The Sigma Whole Europe Index had a volatile session on Friday: the index was under heavy sellig pressure earlier in the day but was finally able to rally at the end of the day and closed near its sesion high.

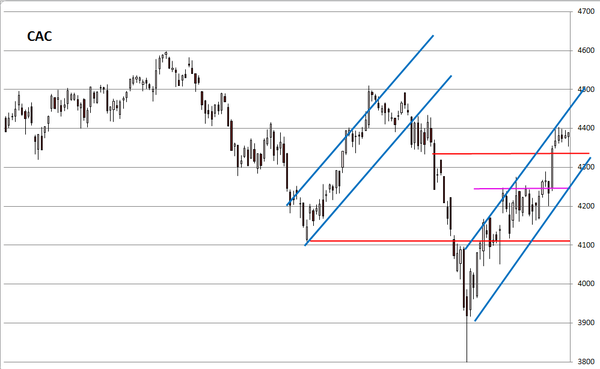

The same situation can be seen on the CAC, Estoxx and DAX. In the case of the DAX, this index is more advance than other European Indexes because it is 'already' challenging its 52 weeks highs.

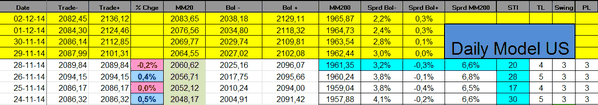

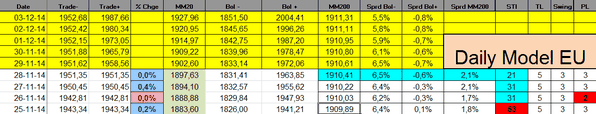

The Sigma Trend Index Europe declined to '21'. Both the Swing and the Power Level (PL) remained neutral (at '3'). There is no sign of impulse move at this stage.

The ST model lowered its stop on the CAC:

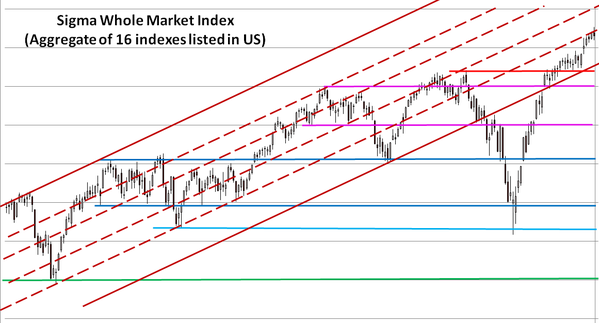

The Sigma Trend Index had a kind of reversal day on Friday: the index printed new record highs early in the session but wasn't able to keep this level. The market reversed in the latest minutes of the session and closed near its intraday low.

While the Nasdaq 100 and the SP500 remain very well oriented, it is important to notice that both the Russell2000 and the Small Cap600 were under pressure on Friday. Those indexes remain the key ones to focus on.

The Sigma Trend Index declinedto '20'. Both the Swing and the Power Level remained neutral' at '3'.

Short Term Trading Book: