There is nothing important this morning (we can say, see or analyze) because the BOJ decided to increase the size of its balance sheet (just when the Fed decided to limit it) and the equity market (around the world) loved the decision.

We know we should get a huge gap at the open but it will be interesting to see if the gains are sustainable or if the investors take this oportunity to sharply reduce their exposure to equities.

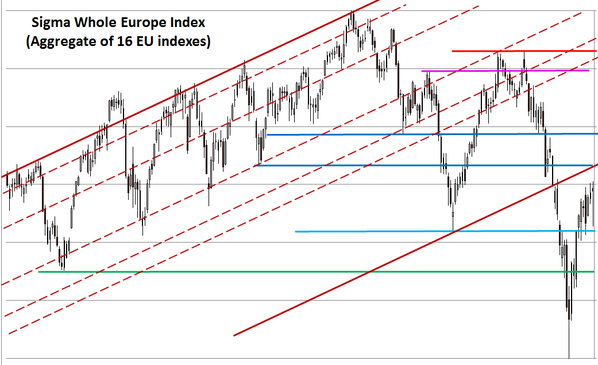

The Sigma trend Index will be important to monitor because a close abve the key '34' level on Friday would be the first element for a sell signal next week.

The IBEX was stopped on Thursday because this index declined below our stop level. (We had no position on this index but we want to report it for the ones who are interested by this index).

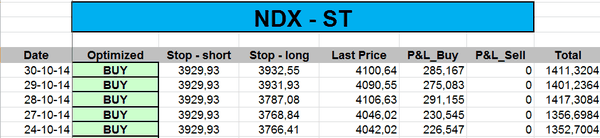

The ST model uplifted its stop for some indexes:

Short Term Trading Book: