The Sigma Whole Europe Index enjoyed another strong session. It seems nothing can stop this market: the market is always able to find another "good" reason to rise.

Most European Indexes are strong at this stage and there is no resistance at current levels and o sign of reversal.

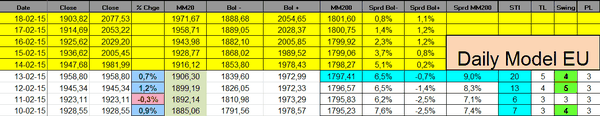

The Sigma Trend Index rose to '20' and the Swing came in at '4' telling us we had another impulsive session.

We were stopped on both the CAC and the Estoxx:

- CAC stopped @ 4757.12: 4659.35 - 4757.12 = -97.77

- EStoxx stopped @ 3465.35: 3392.5 - 3465.35 = -72.85

We cut our "side bet" at same levels and we booked our losses.

The Sigma Whole Market Index was also strong on Friday: it is right below the red horizontal resistance. A reversal at current level would draw a double top pattern while a move above the red horizontal line could clear the way for further gains.

Some US indexes were able to move above strong resistance. So, the internal looks very strong.

The Sigma Trend Index rose to '35'. This means the ST model could generate a 'sell' signal if the Swing or the Power Level declines at '1' or '2' in the next 3 sessions.

Daily Trading Book: