8 août 2013

4

08

/08

/août

/2013

08:02

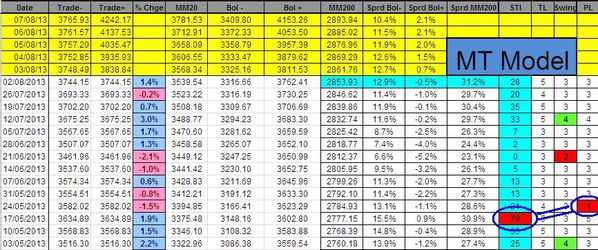

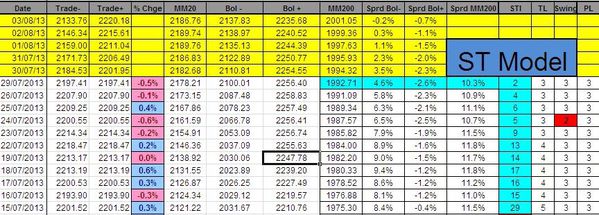

The Sigma Trend Index (STI) slid in negative territory one day after the swing gave a mild negative impulse signal (with a swing at '2').

It is difficult to say if the market has already topped. (see Wednesday's analysis) or if we are in a consolidation phase.

Nevertheless, we keep our long (short term) positions as long as we don't get an exit signal from our ST model.

Short Term Trading Book:

- SPX: 1 long at 1588.17 (stop @ 1603, 3pts below the ST model to take into account bid/ask spread)

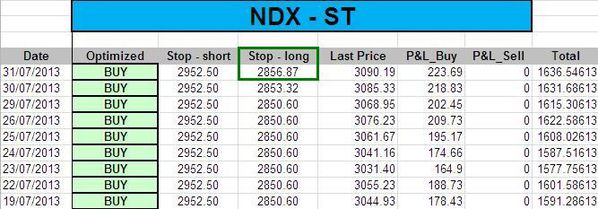

- NDX: 1 long at 2868.65 (stop @ 2863, 5pts below the ST model to take into account bid/ask spread)

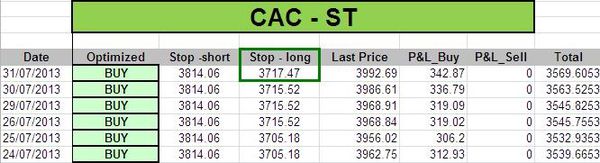

- CAC: 1 long at 3657.24 (stop @ 3733, 5pts below the ST model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 7856, 10pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the MT model to take into account bid/ask spread)

Published by sigmatradingoscillator

-

dans

Market Analysis

7 août 2013

3

07

/08

/août

/2013

09:10

Looking at the chart of the Sigma Whole Market Index, it is unclear if the 5th wave topped earlier this week. In order to get a confirmation, we need to break the pink horizontal support.

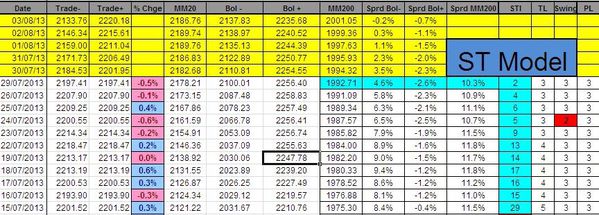

There is no change in the ST model because the Sigma Trend Index (STI) wasn't able to reach the key '34' level.

The Swing is at '2', telling us that Tuesday's decline was rather impulsive.

Short Term Trading Book:

- SPX: 1 long at 1588.17 (stop @ 1603, 3pts below the ST model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 2863, 5pts below the ST model to take into account bid/ask spread)

- CAC: 1 long at 3657.24 (stop @ 3733, 5pts below the ST model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 7856, 10pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the MT model to take into account bid/ask spread)

Published by sigmatradingoscillator

-

dans

Market Analysis

6 août 2013

2

06

/08

/août

/2013

07:00

The Sigma Trend Index declined from'18' to '15'. There is no sign of trend reversal at this time.

In order to get a sell signal, we need first a Sigma Trend Index(STI) above '34'. Thereafter, we need the Swing and/or the Power Level (PL) at 1 or 2.

Short Term Trading Book:

- SPX: 1 long at 1588.17 (stop @ 1603, 3pts below the ST model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 2863, 5pts below the ST model to take into account bid/ask spread)

- CAC: 1 long at 3657.24 (stop @ 3733, 5pts below the ST model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 7856, 10pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the MT model to take into account bid/ask spread)

Published by sigmatradingoscillator

-

dans

Market Analysis

3 août 2013

6

03

/08

/août

/2013

11:44

When we look at the chart of the Sigma Whole Market Index, we can notice the market is actually in a 5th wave. According to Elliott Wave theory, the 5th wave is the last wave of an uptrend prior to 3 waves of correction (in abc).

So, there is a high probability that a short (or medium) term top is around the corner.

The Sigma Trend Index is at '18'. So, we are not far from the key '34' level (required level for a building top process) but we need another upleg early next week.

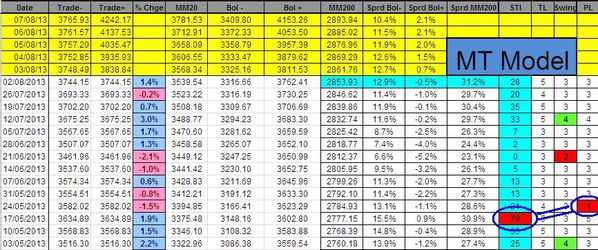

The short term model (ST model) uplifted all stops. We added the Eurostoxx50 to the daily reporting but we don't have any position on this index:

The medium term Sigma Trend Index (based on weekly close) increased from '20' to '28' but the model is unchanged on the week.

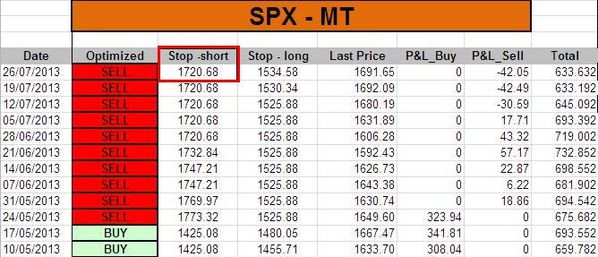

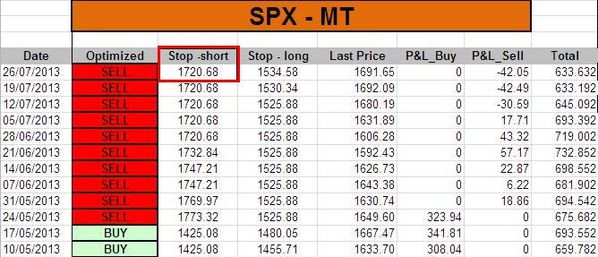

The medium term model (MT model) remains in sell mode and we are not far from the stop loss.

Short Term Trading Book:

- SPX: 1 long at 1588.17 (stop @ 1603, 3pts below the ST model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 2863, 5pts below the ST model to take into account bid/ask spread)

- CAC: 1 long at 3657.24 (stop @ 3733, 5pts below the ST model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 7856, 10pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the MT model to take into account bid/ask spread)

Published by sigmatradingoscillator

-

dans

Market Analysis

2 août 2013

5

02

/08

/août

/2013

08:30

The Sigma Trend Index(STI) increased from'3' to '19'. At the same time the Swing moved from neutral territory ('3') to impulsive ('5'). In case of another strong upmove on Friday, we could reach the key '34' level on the STI.

Following this strong session, the ST model uplifted all its stops (except for the dax):

Short Term Trading Book:

- SPX: 1 long at 1588.17 (stop @ 1602, 3pts below the ST model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 2858, 5pts below the ST model to take into account bid/ask spread)

- CAC: 1 long at 3657.24 (stop @ 3727, 5pts below the ST model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 7848, 10pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the MT model to take into account bid/ask spread)

Published by sigmatradingoscillator

-

dans

Market Analysis

1 août 2013

4

01

/08

/août

/2013

07:04

There is no change in our indicators. The Sigma Trend Index (STI) is close to its zero line and we can't imagine to reach the key '34' level (required level for a 'sell' signal) without a 2-3% up move. So, in absence of any major selloff (reaching our stop levels), the ST model will remain in buy mode in coming days.

