We opened a long position on the CAC40 at 3112.

We believe the 3165 level should be achievable after this brief consolidation(and maybe 3260).

Current positions:

- long CAC40 at 3112 (forex 1.2678)

- short 1.5x std size SPX at 1336.48

We opened a long position on the CAC40 at 3112.

We believe the 3165 level should be achievable after this brief consolidation(and maybe 3260).

Current positions:

- long CAC40 at 3112 (forex 1.2678)

- short 1.5x std size SPX at 1336.48

We've just closed the short we opened at 1359.8: we closed the position at 1355.85 ( 3.95 pts gains) (during Asian session).

As explained in our daily, we consider it remains some upside in the market (around 1370).

So, we will increase our short around this area.

Current position: 1.5x (standard position) short on SPX avg 1336.48

The market is doing what we were waiting for (target zone for the bounce back: 1350-1360), but we closed our long on the CAC40 too early. The divergence between SPX and the CAC40 was so high that we doubted about our idea, and we closed our long on CAC40 at breakeven.

Unfortunately, the CAC40 surged few hours later and we missed important gains.

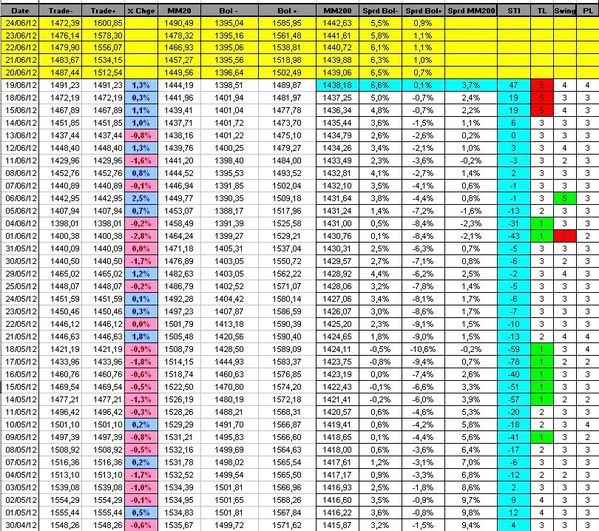

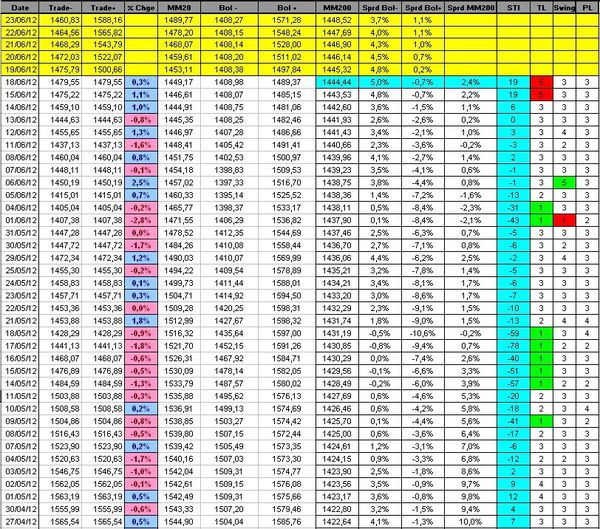

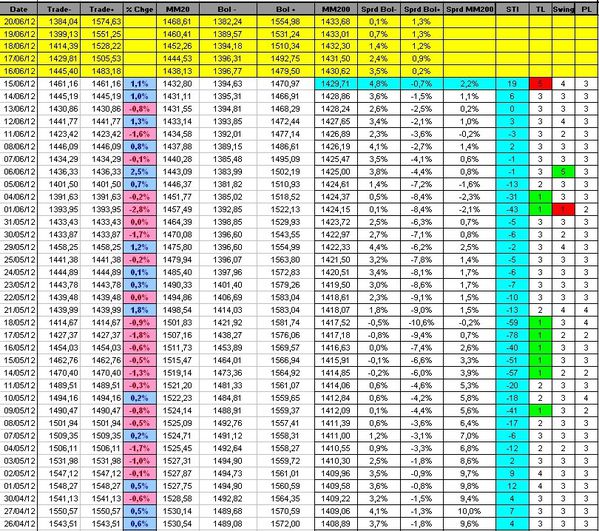

Looking at our indicators, we can notice that the Sigma Trend Index (STI) increased sharply today, moving from '19' to '47'. The Trend Level (TL) was four the 3rd consecutive day at 5 (highest level).

We consider that the market is (now) overbought, and any reversal sign must be interpreted as a warning signal for the current bounce back.

The Breadth Index remains well oriented, and there isn't any sign of reversal or divergence:

Looking at our Sigma Whole Market Index (aggregate of 16 US indexes), we can notice that the market is close to important resistance:

Conclusion:

We believe the top of the rebound is very close but we are not there yet.

In this context, we will close the short position we opened today at 1359.8 during asian sessions in order to benefit from the expected pullback (wave 4/c).

We expect a last push to the upside around 1370. Then, things should turn very bad for the market (SPX ~= 1200).

For those of you interested in our intraday move, you can visit our site during the day: we post all our trades in real time. You can also subscribe to our twitter account (@SigmaTradingOsc), it is free and you are updated on our latest view/trades.

Have a nice day,

SigmaTradingOscillator

The market hit our target zone at 1360.

We move full short at 1359.8

More details tonight.

We are waiting for clear signs of reversal before increasing our short exposure.

