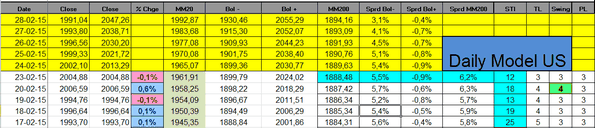

The Sigma Whole Europe Index continues to rally, the euphoria remains the main driver of this market. (blow off top)

Based on the Sigma Smart Money Index Europe (blue line), it seems that "big players" joined the party and this is probably the main explanation behind this huge rally in Europe.

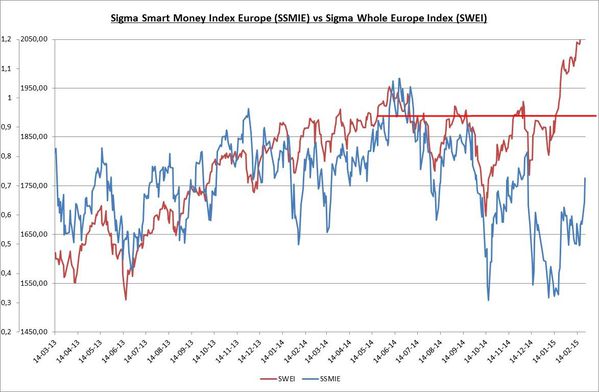

The Sigma Whole Market Index remains very strong. The market is clearly in a no fear mood.

The breakout seems confirmed, and we are in favor of more upside rather on US markets rather than in favor of a reversal from current levels. The market is (according to us) too strong for a false break.

The Sigma Smart Money Index remains below its recent highs. So, "big players" seem/remain cautious.

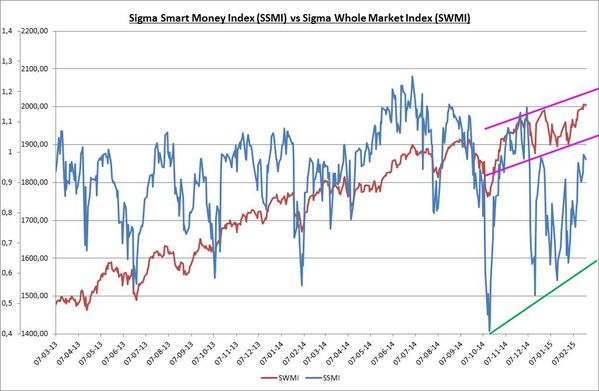

The Sigma Trend Index remains close to '10' => a 'sell' signal (based on our ST model) is nearly impossible in coming sessions.