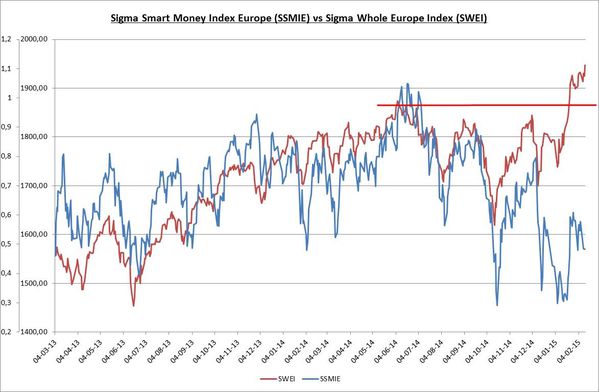

The Sigma Whole Europe Index had another strong session and hit new highs. There is no sign of reversal at this stage.

Nevertheless, looking at the Sigma Smart Money Index Europe (SSMIE) (= Sigma Whole Europe Index adjusted for volatility), we can notice this index is moving in opposite direction to the Sigma Whole Europe Index. This is not a good signal for the European market, and the negative divergence seems unsustainable.

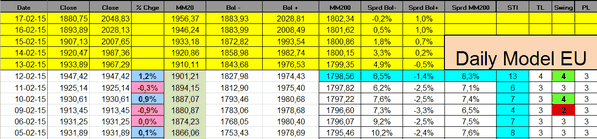

The Sigma Trend Index slightly increased to '13'. The Swing came in at '4' telling us the move was impulsive.

We are now close to our "stops" on most European indexes. If the market reaches our stops, we will take our losses, this is part of the investment process: bad trades always happen and it is normal to stop them. This is why it is very important to avoid "over-leveraged" situations because one bad trade could "kill" you (if its size is too big).

The Sigma Whole Market Index is close to the top end of its trading range. Let's see if it is able to break it or if we get a double top pattern.

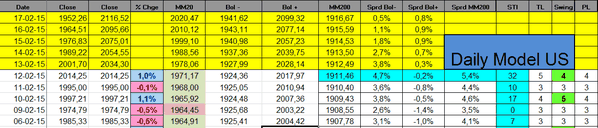

The Sigma Trend Index jumped from '10' to '32'. So, we are very close to the key '34' level (level required in order to generate a 'sell' signal).

Daily Trading Book: