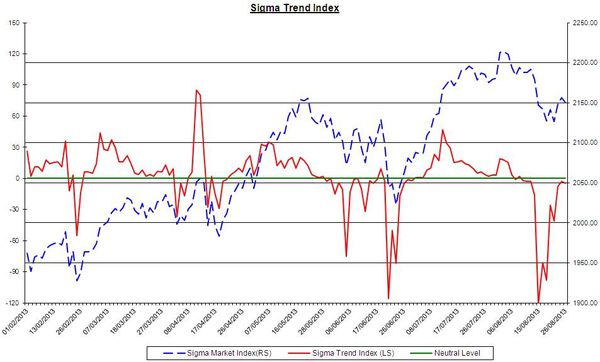

Yesterday we wrote:

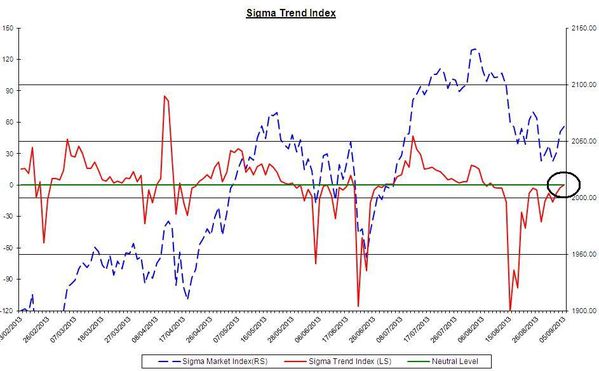

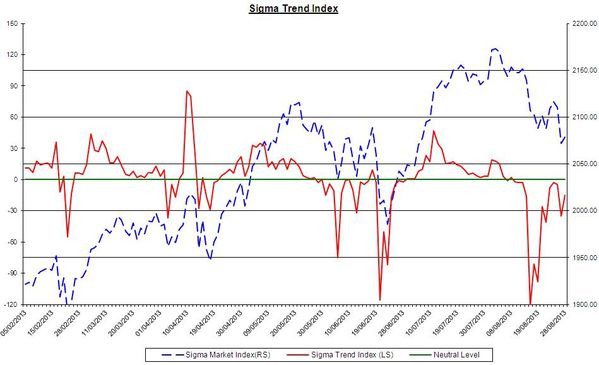

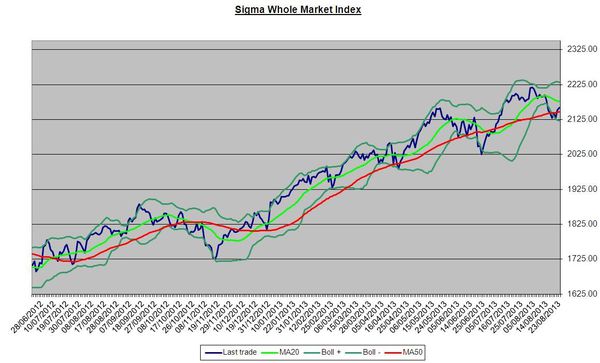

"The Sigma Trend Index is close to its zero line. If it is unable to move in positive territory in coming sessions, we must be prepared for a new downleg."

Our fears were fully justified: the STI wasn't able to move in positive territory (red line) and we got a sell off:

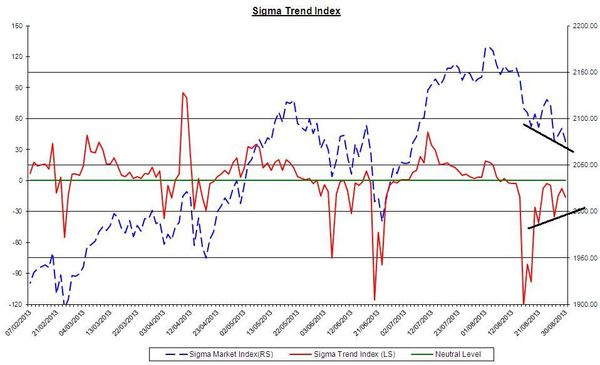

Looking at European indexes, we can see a clear 'abc' pattern (in recent sessions). So, in order to keep a corrective pattern in place (abc), we need a rebound now. If we get further decline, the situation could turn very nasty.

As we wrote during the week-end, the CAC can be considered (for the time being) as a market leader. As it refused to move above its strong resistance (green line) at 4072, we got an acceleration to the downside. We need a rebound now or the situation could further deteriorate.

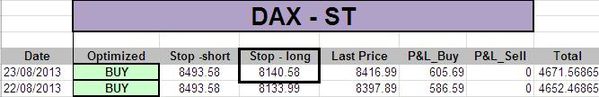

The DAX is close to break a (short term) trend channel, this is not good... (red circle on chart)

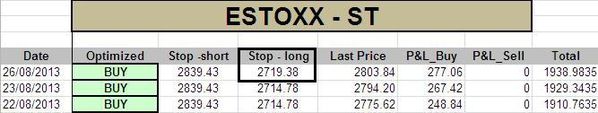

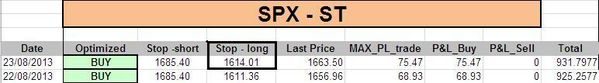

We are very close to our stops. So, if we don't get a rebound (very) soon, we will hit our stops and close our short term long positions.

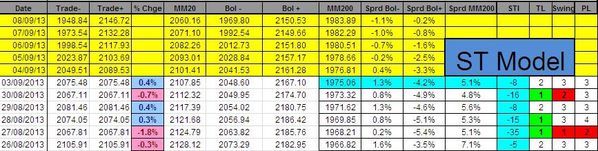

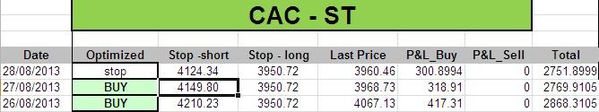

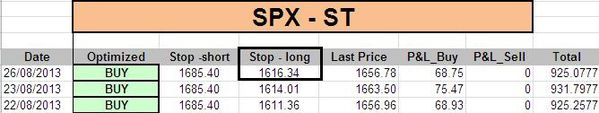

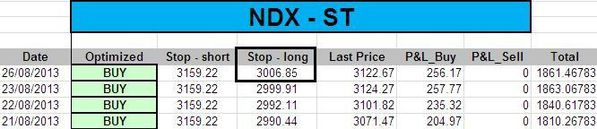

Short Term Trading Book:

- SPX: 1 long at 1654.12 (stop @ 1613, 3pts below the ST model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 3002, 5pts below the ST model to take into account bid/ask spread)

- CAC: 1 long at 3657.24 (stop @ 3946, 5pts below the ST model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 8130, 10pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the MT model to take into account bid/ask spread)