3 décembre 2012

1

03

/12

/décembre

/2012

08:58

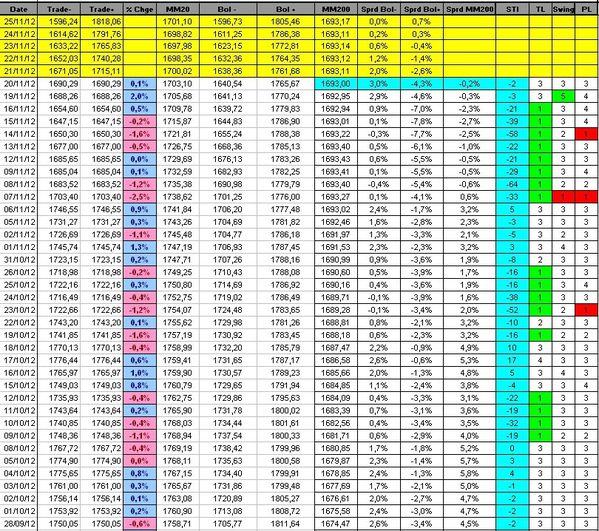

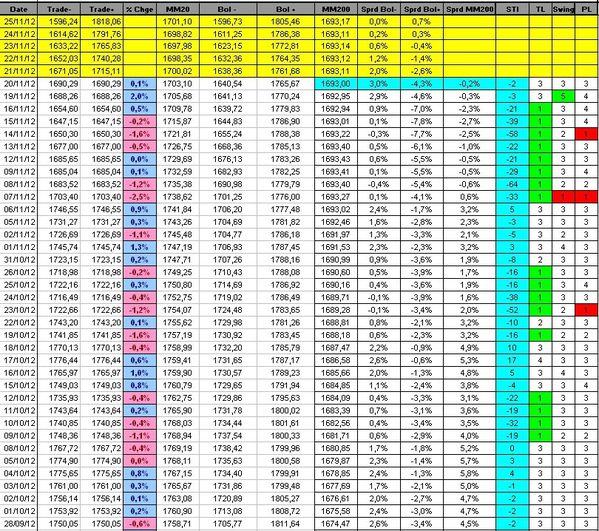

The market printed a 'doji' on Friday and wasn't able to move above Thursay's high. It looks like we are building a short term top leading to (at least) some short term consolidation.

Nevertheless, we wouldn't be surprised to see the market testing the light blue downtrend in coming sessions.

The Sigma Trend Index remains well above its zero line, other indicators are neutral (at '3').

Conclusion:

We continue to expect a short term consolidation of recent advance. Nevertheless, as long as the Sigma Trend Index remains in positive territory it will only be a consolidation and the short term uptrend will remain intact.

Short term position:

- short 1 CAC at 3567.17

- short 1 NDX at 2655.07

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

29 novembre 2012

4

29

/11

/novembre

/2012

07:54

Today, we would like to start with the NDX. We can see 2 open gaps, and according to future's indication, we could have a third gap at market's open. If the theory is right, it should be and exhaustion gap. (1 2 3: Breakaway Runaway then Exhaustion gap).

We expected more consolidation, we got some consolidation but we were surprised by the sharp reversal at the end of the day.

The light blue downtrend or the horizontal dark blue line are strong resistances.

The market tested the zero line at the bottom of the session, then it moved sharply higher. The Sigma trend Index closed the session at '4'. Other indicators are neutral at '3'.

Conclusion:

The consolidation we got was very shy. So, it is bullish for the market.

Nevertheless, the market is fastly approaching strong resistances, we want to see what will happen there.

Short term position:

- short 1 CAC at 3506.24 (stop loss 3544)

- short 1 NDX at 2655.07

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

28 novembre 2012

3

28

/11

/novembre

/2012

07:38

After reaching new highs during the session, the market reversed later in the day and closed around the lowest level of the session.

It is interesting to notice that recent rally retraced 77.4% of previous decline. On top of that, recent rally could be labelled as an 'abc' counter trend move. So, it is important to monitor if the next move (to the downside) is impulsive or not.

