The Sigma Whole Europe Index printed an interesting 'doji' on Thursday. The index closed right on a major support. If it can't hold on this support level, we could have a sharp decline on Friday.

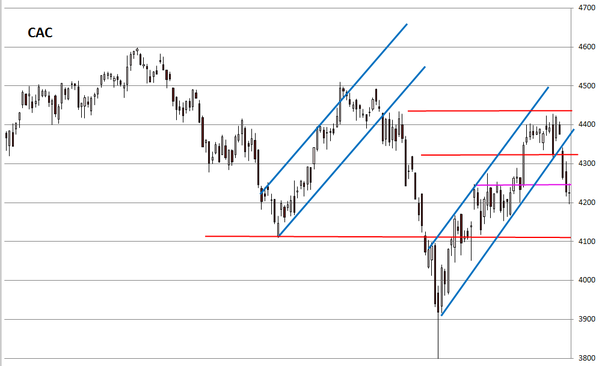

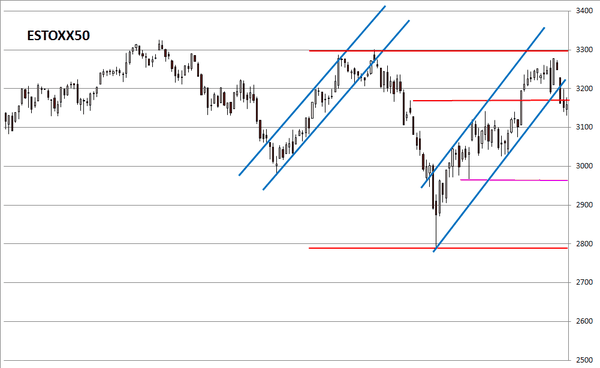

Both the CAC and the Eurostoxx50 are in difficult situation. We believe further downside pressure should materialize in coming days.

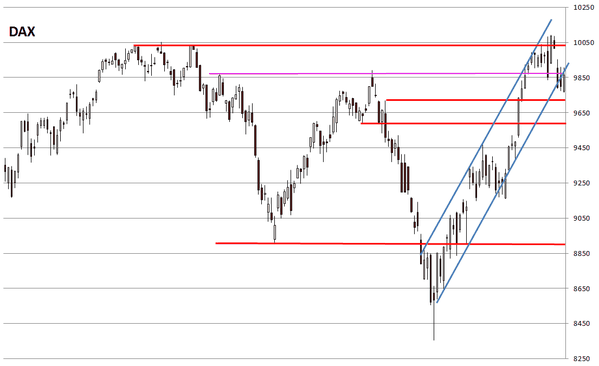

The DAX is in a much better situation because it remains above 2 strong horizontal supports. We are not really surprise because the DAX has no direct exposure to Oil&Gas and to miners: those sectors have been the weakest ones for a couple of weeks.

Looking at our indicators, there is no new information.

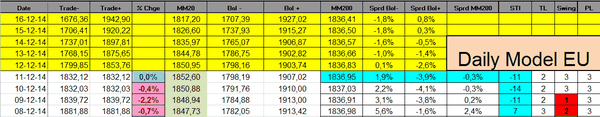

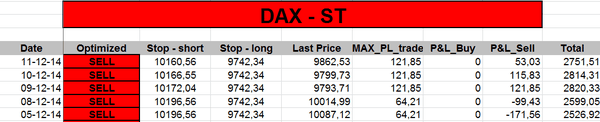

The ST model lowered its stops on all European indexes:

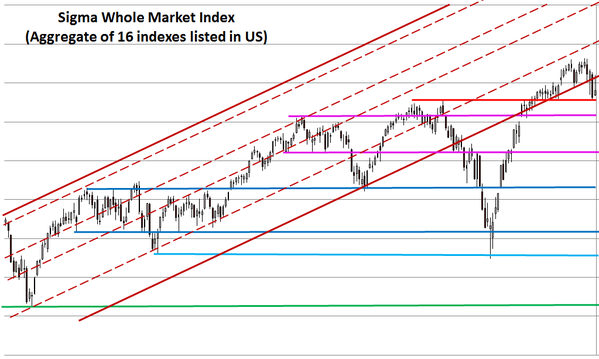

The Sigma Whole Market Index had a bearish reversal on Thursday and it is now testing its (red) horizontal support. US market became highly volatile: we can notice this situation when we look at the 3 latest candles: big black, big white and hammer. This doesn't sound bullish.

It is also interesting to notice the negative divergence between the Sigma Whole MArket Index (SWMI) and the Sigma Smart Money Index (SSMI). The SSMI is declining on a straight line, this is another major warning for US equities.

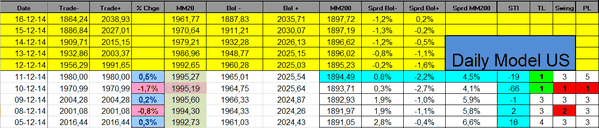

The Sigma Trend Index bounced back to '-19' but it remains in oversold territory: the Trend Level (TL) remains at '1'.

Short Term Trading Book: