When we look at the weekly chart of the Sigma Whole Market Index, it seems the pink resistance we underlined few weeks ago is the next target for this rally. It seems nothing can stop this rally except (maybe) this strong resistance.

Looking at the Sigma Whole Market Index on a daily basis, we can notice current rally is very strong and current length is among the longest of recent rallies (already 27 sessions in current upleg).

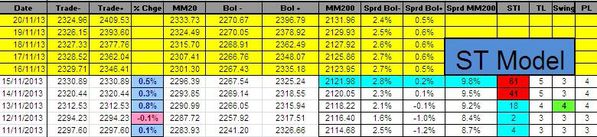

The Sigma Trend Index is at '61'. So we are very close to a fresh 'sell' signal. (for more details on our buy and sell signals, please have a look at our methodology by clicking on the link in the right column).

Short Term Trading Book:

- SPX: no more position

- NDX: 1 short at 3361.01 (stop @ 3441, 5pts above the ST model to take into account bid/ask spread)

- CAC: 1 short at 4272.14 (stop @ 4372, 5pts above the ST model to take into account bid/ask spread)

- DAX: no more position

- EStoxx: 1 short at 3027.17 (stop @ 3108, 5pts above the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- No more medium term position at this stage.