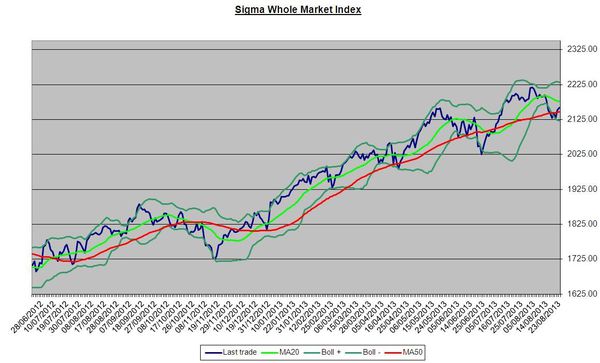

The Sigma Whole Market Index (aggregate of 16 US indexes) was able to close the week above its 50d MA. So, we consider the risk of further (short term) decline is reduced by this move.

The Sigma Whole Market Index is 0.5% below a strong horizontal resistance (pink line). It will be important to see if the market is able to move above this level in coming sessions.

The CAC printed a strong candle on Friday and it is now right below a strong resistance (at 4072). As the CAC has been the clear market leader in recent weeks, it will be highly interesting to monitor if it is able to move above this level early next week.

If the CAC reverse from current level, we are ar risk of a sharp decline.

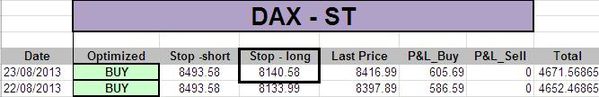

The DAX remains within its short term uptrend. The green horizontal line is a strong resistance.

The Sigma Trend Index(STI) remains close to its zero line (at '-3'). It will be important to see if it is able to move back in positive territory. If the STI declines from current levels, it will mean that this week's rebound was just a bounce back within a (new) downtrend.

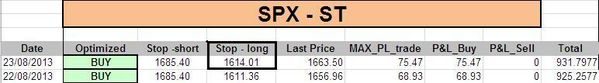

The ST model uplifted most stops:

Short Term Trading Book:

- SPX: 1 long at 1654.12 (stop @ 1611, 3pts below the ST model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 2995, 5pts below the ST model to take into account bid/ask spread)

- CAC: 1 long at 3657.24 (stop @ 3946, 5pts below the ST model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 8130, 10pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the MT model to take into account bid/ask spread)