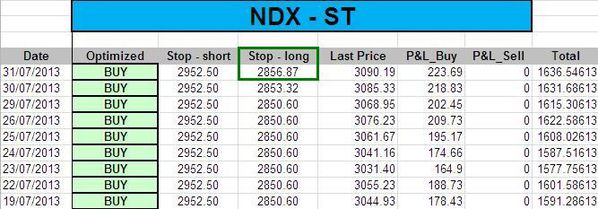

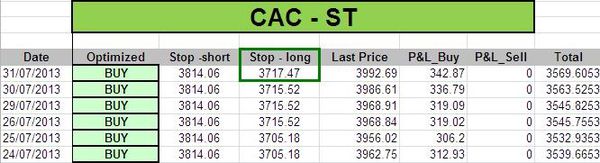

The ST model uplifted its stop levels for both the NDX and the CAC:

Short Term Trading Book:

- SPX: 1 long at 1588.17 (stop @ 1597, 3pts below the ST model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 2852, 5pts below the ST model to take into account bid/ask spread)

- CAC: 1 long at 3657.24 (stop @ 3712, 5pts below the ST model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 7848, 10pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the MT model to take into account bid/ask spread)

Published by sigmatradingoscillator

-

dans

Market Analysis

31 juillet 2013

3

31

/07

/juillet

/2013

07:18

There is no material change in our ST model following Tuesday's session. There is no doubt that the market is waiting for Fed's decision.

The Sigma Trend Index is close to its zero line (close to neutral level) and all other indicators are neutral (at '3').

The ST model uplifted its stop level on the NDX and all other stops are unchanged:

Short Term Trading Book:

- SPX: 1 long at 1588.17 (stop @ 1597, 3pts below the ST model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 2848, 5pts below the ST model to take into account bid/ask spread)

- CAC: 1 long at 3657.24 (stop @ 3711, 5pts below the ST model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 7848, 10pts below the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the MT model to take into account bid/ask spread)

Published by sigmatradingoscillator

-

dans

Market Analysis

30 juillet 2013

2

30

/07

/juillet

/2013

08:07

Monday was a quiet day with low volatility.

The Sigma Trend Index is close to its zero line and all other indicators are neutral at '3'.

There is no change in our ST model, our stop levels are unchanged.

Short Term Trading Book:

- SPX: 1 long at 1588.17 (stop @ 1597, 3pts below the model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 2845, 5pts below the model to take into account bid/ask spread)

- CAC: 1 long at 3657.24 (stop @ 3711, 5pts below the model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 7848, 10pts below the model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the model to take into account bid/ask spread)

Published by sigmatradingoscillator

-

dans

Market Analysis

28 juillet 2013

7

28

/07

/juillet

/2013

09:50

The daily chart of the Sigma Whole Market Index remains well oriented and on a wave basis, it looks like the equity market is ready for the next upleg.

We want to underline that this chart is just a visual support because all our positions are based on our quant models and not on charts.

Looking at our ST model (ST for short term), there is no change in our daily indicators: the Sigma Trend Index (STI) is close to zero and all indicators are neutral at '3'

The ST model uplifted the stop level for the CAC40. The DAX and the US are unchanged:

Looking at the MT model (MT for medium term), there is no material change this week: the Sigma Trend Index continues to ease but there is no sharp decline at this time.

The MT model remains in 'sell' mode and stop level has been recomputed for the SPX:

Short Term Trading Book:

- SPX: 1 long at 1588.17 (stop @ 1597, 3pts below the model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 2845, 5pts below the model to take into account bid/ask spread)

- CAC: 1 long at 3657.24 (stop @ 3711, 5pts below the model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 7848, 10pts below the model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1724, 3pts above the model to take into account bid/ask spread)

Published by sigmatradingoscillator

-

dans

Market Analysis

26 juillet 2013

5

26

/07

/juillet

/2013

07:55

When we look the chart of the Sigma Whole Market Index, it looks like the equity market is currently in a modest consolidation (wave '4') prior to the next upleg.

Looking at our indicators, there is no change today and no 'stop' was modified:

Short Term Trading Book:

- SPX: 1 long at 1588.17 (stop @ 1597, 3pts below the model to take into account bid/ask spread)

- NDX: 1 long at 2868.65 (stop @ 2845, 5pts below the model to take into account bid/ask spread)

- CAC: 1 long at 3657.24 (stop @ 3700, 5pts below the model to take into account bid/ask spread)

- DAX: 1 long at 7817.14 (stop @ 7848, 10pts below the model to take into account bid/ask spread)

Medium Term Trading Book:

- SPX: 2 shorts at 1682.84 (stop @ 1701, 3pts above the model to take into account bid/ask spread)

Published by sigmatradingoscillator

-

dans

Market Analysis