The Sigma Whole MArket Index had a very strong session on Tuesday. It seems nothing can stop this market.

We have been underlying for a couple of weeks that both the Russell 2000 and the Small Caps 600 were much weaker than the rest of the market and that they were unable to print new highs. Now, this divergence has been cleared for the Small Caps 600 but not yet for the Russell 2000..

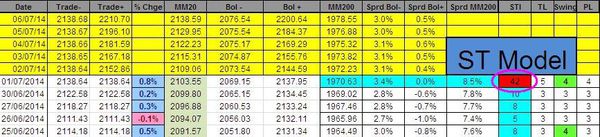

The Sigma Trend Index surged to '45' (above the key '34' level) and the Swing was at '4', telling us the session was rather impulsive.

The NDX hit our stop loss and we booked a major loss: 3720.24 - 3881.13 = -160.89 (loss).

We are not happy with current trading performance but we are still positive on a ytd basis:

- CAC: +426.43 pts

- DAX: +405.96 pts

- Estox: +193.09pts

- IBEX: -270.91 pts

- SPX: +14.07 pts

- NDX: +122.85pts

Short Term Trading Book:

- SPX: short at 1912.06 (stop @ 1981, 3pts above the ST model to take into account bid/ask spread)

- NDX: stopped

- CAC: short at 4526.78 (stop @ 4621, 5pts above the ST model to take into account bid/ask spread)

- EStox: short at 3242.67 (stop @ 3354, 5pts above the ST model to take into account bid/ask spread)

- DAX: short at 9936.15 (stop @ 10085, 10pts above the ST model to take into account bid/ask spread)

- IBEX: short at 110496.6 (stop @ 11296, 10pts above the ST model to take into account bid/ask spread)

Medium Term Trading Book:

- No more medium term position at this stage.