Today, I wrote a short topic on strategy. No update on the quant models but there is no change in our positions.

It is interesting to notice that the Economic surprise is improving fast in Europe(red line) while this index is declining fast in US(blue line). The negative correlation is so 'perfect' that we believe the FX has been the main driver of this situation.

We can notice this situation is in line with recent outperformance of the Stoxx600 relative to the S&P500 (in euro): medium term uptrend in favor of the S&P has just been broken.

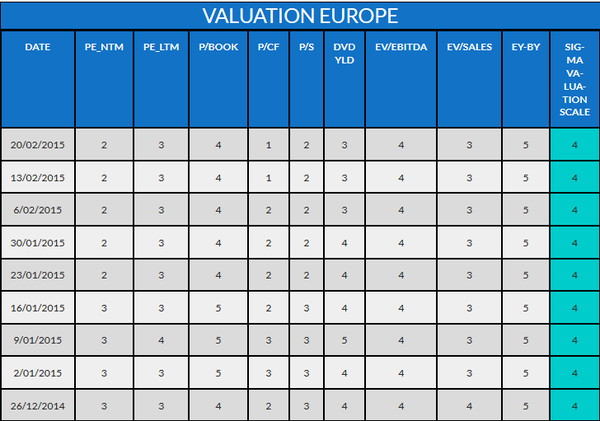

Looking at key valuation metrics, it is obvious that Europe is much cheaper than US. Here is a sum up review of US & EU valuatin based on key metrics. (1= not attractive based on long term average multiple, 3=neutral, 5=attractive based on long term average multiple).

Explanation of different abbreviations:

- PE_NTM = P/E Next 12Months

- PE_LTM = P/E Last 12Months

- P/Book = Price/Book Value

- P/S = Price/Sales

- Dvd Yld = Dividend Yield

- EV/EBITDA = Enterprise Value/EBITDA

- EV/Sales = Enterprise Value/Sales

- EarningsYLD - BDS_YLD = Earnings YLD (= 1/PE) - 10y Government benchmark

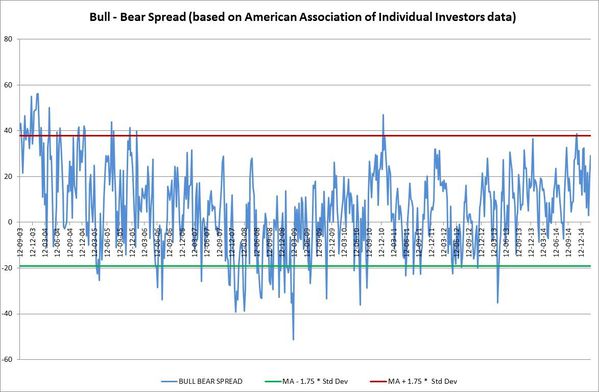

Looking at current sentiment, we can notice the Bull/Bear spread is at elevated level but we are not (yet) in euphoria territory. So, Current situation could last for some times and the party is (probably) not over. You can remain on the dance floor but don't forget to remain close to the emergency exit, it is always better in case of fire alarm...

There is no change in our positin at this stage.

Daily Trading Book: