19 mai 2015

2

19

/05

/mai

/2015

08:49

Europe:

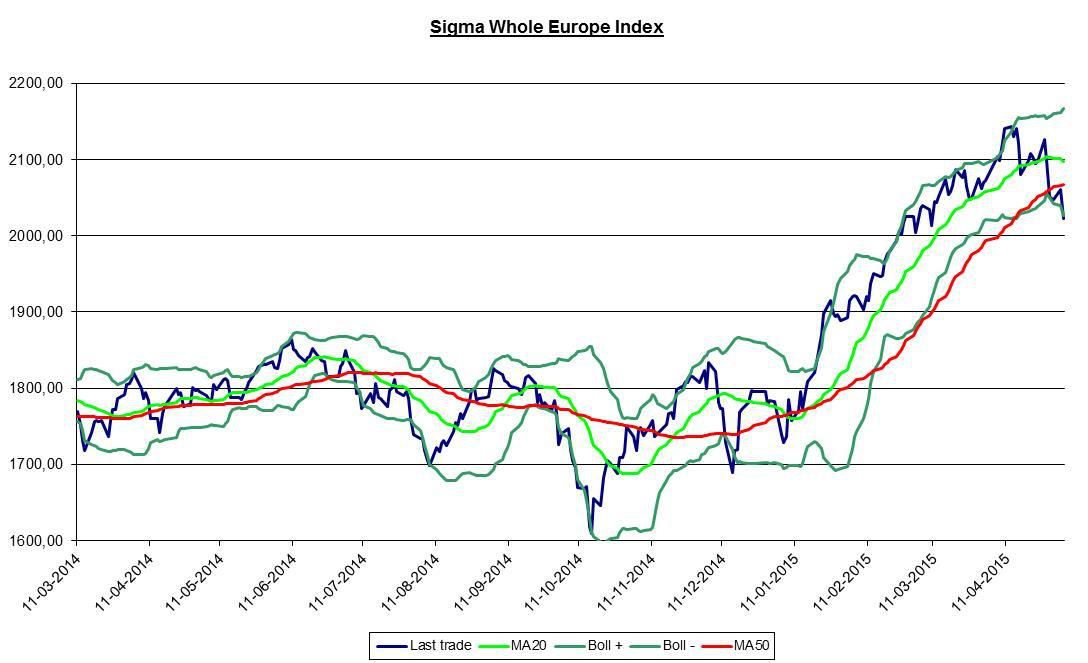

The Sigma Whole Europe Index remains highly vlatile on an intraday basis. We continue to believe the 'abc' pattern is possible (with 'c' to come).

The Sigma Trend Index declined to '-1' but both the Swing and the Power Level were neutral.

United States:

The Sigma Whole Market Index is close to print new highs, both the DJI and the SPX already did it.

The Sigma Trend Index increased from '10' to '15' but it is still far from the key '34' level.

The IBEX was stopped at the lowest point of the session...

- SPX: long at 2107.53 (stop @ 2042, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 4236.28 (2014's close) (stop @ 4340, 5pts below the ST model to take into account bid/ask spread)

- CAC: stopped

- EuroStoxx50: stopped

- DAX: stopped

- IBEX: stopped

Published by sigmatradingoscillator

18 mai 2015

1

18

/05

/mai

/2015

10:01

Europe:

The Sigma Whole Europe Index remains highly volatile and after Friday's 'small' double top pattern, the 'abc' bounce back could be over. Let's see what happens next week.

If the market can move higher, the probability the correction is 'over' will sharply increase.

The Sigma Trend Index is right on its zero line and both the Swing and the Power Level were neutral at '3' on Friday.

So, we have no indication coming from our indicators.

United States:

The Sigma Whole Market remains close to the upper end of its trading range. Both the S&P500 and the DJI are close to print new highs.

The Sigma trend Index was unchanged on Friday at '10'. Both the Swing and the Power Level were neutral at '3'.

The ST model uplifted its stop on the IBEX from 11186 to 11207

- SPX: long at 2107.53 (stop @ 2042, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 4236.28 (2014's close) (stop @ 4340, 5pts below the ST model to take into account bid/ask spread)

- CAC: stopped

- EuroStoxx50: stopped

- DAX: stopped

- IBEX: theoretical long at 11424.7 (stop @ 11207, 10pts below the ST model to take into account bid/ask spread)

Published by sigmatradingoscillator

15 mai 2015

5

15

/05

/mai

/2015

10:41

Europe:

The Sigma Whole Europe Index continues to rebound. Action remains volatile but the 'abc' pattern remains valid. We continue to believe recent decline was in 5 waves (and not 3) => wave A.

So current rebound should be in 'abc' => B

And then we should have another 5 waves decline in order to end the correction => C.

The alternative is that recent decline described a complex 3 waves pattern and the correction is already over.

The Sigma Trend Index increased to '2' and both the Swing and the power Level were neutral at '3'.

United States:

The Sigma Whole Market Index is close to the top of its trading channel. Both the S&P500 and the DJI are close to their previous tops.

The Sigma Trend Index rose to '10' and the Swing was at '4, telling us the move was rather impulsive.

The ST model uplifted its stop on the IBEX from 11186 to 11207

- SPX: long at 2107.53 (stop @ 2042, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 4236.28 (2014's close) (stop @ 4340, 5pts below the ST model to take into account bid/ask spread)

- CAC: stopped

- EuroStoxx50: stopped

- DAX: stopped

- IBEX: theoretical long at 11424.7 (stop @ 11207, 10pts below the ST model to take into account bid/ask spread)

Published by sigmatradingoscillator

14 mai 2015

4

14

/05

/mai

/2015

09:30

Europe:

The Sigma Whole Europe Index had another volatile session: the market start on a strong mood but lost all its gains in the last hours of trading and closed in negative territory. This candle is ugly.

Most European indexes are now close to major supports, let's see what happens there.

The 'abc' pattern in this rebound is still possible at this stage.

The Sigma Trend Index remains in negative territory, both the Swing and the Power Level were neutral at '3'.

United States:

The Sigma Whole Market Index remains in its trading range and the situation starts to be boring.

It is important to notice that both the DJU and the DJT are at critical levels.

The Sigma Trend Index declined to '-5' and both the Swing and the Power Level were neutral at '3'.

- SPX: long at 2107.53 (stop @ 2042, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 4236.28 (2014's close) (stop @ 4340, 5pts below the ST model to take into account bid/ask spread)

- CAC: stopped

- EuroStoxx50: stopped

- DAX: stopped

- IBEX: theoretical long at 11424.7 (stop @ 11186, 10pts below the ST model to take into account bid/ask spread)

Published by sigmatradingoscillator

13 mai 2015

3

13

/05

/mai

/2015

08:56

Europe:

The Sigma Whole Europe Index had a wild session on Tuesday but it seems the 'abc' pattern is right on track. Friday rebound was 'a', Monday and Tuesday's pullback was 'b', and the rebound started on Tuesday is the beginning of 'c'.

If this pattern is the right one, we should (at least) reach Friday's summit by Wednesday or Thursday.

The Sigma Trend Index declined in negative territory and the Swing came in at '2'.

The ST model was stopped on all European positions except the IBEX.

The ST model is experiencing its worst year on 3 years. It is clear current market conditions don't fit with this model.

The intraday model seems much more accurate in current environment and we are more and more exposed to this model in our own book.

United States:

The Sigma Whole Market Index printed a nice candle (looks like a reversal day) and this is rather bullish.

Both the Mid Cap Index and the Russell 2000 successfully tested major supports.

The Sigma Trend Index declined to '-2' and both the Swing and the Power Level were neutral at '3'.

- SPX: long at 2107.53 (stop @ 2042, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 4236.28 (2014's close) (stop @ 4340, 5pts below the ST model to take into account bid/ask spread)

- CAC: stopped

- EuroStoxx50: stopped

- DAX: stopped

- IBEX: theoretical long at 11424.7 (stop @ 11186, 10pts below the ST model to take into account bid/ask spread)

Published by sigmatradingoscillator

12 mai 2015

2

12

/05

/mai

/2015

07:37

Europe:

The Sigma Whole Europe Index was in a consolidation mood on Monday. Looking at recent action, it seems the 'b' wave is underway. If this count is right, another upleg should occur in coming sessions (followed by another sharp correction).