This market is just too strong for the time being.

The results of the audit on Spanish Banks is postponed to Spetember. I don't believe it is a good news for the market.

So, we cut our long on the CAC 40 at 3070.32 (with forex at 1.259 ~= 3865.53 usd per contract).

As our opening price was 3869.17 usd, we loose 4 usd per contract. (~= 0.1%)

Current position: 1.5x (standard position) short on SPX avg 1336.48

At the opening of Asian markets on Monday, the SPX CFD traded around 1350.

So, we decided to open 1/2 short at 1350.48 (see our intraday comments).

After Monday's session, we consider there is no sign of reversal in the market.

Our Sigma trend index is unchanged at '19' and our Trend Level (TL) is at 5 (highest level).

If we get a '1' either in the Swing or in the Power Level, we will interpret it as the end of the bounce back.

The Breadth index remains well oriented:

Conclusion:

The are a couple of days that we believe the market could reach the 1350-1360 level in this bounce back. We are waiting for warning signals from our indicators in order to increase our short exposure.

Current positions: We have 2 positions

We have one spread trade between SPX and CAC40:

- short SPX at 1329,89 (average price)

- long CAC40 at 3068.09 (with Forex at 1.2611) ~ 3869.17 pts in usd terms

We have 1/2 short on SPX at 1350.48

Have a nice day,

SigmaTradingOscillator

There are a couple of days that we are targeting the 1350-1360 area for this rebound.

At the opening of Asian markets, the SPX CFD are trading around 1350.

So, we decided to open 1/2 short at 1350.48.

Current positions: We have 2 positions

We have one spread trade between SPX and CAC40:

- short SPX at 1329,89 (average price)

- long CAC40 at 3068.09 (with Forex at 1.2611) ~ 3869.17 pts in usd terms

We have 1/2 short on SPX at 1350.48

This week will probably be very exciting,

Have a nice day,

SigmaTradingOscillator

Looking at Friday's chart, it sounds very clear that bulls took the lead in the market. Nevertheless, final decision will depend on Greek elections, and everything can happen.

In this context, we decided to hedge our short position on the SPX by a long position on the CAC40. We consider that in case of positive outcome from Greek elections, we should benefit from an important bounce back from both the euro (vs USD) and the CAC40. These gains should more than offset our losses from the short position on the SPX.

In case of negative outcome from Greek elections, we expect a sharp sell off in the euro. In this context our losses on the CAC40 in euro terms should be much lower in usd. On top of that, the SPX should also decline and we should benefit from this decline thanks to our short position.

Looking at our indicators, the Sigma Trend Index (STI) continues to improve from '6' to '19'. This is an important jump and it underlines that we should reach the 1350 - 1360 area in coming days.

The Trend Level (TL) is at '5' (highest level), and the Swing is at '4' (buy territory)

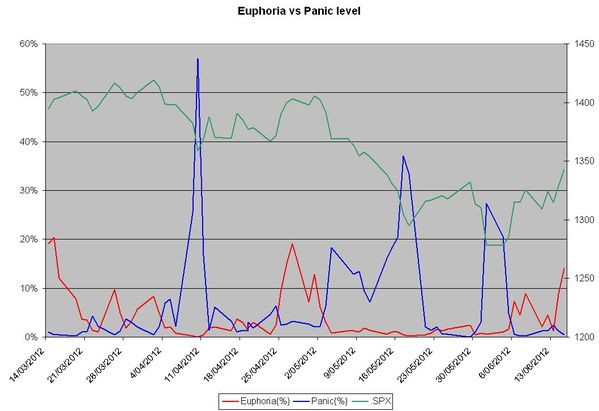

It is important to have a look at our short term sentiment and to notice that the bull sentiment is picking up (at 14%).

In March and May, it reached 20% at its top. So we need to be careful if/when we reach this level.

Conclusion:

We believe that the market can reach the 1350-1360 area. If it doesn't, it will be due to a dramatic outcome from Greek election and the end of "current" euro-zone.

Current position:

- short SPX at 1329,89 (average price)

- long CAC40 at 3068.09 (with Forex at 1.2611) ~ 3869.17 pts in usd terms

Have a nice week-end,

SigmaTradingOscillator

We have just sold some SPX in order to be market neutral between our short on SPX and our long on CAC.

We made a mistake earlier today: we need 3x more SPX short for each CAC long.

Current position:

- short SPX at 1329,89 (average price)

- long CAC40 at 3068.09 (with Forex at 1.2611) ~ 3869.17 pts in usd terms

If you want to get alerts when we post new articles, follow us on Twitter:

Our account is @SigmaTradingOsc

Some explanations on the model itself (English version)

Quelques explications sur le modèle (Version Française)

Recopiez l'adresse de notre site internet dans l'encadré du

site Google Translate et appuyez sur entrée pour obtenir la traduction

NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT, INCLUDING BUT NOT LIMITED TO STOCKS, COMMODITIES, OPTIONS, BONDS, FUTURES, OR BULLION. ACTIONS YOU UNDERTAKE AS A CONSEQUENCE OF OUR ANALYSIS, OPINION OR ADVERTISEMENT ON THIS SITE ARE YOUR SOLE RESPONSIBILITY.

FOR INVESTMENT ADVICE, PLAN A MEETING WITH A FINANCIAL ADVISOR IN ORDER TO ESTABLISH YOUR OWN RISK PROFILE.