First of all, I want to wish you all the best to you and your family in 2015. And, a lot of good trades...

I want to take the opportunity of the first week-end of the year to post a sum up of all the trades we did in 2014.

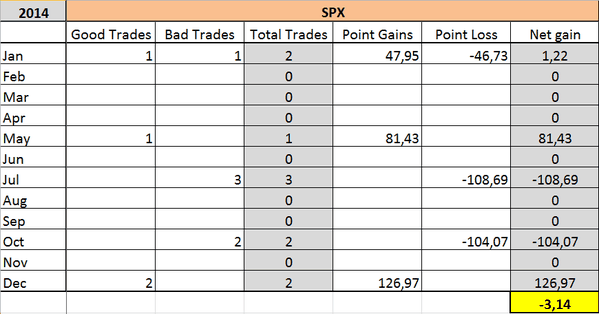

The SP500 is the only index for which we booked a small loss in 2014: 40% of good trades and avg gains 148% above avg losses.

10 trades: 4 good vs 6 bad

Avg gains for good trades: 64.09 pts/trade

Avg loss for bad trades: -43.25pts/trade

Total gains: -3.14pts

50% of good trades and avg gains 126% above avg losses.

10 trades: 5 good vs 5 bad

Avg gains for good trades: 135.62 pts/trade

Avg loss for bad trades: -107.72pts/trade

Total gains: 139.49pts

62% of good trades and avg gains in line with avg losses.

13 trades: 8 good vs 5 bad

Avg gains for good trades: 124.95 pts/trade

Avg loss for bad trades: -124.16pts/trade

Total gains: 378.8pts

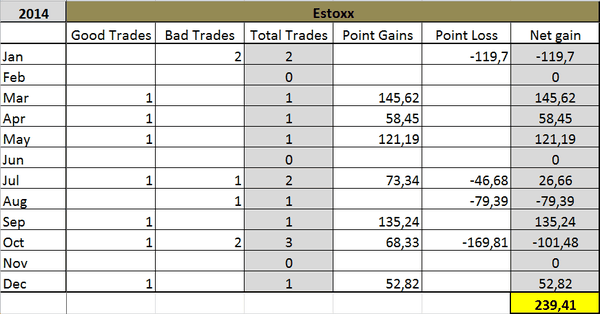

54% of good trades and avg gains 134% above avg losses.

13 trades: 7 good vs 6 bad

Avg gains for good trades: 93.57 pts/trade

Avg loss for bad trades: -69.59pts/trade

Total gains: 239.41pts

58% of good trades and avg gains 135% above avg losses.

12 trades: 7 good vs 5 bad

Avg gains for good trades: 306.51 pts/trade

Avg loss for bad trades: -227.58pts/trade

Total gains: 1007.68pts

The DAX is the index with the best return: 58% of good trades and avg gains 160% above avg losses.

12 trades: 7 good vs 5 bad

Avg gains for good trades: 356.4 pts/trade

Avg loss for bad trades: -221.73pts/trade

Total gains: 1386.13pts