If we are in presence of a counter trend move (consolidation) we should not retrace more than 61.8% of recent rally (and 50% would be better).

If we move below the 61.8% retracement level, it will be very very bad for the market.

The Sigma Trend Index declined to '2' and remains in positive territory. Other indicators are neutral. So, there is no fright coming from here.

Conclusion:

We believe the market should at least continue to consolidate recent rally. This is why we took some short term short positions.

If the market shows some signs of negative impulse move, we will have to see if the key 61.8% retracement holds on or not.

Short term position:

- short 1 CAC at 3506.24 (stop loss 3544)

- short 1 NDX at 2655.07

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

27 novembre 2012

2

27

/11

/novembre

/2012

08:38

Yesterday's price action can be interpreted as the start of the expected consolidation but the end of the session was stronger than what we wanted.

In this context, we don't rule out more strength on Tuesday prior to the start of the consolidation.

The Sigma trend Index eased a little bit from '4' to '3'. The short term trend remains well oriented.

Other indicators are neutral at '3'.

Conclusion:

We continue to expect a consolidation (very soon). Thereafter the short term uptrend should resume, testing even the dark blue horizontal line or the light blue downtrend.

We remain bearish on a medium term basis

Short term position:

- short 1 CAC at 3506.24 (stop loss 3544)

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

26 novembre 2012

1

26

/11

/novembre

/2012

08:39

The market was able to align 5 white candles. We are now well above resistances. After such a rally, we wouldn't be surprised to see some consolidation in coming days, then a new upleg should develop. The key test will occur when we test the light blue downtrend.

The Sigma trend Index is in positive territory (at '4'), telling us the short term downtrend is probably over.

Conclusion:

Recent move was powerful. We expect some short term consolidation, then we should visit higher level.

Short term position:

- short 1 CAC at 3506.24 (stop loss 3544)

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

22 novembre 2012

4

22

/11

/novembre

/2012

08:44

The market is stuck betwwen one resistance and one support. We don't believe we still have enough momentum to move through the resistance (after the recent rally). In this context, we expect a short term pullback in coming days. Thereafter, a new upleg should occur (the light blue downtrend could be retested during this next upleg)

The Sigma Trend Index is at '-1'. It will be important to see if we are able to move above the zero line in coming days.

But it would be logical to get at least a pullback when we test the zero line.

Conclusion:

We got a powerful rally since last Friday, we expect a short term consolidation/pullback (soon). Thereafter, the bounce back should resume.

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

21 novembre 2012

3

21

/11

/novembre

/2012

10:25

After some consolidation during the session, the market was able to close above the dark blue horizontal resistance (close to the high of the day). When we look at Tuesday's candle, we can detect, once again, a kind of bullish reversal day.

The Sigma trend Index continues to improve, we are now at '-2'. Other indicators are at '3' in neutral territory.

The Breadth Index is now in positive territory, it will be interesting to monitor its evolution.

Conclusion:

After some consolidation during the session, the market was able to close above a major resistance. This is short term bullish.

In this context, we will open some short term long positions.

On a medium term basis, our Medium Term momentum index remains in sell mode, so there is no change in our medium term view at this time.

