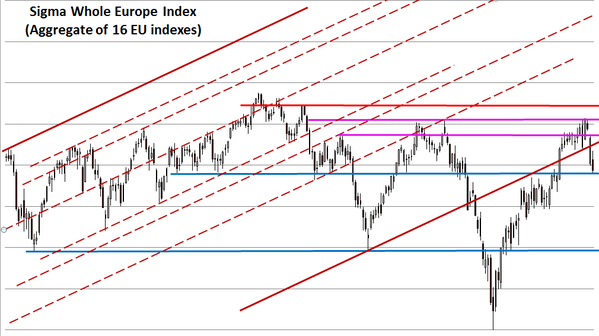

The Sigma Whole Europe Index continues to slide. It is now testing a major support.

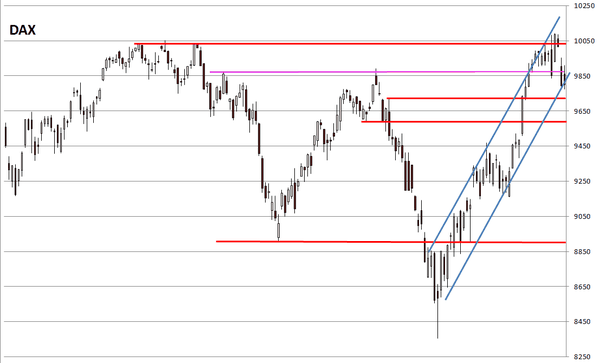

Looking at key European indexes, we can notice that most of them (except the DAX) are in danger.

The Sigma Trend Index declined again to '-14' but both the swing and the power level were neutral.

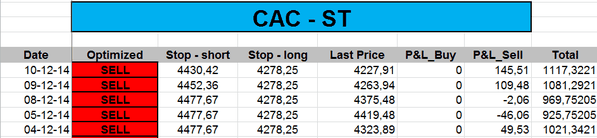

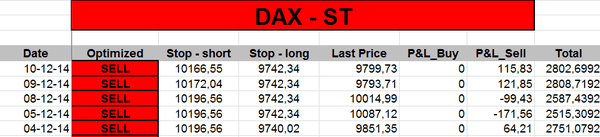

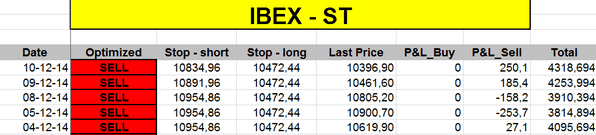

The ST model computed new stop levels for our short positions:

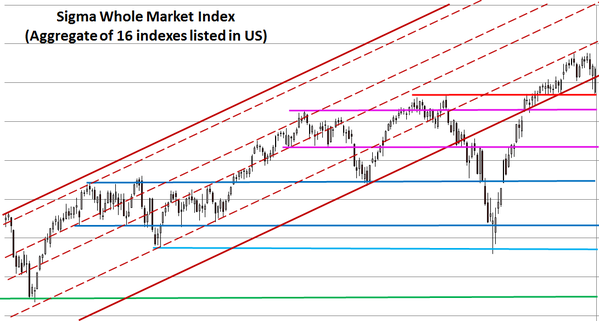

The Sigma Whole MArket Index had a very bad session with a bug black candle. This index is now right on a major suport, it is very important to keep this level.

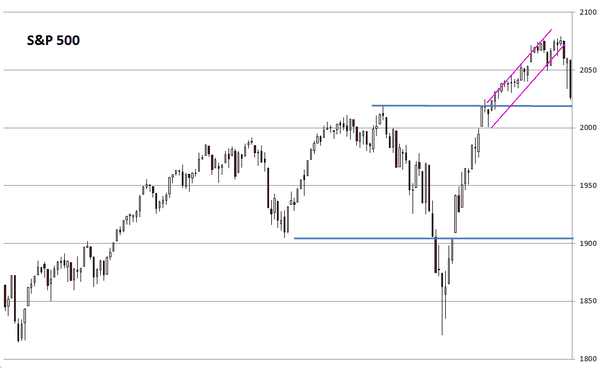

The SP500 had a bad session and it is also on a major support.

The Sigma Trend Index collapsed to '-66'. This means the market is highly oversold on a short term basis. Both the Swing and the Power Level were at '1', telling us the decline was highly impulsive.

Short Term Trading Book: