Our stop buy has been triggered at 3027.16 => 3103.72 - 3027.16 = 66.56 (gains) or 2.2%

Current position:

- short 1.5x std size SPX at 1336.48 (stop loss 1350)

- 1/2 short SPX at 1316 (take profit at 1302)

Our stop buy has been triggered at 3027.16 => 3103.72 - 3027.16 = 66.56 (gains) or 2.2%

Current position:

- short 1.5x std size SPX at 1336.48 (stop loss 1350)

- 1/2 short SPX at 1316 (take profit at 1302)

We move our stop buy for the full short position on the cac40 at 3027.

Our take profit is at 2965 (for the full position too)

Current position:

- short 1.5x std size SPX at 1336.48 (stop loss 1350)

- 1/2 short CAC40 at 3103.72 (stop loss 3140)

- 1/2 short SPX at 1316 (take profit at 1302)

It looks like we have an impulsive move from 3006 => we introduce a stop buy order for 1/4 of CAC40 at 3025

We have just lifted our stop buy to 3032 (from 3025) in order to allow a 61.8% retracement.

Therefore, we move our take profit to 2965 from 2995

We will close half of our short on the CAC at 2995.

For the remaining part of our short, we will introduce an order at 2960:

- we assume wave 1 was from 3155 to 3075 -> 50 pts

- if we are right that 3035 this morning was top of 4 and if we want that 5 = 1 => 2955 should be a normal target for this first (complete) downleg.

We will close half of our short position on the CAC40 at 2995 if we reach this level today.

Current position:

- short 1.5x std size SPX at 1336.48 (stop loss 1350)

- 1/2 short CAC40 at 3103.72 (stop loss 3140)

- 1/2 short SPX at 1316 (take profit at 1302)

The CAC is currently trading around 3032 (23.6% retracement from 3114 to 3006).

Current level should act as an important resistance (could extend to 38.2% retracement: 3050).

Thereafter, we believe another downleg (later in the day) could materialize, reaching 2990.

We wrote during the week-end:

"After Thursday's selloff, the market achieved a small pullback, retesting a key resistance. We believe this move could be a 4th of 1. Then we should have a lower low early next week followed by 3 to 5 days of consolidation. A sharp decline should start (3rd wave) after this consolidation."

At this stage, we are not convinced that 1309 was the low we were waiting for: we believe we can print one marginal low around 1300-1305 before the 2 to 5 days consolidation period (but the short term bottom could already be in). During this period, we should retrace 38.2% to 50% from previous decline.

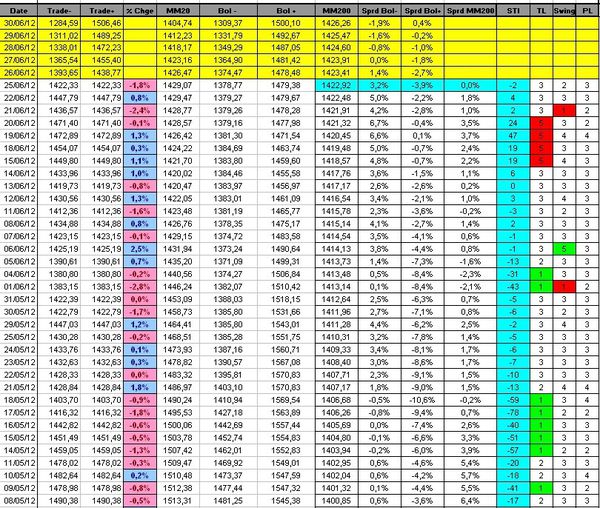

Looking at our indicators, we can notice that the Sigma Trend Index (STI) is in negative territory (from '4' to '-2').

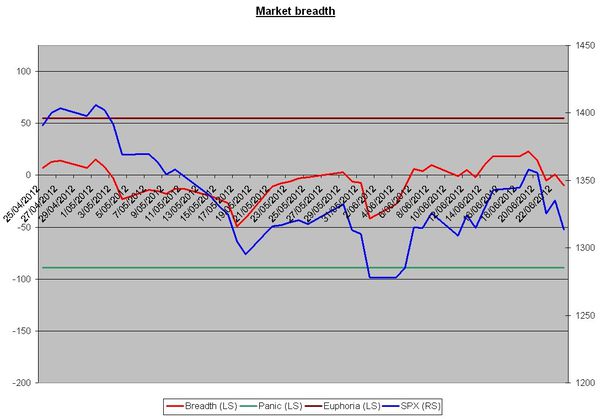

The Breadth Index is also in negative territory (red line):

Looking at our short term sentiment index, it is important to notice that the panic level is very low. So, we have a long way to go before reaching panic level (panic: blue line, euphoria: red line)

Conclusion:

Both the Sigma Trend Index and the Breadth index are in negative territory, this tells us that the downtrend is taking control of the market (once again) .

We consider that the market is close to a short term (intermediate) bottom/consolidation phase. Thereafter, we should have a dramatic sell off: 1200 is our first target but the final low could be much lower.

Current position:

- short 1.5x std size SPX at 1336.48 (stop loss 1350)

- 1/2 short CAC40 at 3103.72 (stop loss 3140)

- 1/2 short SPX at 1316 (take profit at 1302)

Have a nice day,

SigmaTradingOscillator

We have just increased our short exposure to the SPX at 1316 (38.2% retracement from the move 1328-1309).

We belive a final leg down should occur in coming hours before 2 to 5 days of consolidation

Current position:

- short 1.5x std size SPX at 1336.48 (stop loss 1350)

- 1/2 short CAC40 at 3103.72 (stop loss 3140)

- 1/2 short SPX at 1316 (take profit at 1302)

Looking at intraday charts and our models, it looks like the SPX could drop around 1300 before finding some support and bouncing back for 2 to 5 days

Current position:

- short 1.5x std size SPX at 1336.48 (stop loss 1350)

- 1/2 short CAC40 at 3103.72 (stop loss 3140)

The SPX is currently trading at 1316.

We believe the market could recover for 2 to 5 days from these levels to levels around 1325 - 1335.

We don't reduce our short exposure on the SPX because we believe the next decline will be massive and we don't want to be out of the market when it starts.

As the CAC40 was unable to move above 3045 during its intraday bounce back, we believe the bear case is bigger than we initially thought. So, we won't cut our short at 2990.

Current position:

- short 1.5x std size SPX at 1336.48 (stop loss 1350)

- 1/2 short CAC40 at 3103.72 (stop loss 3140)

If you want to get alerts when we post new articles, follow us on Twitter:

Our account is @SigmaTradingOsc

Some explanations on the model itself (English version)

Quelques explications sur le modèle (Version Française)

Recopiez l'adresse de notre site internet dans l'encadré du

site Google Translate et appuyez sur entrée pour obtenir la traduction

NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT, INCLUDING BUT NOT LIMITED TO STOCKS, COMMODITIES, OPTIONS, BONDS, FUTURES, OR BULLION. ACTIONS YOU UNDERTAKE AS A CONSEQUENCE OF OUR ANALYSIS, OPINION OR ADVERTISEMENT ON THIS SITE ARE YOUR SOLE RESPONSIBILITY.

FOR INVESTMENT ADVICE, PLAN A MEETING WITH A FINANCIAL ADVISOR IN ORDER TO ESTABLISH YOUR OWN RISK PROFILE.