Looking at the charts, there is no threat at this time. The Sigma Whole Market Index remains well oriented and European Indexes are breaking to new highs (except for the CAC40). The CAC40 is breaking a downtrend.

It is difficult to count current move. Is it a 3 or a 5 waves move? If there is only 3 waves, we need a small consolidation (4th wave) prior to a last move to the upside (5th wave). Thereafter a deeper correction should occur. If we finished the 5th wave on Friday, the correction should start now.

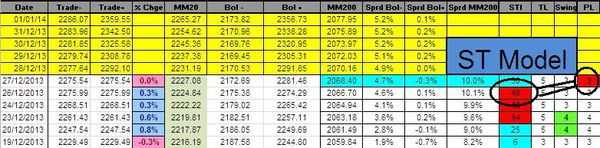

The Swing declined to '2' on Friday. As the Sigma Trend Index was above '34' on Thursday, the ST model generated a fresh sell signal on Friday's close.(for more details on the way the ST model generates buy and sell signals, please have a look at our methodology (link in right column)).

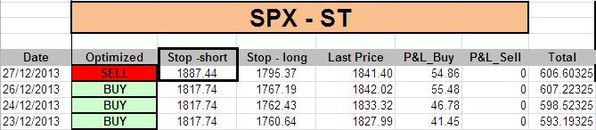

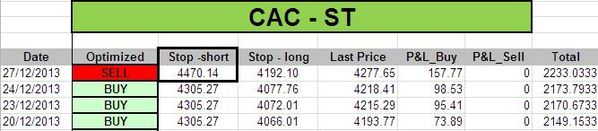

We closed our long positions and booked some nice gains:

- 1 ndx closed at 3577.69 => 3577.69 - 3475.53 = 102.36 (gains)

- 1 spx closed at 1841.42 => 1841.42 - 1787.18 = 54.24 (gains)

- 1 cac closed at 4280.47=> 4280.47 - 4115.38 = 165.09 (gains)

- 1 dax closed at 9587.06 => 9587.06 - 9164.04 = 423.02 (gains)

- 1 EStox closed at 3114.05 => 3114.05 - 2974.13 = 139.92 (gains)

In line with our model, we opened short positions

Short Term Trading Book:

- SPX: short at 1841.42 (stop @ 1890, 3pts above the ST model to take into account bid/ask spread)

- NDX: short at 3577.69 (stop @ 3686, 5pts above the ST model to take into account bid/ask spread)

- CAC: short at 4280.47 (stop @ 4475, 5pts above the ST model to take into account bid/ask spread)

- DAX: short at 9587.06 (stop @ 9798, 10pts above the ST model to take into account bid/ask spread)

- EStoxx: short at 3114.05 (stop @ 3200, 5pts above the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- No more medium term position at this stage.

Out of model position: (hedge against a blow off rally like in 2000)

- 1 call NDX January 2014 strike 3700 @ 5.06