Short Term(ST)

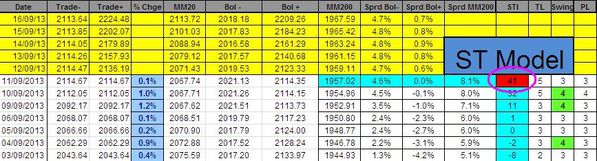

When we look at the chart of the Sigma Whole Market Index (aggregate of 16 US indexes), we can notice recent rebound represents 50% of last month's decline. On top of that, the strong pink horizontal resistance is not far from current levels.

We don't consider it is easy to count last decline: is it a 5waves decline (1,2,3,4,5) or a 3 waves decline (a,b,c with c in 5 subwaves)?

A 5 waves decline would mean the start of a downtrend/correction while a 3 waves decline would mean a pullback in an uptrend.

In this context, it will be very important to see if the market can move above the pink horizontal level. If it can, recent decline was probably a pullback in an uptrend. But if the market reverses next week from current levels, we could have a nasty sell off.

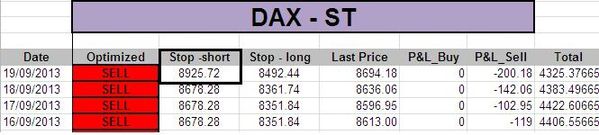

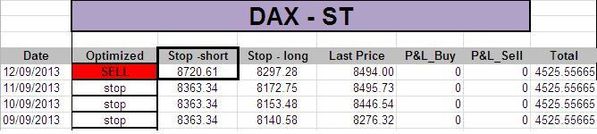

When we look at the chart of the DAX, we can notice the recent rebound is very modest, and we are actually testing the broken uptrend channel by the south. If we can't move above this level next week, this will be bearish.

Nevertheless, looking at the DAX, it seems that last decline was a 3 waves move => slightly in favor of a pullback rather than the start of a decline

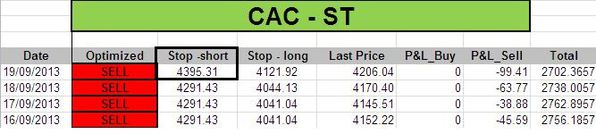

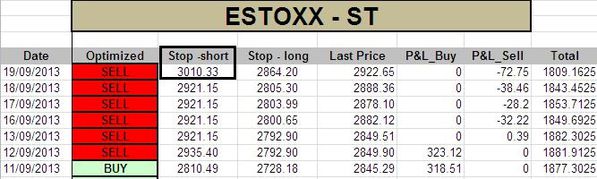

When we look at the chart of the CAC and the EuroStoxx50, we can notice that recent rebounds were the strongest ones(relative to other indexes)with a 61.8% retracement of last decline. We consider it is due to an outperformance of European financials (heavily weighted in both the CAC and the EuroStoxx) vs the rest of the market.

As a 61.8% retracement is an important pullback, those indexes are the ones to focus on early next week. If they can continue to advance from current levels, there is a good probability that recent decline was just a pullback in an uptrend.

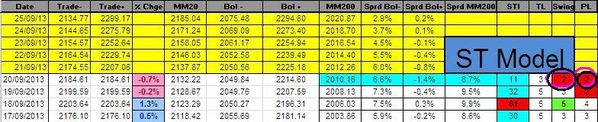

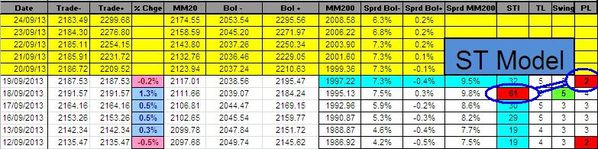

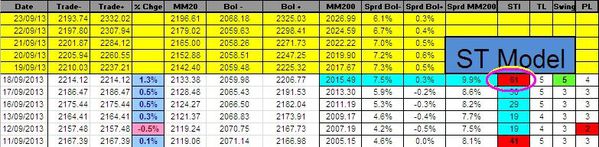

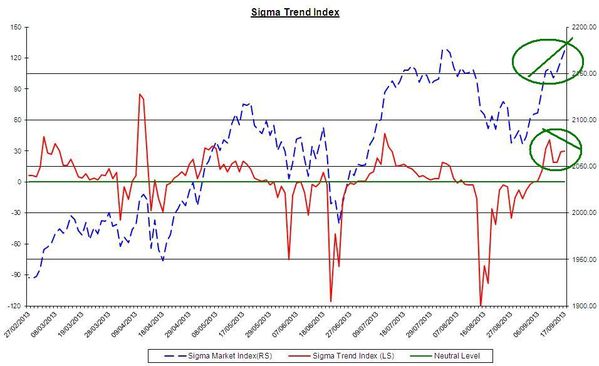

The Sigma Trend Index(STI) was able to close in positive territory on Friday (at '1'), telling us we are in a weak positive uptrend.