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

20 novembre 2012

2

20

/11

/novembre

/2012

09:05

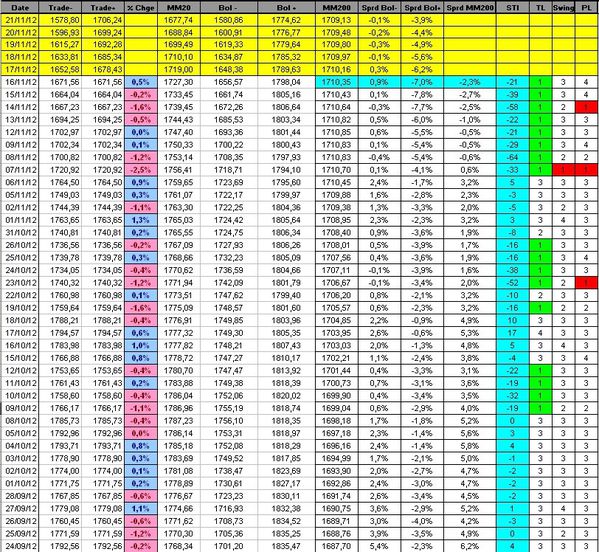

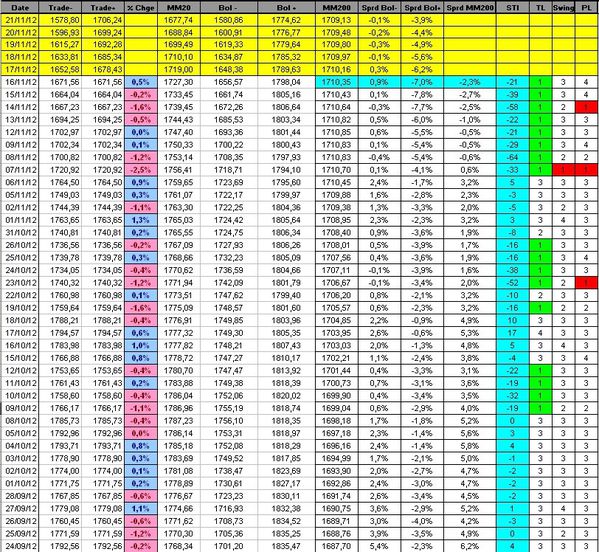

The market confirmed our bullish reversal call. The rebound was very impressive in both Europe and US.

The rally was halted by the dark blue horizontal resistance. Once again it shows how important this level is.

After Monday's rally, we expect a pullback on Tuesday morning. Then, it will be important to monitor price action.

The Sigma Trend Index moved sharply to the upside but remains in negative territory. The Swing moved to '5' (bullish impulse). This is a powerful signal, and we have to respect it: it could signal the start of a multi days/weeks rally.

Conclusion:

The Swing indicators moved to '5' with the Trend Level(TL) having been at '1' for a couple of days. Usually, this combinaition occurs at the start of a rally/counter trend rally.

So, if the market is able to move above the dark blue horizontal resistance, we will open a short term long position. If we are not able to move above yesterday's high (in the next 2 days), we will re-open a short position.

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

18 novembre 2012

7

18

/11

/novembre

/2012

17:06

The market declined untill the next horizontal support (pink line). Then a major rally started and the market closed well above the session's low. Friday's session looks like a bullish reversal day.

The Sigma trend Index improved again on Friday, it moved from '-39' to '-21'. The trend Level is at '1', remaining in oversold condition but the power level (PL) was at '4' (bullish impulse) for the second consecutive session.

Conclusion:

The bullish divergence detected on the Breadth index on Thursday was confirmed by the market (on Friday).

We sharply reduced our short positions during the session.

As our medium term momentum index remains in sell mode, we will re-enter short at higher price when we detect a good opportunity.

Medium term positions:

- short 1.5 SPX at 1376.22

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis

16 novembre 2012

5

16

/11

/novembre

/2012

01:08

The market printed a 'doji' on thursday. There are 2 supports not far from current levels, it will be important to monitor what happen if/when we reach those supports.

The Sigma Trend Index slightly improved from '-58' to '-39'. The Trend Level (TL) remains at '1' (oversold).

The Power Level moved from '1' to '4', telling us the negative momentum is easing a little bit.

When we look at the Breadth Index, we can notice a positive divergence: market continues to decline while less stocks participate to this decline.

This could be the early sign of a bottom under construction.

Conclusion:

The market printed a 'doji' and we have a positive divergence between the breadth index and price.

In this context, we will reduce the size of our medium term positions, booking some gains.

Medium term positions:

- short 3 SPX at 1376.22

- short 1 NDX at 2578.46

- short 1.5 CAC at 3103.87

Published by sigmatradingoscillator

-

dans

Market Analysis