Looking at our indicators, we can notice that the Trend Level (TL) is at '5' (overbought) for the second consecutive day.

We know it can remain at this level for a couple of days, but this is a warning signal that a short term top is not far.

Looking at the Sigma Trading Oscillator, we can notice a negative divergence between the Sigma Market Index (in blue) and the Sigma Trend Index (in red): higher price but lower Sigma Trend Index:

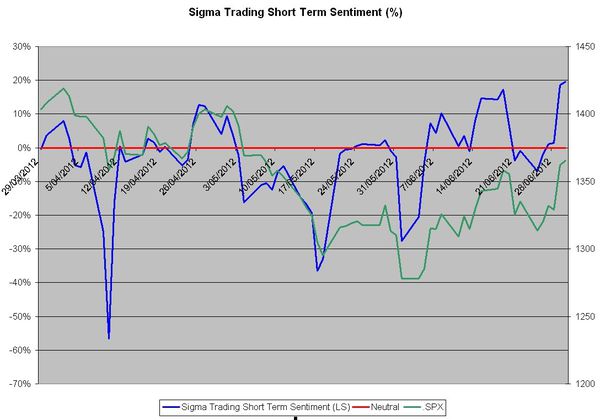

Looking at the Sigma Trading Short Term Sentiment, we can notice we are at elevated level (blue line). This is another warning signal but we also have to admit that 20% is not 'euphoria'.

Conclusion:

It seems we are not far from a short term top.

We don't have any idea if it will be a short term top or the major reversal we are waiting for. We will have to analyze retracement levels and the velocity of the move (when it happens) in order to detect if we are in presence of a trending move or a counter trend move.

Current position:

- short 2.5x std size SPX at 1331.28 (stop loss at 1370 for 1 std size)

- short 1/2 CAC at 3250 (stop loss at 3270)

Have a nice day