Today, we want to start our charts review with Europe. Tuesday's session made a lot of damages to the EuroStoxx and the CAC. The Dax also broke an important uptrend but its momentum remains strong.

Once again, the CAC looks like the weakest one, and the perfect candidate to short.

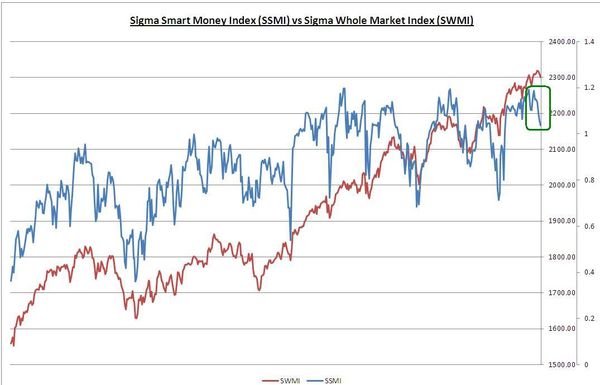

Looking at the Sigma Whole Market Index, we can notice current decline is very modest and looks more like a consolidation rather than the start of a decline. There is no sign of (negative) impulse at this time.

But the Sigma Smart Money Index continues to deteriorate much faster than the Sigma Whole Market Index, telling us smart investors are reducing their exposure to the market.

Looking at our indicators, the Sigma trend Index is at '3', other indicators are neutral. It is interesting to notice that we got 2 sets of 3 consecutive negative sessions in a very short time. That hasn't occured for a long time and could be the first sign of a weakening market.

The ST model computed new stop levels for both the CAC and the Eurostoxx:

Short Term Trading Book:

- SPX: short at 1792.26 (stop @ 1827, 3pts above the ST model to take into account bid/ask spread)

- NDX: stopped

- CAC: short at 4272.14 (stop @ 4385, 5pts above the ST model to take into account bid/ask spread)

- DAX: stopped

- EStoxx: short at 3027.17 (stop @ 3103, 5pts above the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- No more medium term position at this stage.

Out of model position:

- 1 call NDX January 2014 strike 3700 @ 5.06