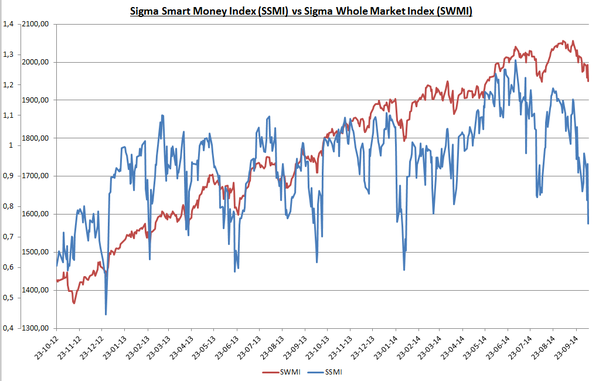

The Sgima Whole Market Index lost its Wednesday's gain. We are once again close to the major horizontal support.

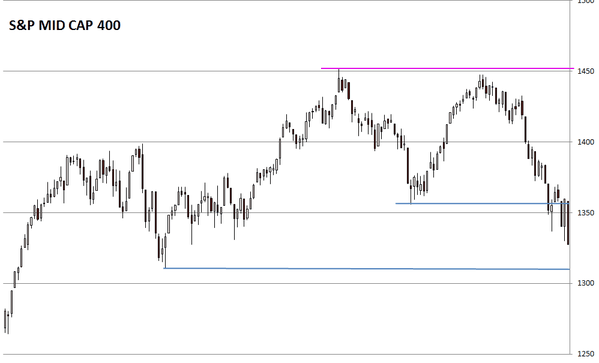

Both the Russell 2000 and the S&P Mid Cap400 closed at the low of the session. Those indexes are very close to print new lows.

It is interesting to notice that the Sigma Smart Money Index sharply decined (blue line). This means that smart investors sharply reduced their exposure to the market.

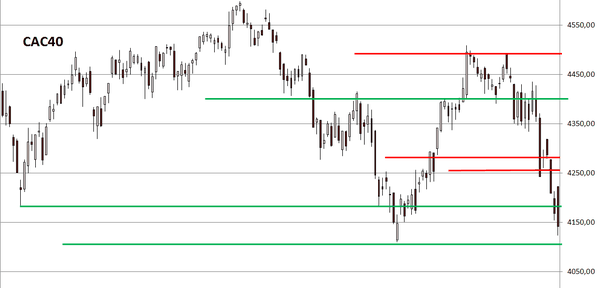

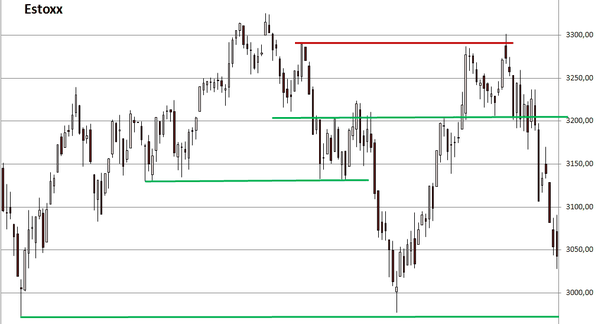

Looking at some European indexes, we can notice we are still above last month's low.

The Sigma Trend Index fall back in negative territory and both the Swing and the Power Level are telling us we had an impulsive session.

There is no change in our positions at this stage:

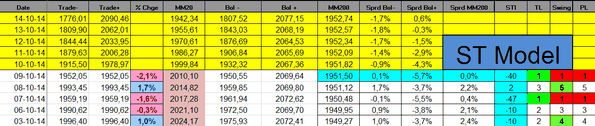

Short Term Trading Book: