The Sigma Whole Market Index enjoyed a powerful rally. The best day of the year gor US stocks! This is great, and we are happy because we are long.

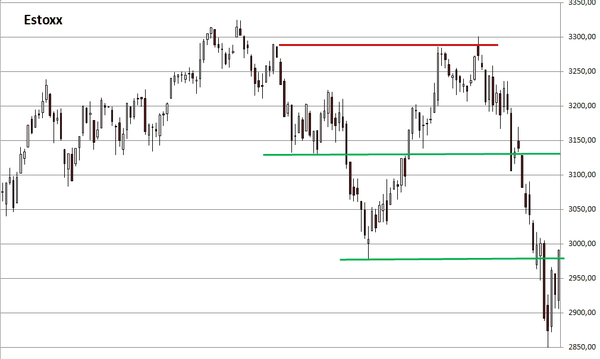

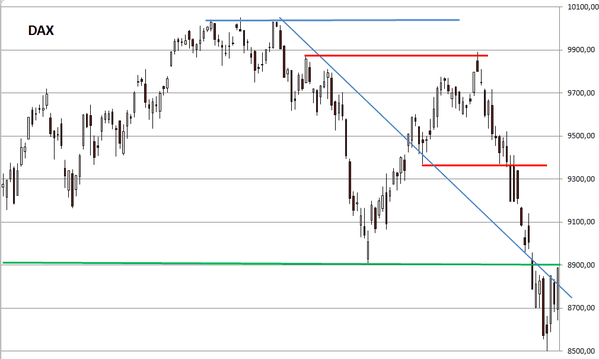

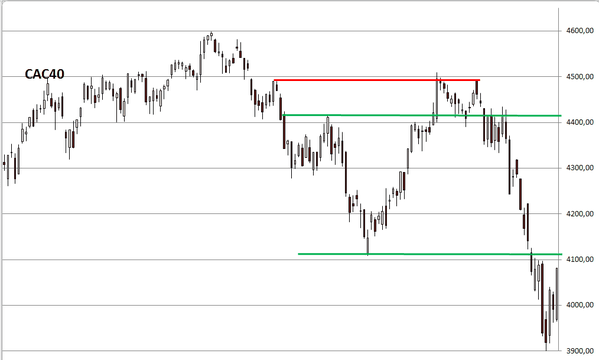

Nevertheless, it is important to notice that recent rebound looks like an 'abc' (= bounce back in a downtrend) and that most indexes are close or very close to strong resistances.

The Sigma trend Index is well in positive territory and this is (also) god news. Now, it is important that it stays in positive for a couple of days. One day is not enough to underline a new trend.

The Swing came at '5' but looking at the size of the white candle (on the chart), we are not surprised it was an highly impulsive day.

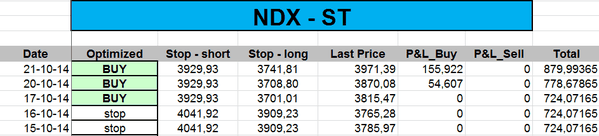

The ST model sharply uplifted all its stops:

Short Term Trading Book: