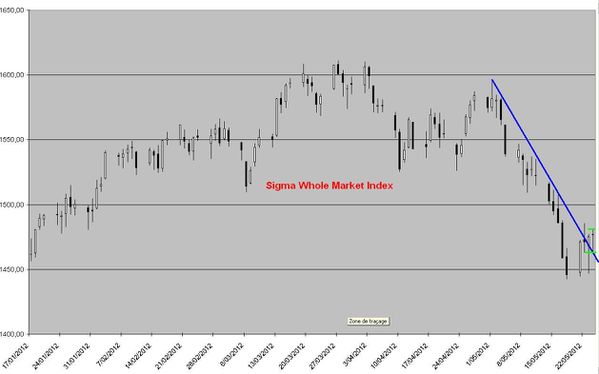

You can notice on the Sigma Whole Market Index (representing the aggregate of 16 US indexes) that yesterday's low was higher than previous low which was also above than previous low (small horizontal red lines) => the downtrend was in a total lack of momentum and was unable to push below previous lows.

You can also notice we had a reversal day: long vertical line with a small "body" located at the top of a long vertical line. Such reversal days are identified by green boxes on our chat.

Very interesting too, we were able, for the first time, to close above the downtrend line (dark blue line).

=> Our chart tells us that there is a HIGH probability for a rebound NOW.

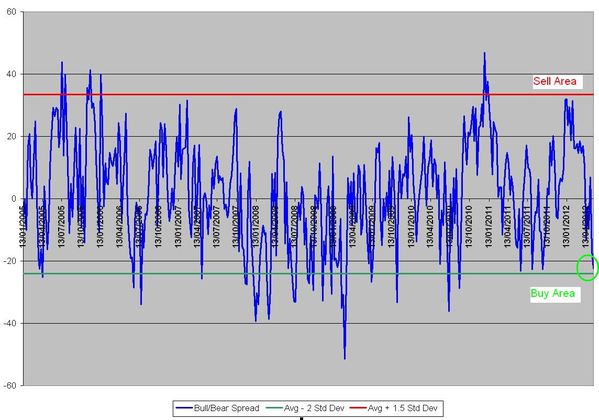

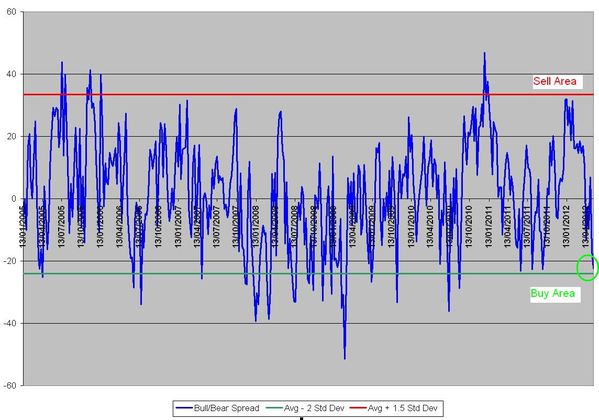

Looking at sentiment data, we can also notice that the bull/Bear spread released today by AAII is very close to buy zone:

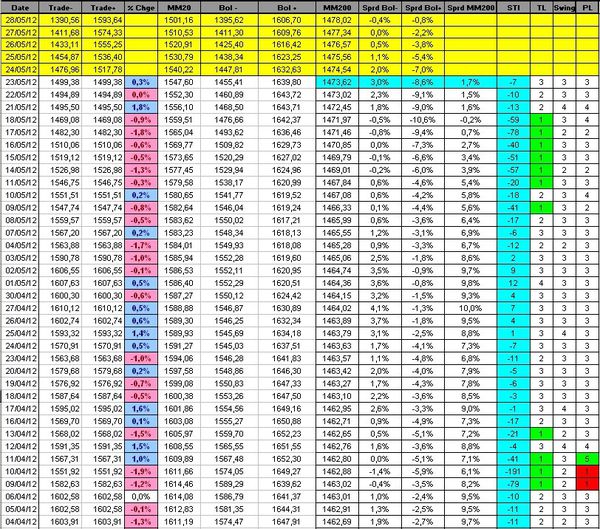

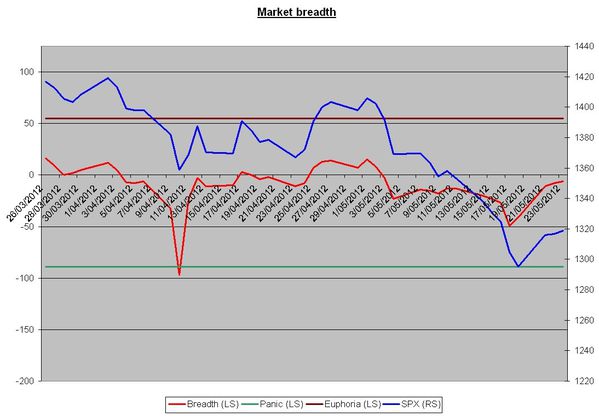

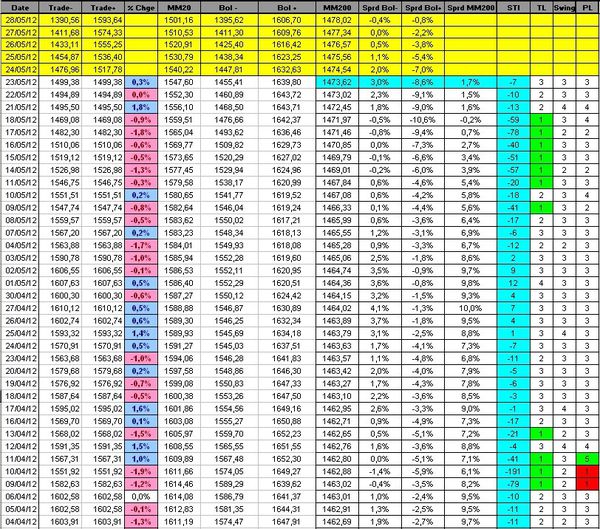

Looking at our models, we continue to notice that the situation is slightly improving, both the breadth index and the sigma trend index (STI) improved yesterday:

The sigma trend Index moved from -10 to -7, telling us the downtrend continues to weaken:

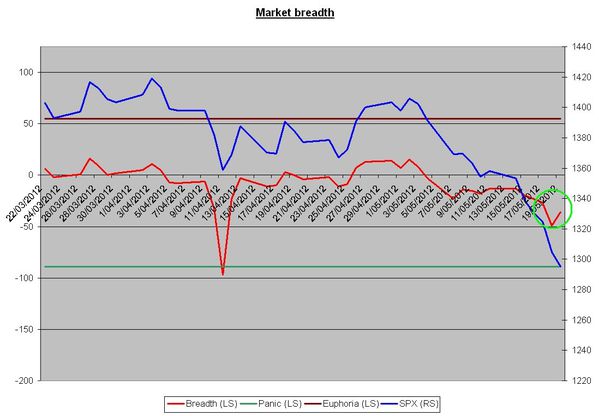

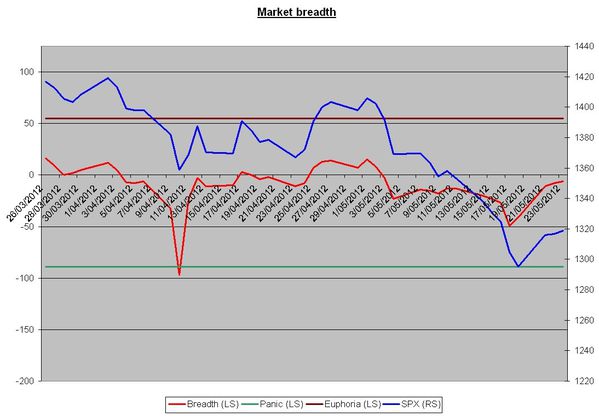

The Breadth Index (red line) improved too:

Conclusion:

When we detected that the market was unable to move below previous low, we decided to cut our 1/2 short position at 1318.62 (=< 18 pts gain).

At the end of the session, thanks to the important reversal day, confirmed buy our improving signal, we decided to open a FULL LONG position @ 1318.92

Current position: long @ 1318.92

Have a nice day,

SigmaTradingOscillator