The Sigma Whole Europe Index had a difficult start on Tuesday but after a pullback of more than 1% early in the morning, the index started to recover early losses around lunch time. The afternoon was relatively strong and the index was roughly flat on the close. Once again, it seems nothing can stop the market as long as the different Central Banks are in dovish mood.

Most Europe Indexes are close to print new highs: it seems nobody cares about Greece and Ukraine.

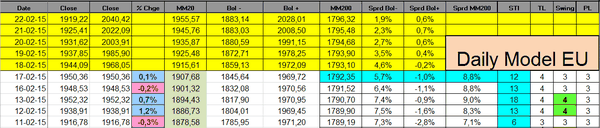

The Sigma Trend Index remains close to '10', both the Swing and the Trend Level are neutral at '3'.

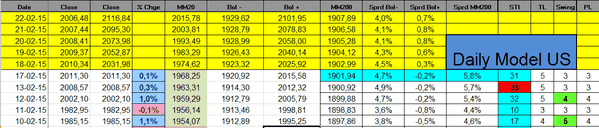

The Sigma Whole Market Index is right on previous top. Let's see if the market is able to print new highs in coming days or if it rolls down from current levels.

The Sigma Trend Index slightly declined on Tuesday but both the Swing and the Power Level(PL) were at '3'. So, we didn't get any 'sell' signal at this stage.