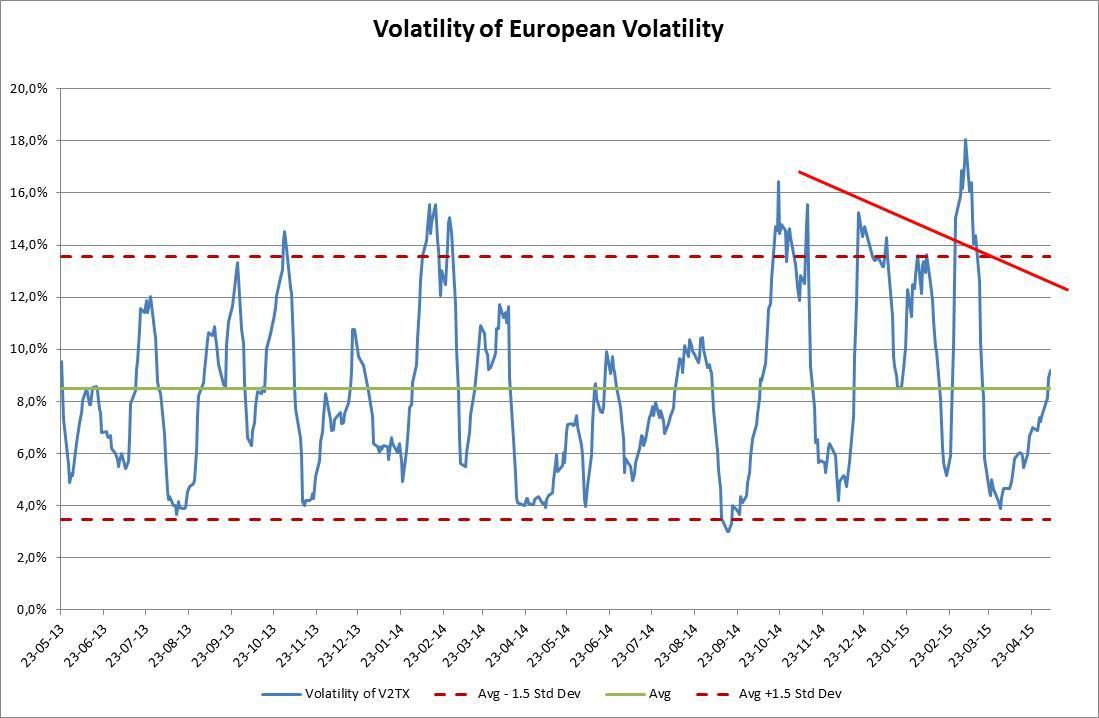

The volatility of European volatility continues to rise and this is something to monitor.

The Sigma Trend Index is right on its zero line and it will be interesting to monitor what happens from here: will it be able to move and stabilize in positive territory or will it fall back in negative territory?

Both the Swing and the Power Level were neutral at '3'.

United States:

The Sigma Whole Market Index remains in its trading range. Nevertheless, looking at Monday's candle, we can notice the price action was rather bearish on the SP500, Russell 2000, DJI, DJT, ...

This is not a good sign for coming sessions.

The Sigma Trend Index declined from '13' to '3' and remains in positive territory. Both the Swing and the Power Level were neutral at '3'.

There is no change in our daily trading book.

- SPX: long at 2107.53 (stop @ 2042, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 4236.28 (2014's close) (stop @ 4340, 5pts below the ST model to take into account bid/ask spread)

- CAC: long at 5042.73 (stop @ 4958, 5pts below the ST model to take into account bid/ask spread)

- EuroStoxx50: long at 3623.29 (stop @ 3553, 5pts below the ST model to take into account bid/ask spread)

- DAX: theoretical long at 11709.7 (stop @ 11407, 10pts below the ST model to take into account bid/ask spread)

- IBEX: theoretical long at 11424.7 (stop @ 11186, 10pts below the ST model to take into account bid/ask spread)

Published by sigmatradingoscillator

11 mai 2015

1

11

/05

/mai

/2015

08:52

Europe:

The Sigma Whole Europe Index enjoyed a strong bounce back on Friday. Looking at recent decline, we can clearly count a 5 waves pattern. So these 5 waves don't fit with an 'abc' correction. In this context, the recent decline in 5 waves could be the 'a' wave, the current bounce back underway could be the 'b' wave and the 'c' wave (decline) should occur in coming sessions.

The Sigma Trend Index bounced back from '-22' to '-1'. The Swing came in at '4'. So, the ST model generated a new buy signal on European markets.

As the market was very strong on Friday, we didn't implement new positions at Friday's close but we did it this Monday morning around 8.00 CET.

We only implemented 2 long positions (CAC and EStox), other will be reported as theoretical positions.

So, we bought:

- 1 CAC @ 5042.73

- 1 EStoxx @ 3623.29

United States:

The Sigma Whole Market Index enjoyed a strong session on Friday. It is interesting to notice some key indexes are close to print new highs (SP500, DJI) while other indexes are close to major supports (DJT, DJU).

The Sigma Trend Index jumped from '-7' to '13' and the Swing came in at '5' telling us the move was highly impulsive.