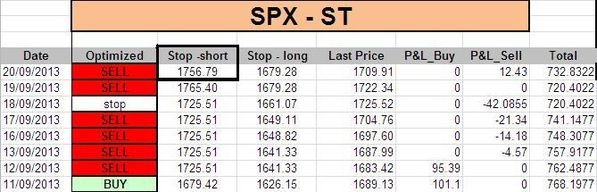

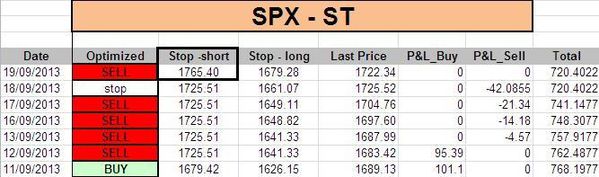

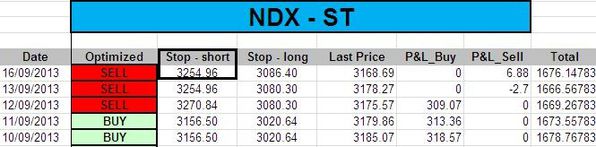

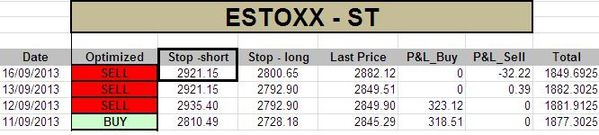

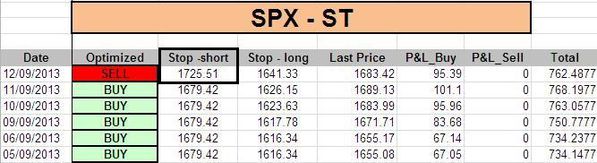

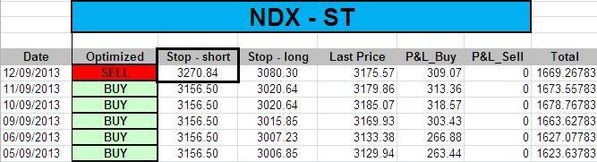

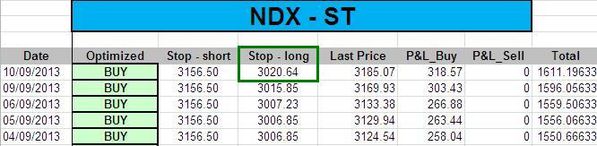

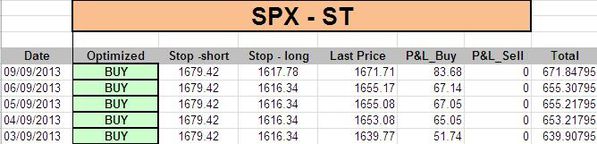

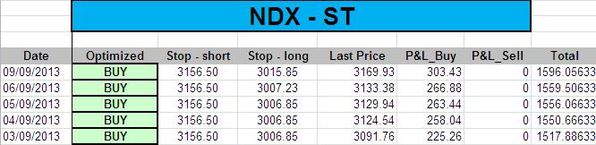

The ST model uplifted its stop level on the NDX and left it unchanged on the SPX. We don't have anymore position in Europe because our stops were hit during recent decline (and we booked strong gains).

Medium Term:(MT)

We can notice the Sigma Whole Market Index remains below its 50days MA (red line).

We had a similar situation twice in the past (boxes A and B). In box A we got a nasty sell off after a retest of the 50d MA (by the south) while in box B the market was able to restore its uptrend.

It is difficult to say which pattern will be followed this time but as long as we have an upward 50d MA, current situation looks more like the B box. But if the 50d MA starts to flatten, the situation could deteriorate very quickly.

There is no change in the MT model, it is in sell mode on both the SPX and the NDX since Easter.

There is no change in our positions:

Short Term Trading Book:

- SPX: 1 long at 1654.12 (stop @ 1613, 3pts below the ST model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 3002, 5pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the MT model to take into account bid/ask spread)