- SPX: long at 2107.53 (stop @ 2042, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 4236.28 (2014's close) (stop @ 4340, 5pts below the ST model to take into account bid/ask spread)

- CAC: long at 5042.73 (stop @ 4958, 5pts below the ST model to take into account bid/ask spread)

- EuroStoxx50: long at 3623.29 (stop @ 3553, 5pts below the ST model to take into account bid/ask spread)

- DAX: theoretical long at 11709.7 (stop @ 11407, 10pts below the ST model to take into account bid/ask spread)

- IBEX: theoretical long at 11424.7 (stop @ 11186, 10pts below the ST model to take into account bid/ask spread)

Published by sigmatradingoscillator

8 mai 2015

5

08

/05

/mai

/2015

11:27

The system is fully loaded updating the models for the new internet site, we are unable to update the blog at this time.

We didn't open any 'daily' position yesterday.

The intraday model did a great job and we are very excited to present it to beta testers in a couple of weeks.

Have a nice day

Oui daily book is unchanged.

- SPX: long at 2107.53 (stop @ 2042, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 4236.28 (2014's close) (stop @ 4340, 5pts below the ST model to take into account bid/ask spread)

- CAC: stopped

- EuroStoxx50: stopped

- DAX: stopped

- IBEX: stopped

Published by sigmatradingoscillator

7 mai 2015

4

07

/05

/mai

/2015

09:44

Europe:

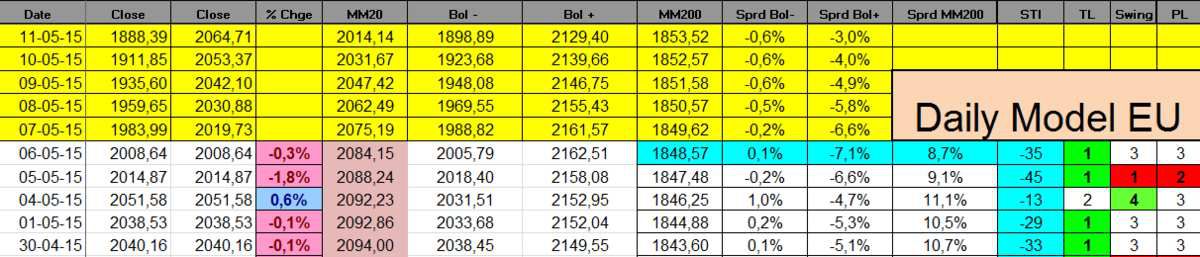

The Sigma Whole Europe Index printed a 'doji' on Wednesday. European volatility continues to rise very fast and some indexes are close (or below) to major supports.

The STI rose a little bite from '-45' to '-35'. Both the Swing and the Power Level were neutral at '3'.

Following the selloff in the first hours of trading in Europe, we were stop on our European positions:

- CAC stopped: -121.9pts

-EStoxx stopped: -96.7pts

Unite States:

The Sigma Whole Market Index declined on Wednesday but current trading range is still in place and it is too early to talk about major change in US trend.

It is interesting to notice the RUT printed a reversal candle and that the MID Cap index is at the bottom end of its ascending trend channel.

The DJT is right on a major support.

The Sigma Trend Index declined from '-23' to '-27', both the Swing and the Power Level were neutral.

- SPX: long at 2107.53 (stop @ 2042, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 4236.28 (2014's close) (stop @ 4340, 5pts below the ST model to take into account bid/ask spread)

- CAC: stopped

- EuroStoxx50: stopped

- DAX: stopped

- IBEX: stopped

Published by sigmatradingoscillator

6 mai 2015

3

06

/05

/mai

/2015

09:06

Europe:

The Sigma Whole Europe Index was under heavy selling pressure on Tuesday. The index has been unable to move above its 50days MA. The bollinger bands in expansion, the situation looks rather bearish.

The Sigma Trend Index sharply declined to '-45'. The swing came in at '1' and the Power Level at '2', telling us the decline was impulsive.

The ST model was stopped on some EU positions:

- DAX stopped: -295pts

- IBEX stopped -233pts

United States:

The Sigma Whole Market Index lost some ground on Tuesday. The RUT is breaking below major support. It will be important to monitor the DJU and the DJT in coming sessions.

The Sigma Trend Index declined to '-23' and both the Swing and the Power Level came in at '14 telling us the decline was highly impulsive.

The ST model uplifted its stop on some EU positions:

- SPX: long at 2107.53 (stop @ 2042, 3pts below the ST model to take into account bid/ask spread)

- NDX: long at 4236.28 (2014's close) (stop @ 4340, 5pts below the ST model to take into account bid/ask spread)

- CAC: long at 5083.2 (stop @ 4960, 5pts below the ST model to take into account bid/ask spread)

- EuroStoxx50: long at 3634.8 (stop @ 3536, 5pts below the ST model to take into account bid/ask spread)

- DAX: stopped

- IBEX: stopped

Published by sigmatradingoscillator